“When the architects of our republic wrote the magnificent words of the Constitution and the Declaration of Independence, they were signing a promissory note to which every American was to fall heir.

This note was a promise that all men would be guaranteed the unalienable right of life, liberty, and the pursuit of happiness.

I have a dream. It is a dream deeply rooted in the American dream.”

–Martin Luther King, Jr.

What is your definition of the American dream? Go to school, get a degree, find a high-paying job, fund a 401(k), and retire at 65? This narrative doesn’t equate to happiness, and it wasn’t the vision of our Founding Fathers.

The American dream is dying because our current narrative is telling us to pursue happiness in all the wrong places.

Can Money Buy Happiness?

Psychologist and professor Laurie Santos, who teaches “The Science of Well-Being” at Yale University, says of the curriculum taught in her class, “This is not what our capitalist culture teaches, students…feel like they’ve been duped for so much of their lives, they’ve been taught that they have to get perfect grades, so you can get into the perfect college, so you can get into the perfect job, so you can make a ton of money, and no one is teaching them to prioritize the things that really matter.”

The misconception we have today of the American dream—career plus money equals happiness—is an over-simplified rhetoric that fails to include components of our lives that are true sources of joy. Further, career plus money doesn’t equal financial freedom.

Does money equal happiness? Do things actually bring more joy to our lives? According to a study from Princeton University, emotional well-being doesn’t increase beyond an annual income of $75,000 in the United States. In other words, once we have sufficient funds to pay for our cost of living, income becomes irrelevant to happiness.

So if money doesn’t buy happiness, what does?

Maslow & the American Dream

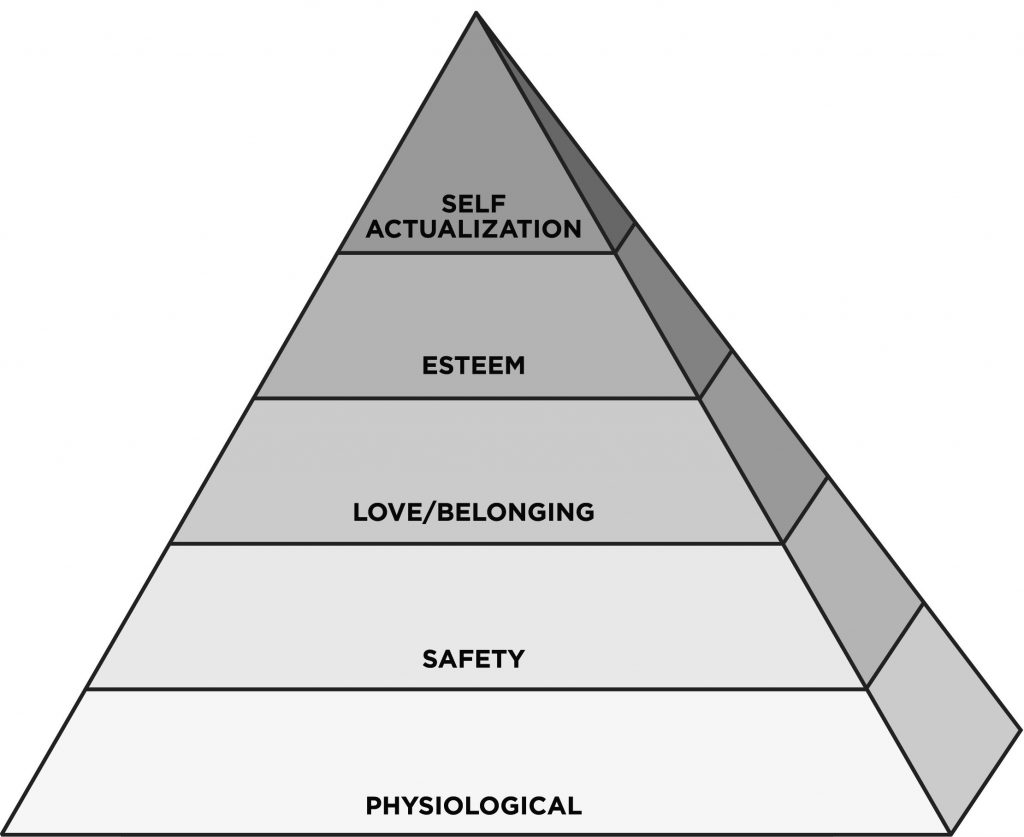

Abraham Maslow’s Hierarchy of Needs outlines a path to emotional fulfillment that is achieved by covering our basic needs, like food, shelter, and safety, first. Only then can we begin to explore behaviors that make us human, like friendships, family, love, self-esteem, respect, and ultimately, self-actualization.

Unfortunately, many American’s view this pyramid as an hourglass, where basic needs and self-actualization are pursued simultaneously. It’s a mentality of entitlement perpetuated by a society that seeks out immediate gratification. Meanwhile, our community, friendships, and family take a back seat. Especially in the age of automation, where real human interaction is replaced by technology, relationships are receiving less attention than ever before.

According to this article from Business Insider, research shows there are nine behaviors that are proven to increase happiness. The top two:

1. Build strong relationships with people who support you.

2. Choose work that gives you more free time over work that pays more money.

Other happiness-inducing behaviors include being grateful for what you currently have, serving others, and spending money on experiences instead of things. Equipped with the knowledge of where real joy comes from, you can reignite the American dream.

Life, Liberty & the Pursuit of Happiness in 2020

Life is the context in which we experience everything. Without it, nothing else would matter. When we live in an environment that allows us to nurture, improve, and optimize our most valuable asset—ourselves—we gain personal fulfillment. Your life is an asset not measured by any bank statement, but is an essential component of The Human Capital Statement.

Liberty is the ability to control your own outcomes. Too many Americans are handing control over their financial outcomes to third parties like Wall Street, banks, and the government. The Perpetual Wealth Strategy™ is a system we use at Paradigm Life to help you achieve financial independence on your terms.

The pursuit of happiness alludes to our freedom to pursue limitless value in our lives—value found in education, personal development, and our relationships with others. The natural outcome is happiness; the by-product is wealth.

It is up to you to determine what the American dream looks like for yourself. A solid financial foundation will support you on your journey to fulfill your own personal dream guided by what brings you fulfillment and joy.

At Paradigm Life we can customize a policy to fit your financial situation. Our expert Wealth Strategists are available to answer your questions and show you customized illustrations, outlining an individual plan of action to help you achieve your goals.

FAQ

Q: What is the significance of financial freedom in the context of the American Dream?

A: Financial freedom is seen as a fundamental component of the American Dream, allowing individuals to pursue their passions, achieve goals, and enjoy a higher quality of life without financial constraints.

Q: How can individuals work towards achieving financial freedom?

A: Individuals can work towards financial freedom by setting clear financial goals, creating a budget, saving and investing wisely, reducing debt, and seeking financial education and advice.

Q: Why is it important for individuals to align their financial aspirations with the concept of financial freedom, and how can it lead to a more fulfilling life?

A: Aligning financial aspirations with financial freedom allows individuals to have greater control over their lives, pursue meaningful experiences, and reduce financial stress, leading to a more fulfilling and satisfying life.