Funding Large Expenditures on Your Current Income

The No. 1 financial fear for most people — especially baby boomers — is running out of money and not being able to pay for

The No. 1 financial fear for most people — especially baby boomers — is running out of money and not being able to pay for

Unlike the old adage about leaving things that work alone, some things really are broken and do need fixing. Like poor or bad credit. While there

When you retire and no longer get a weekly paycheck, your bills don’t stop. You need money each month to keep the lights on, eat,

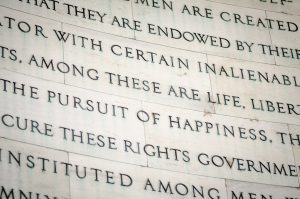

“When the architects of our republic wrote the magnificent words of the Constitution and the Declaration of Independence, they were signing a promissory note to

Did you know that over 60% of Americans still live paycheck to paycheck? This means that even a single unexpected expense—a car repair, a medical

Once a graduate degree was considered one of the most prestigious and pursued degrees in the world, and most would agree that it still holds

The rising cost of college tuition has made student loan debt a harsh reality for many individuals. With total student loan debt surpassing $1.7 trillion,

Patrick Donohoe and Michael Bonny talk Debt and Taxes. What is debt? Why do we utilize debt? Is debt really beneficial? For more information about

Last year I had a client bring in some literature of Dave Ramsey and his take on Permanent Life Insurance. Dave Ramsey is one of

Conditioned thinking is the mental pattern we develop over time based on repeated exposure to certain beliefs or behaviors. Just like any habit, it shapes

In this month’s Podcast Patrick Donohoe of Paradigm Life is joined byJason Rink Executive Director of “Banking With Life“, to discuss the benefits of Infinite

The Real Estate Guys Radio Show hosts Robert Helms and Russell Grey took the time in one of their latest shows to cover Cash Management Strategies