As the concept of Infinite Banking gains attention in the financial world, many are curious about how it works and whether it’s the right approach to managing and growing wealth. While Infinite Banking offers intriguing ideas about becoming your own banker, it’s essential to understand its limitations and how it compares to more comprehensive strategies, such as Paradigm Life’s Perpetual Wealth Strategy™.

This blog post will explore the basics of Infinite Banking, its strengths and drawbacks, and why the Perpetual Wealth Strategy™ may be a superior option for achieving long-term financial freedom and security.

What Is Infinite Banking?

The concept of Infinite Banking was created by Nelson Nash in the 1980s. Nash was a finance expert and follower of the Austrian school of economics, which advocates that the value of goods aren’t explicitly the result of traditional economic structures like supply and demand. Rather, individuals value money and goods differently based on their economic status and needs. Out of this thought, Nash developed the idea of individuals becoming their own bankers to better achieve their own unique, individual financial goals.

Listen: R. Nelson Nash, Founder of the Infinite Banking Concept®

One of the pitfalls of traditional banking, according to Nash, was high-interest rates on loans. Too many people, himself included, got into financial trouble due to reliance on banking institutions. So long as banks set the interest rates and loan terms, individuals didn’t have control over their own wealth.

Becoming your own banker, Nash determined, would put you in control over your financial future. But in order for Infinite Banking to work, you need your own bank.

How Infinite Banking Works

Infinite Banking relies on the unique features of dividend-paying whole life insurance. Here’s a simplified breakdown:

1. Build Cash Value

- When you pay premiums, a portion goes toward building the policy’s cash value.

- This cash value grows at a guaranteed rate and may also earn dividends.

2. Access Funds Through Policy Loans

- Policyholders can borrow against their cash value for any purpose—investments, emergencies, or major purchases.

- Unlike bank loans, policy loans don’t require approval and don’t affect your credit score.

3. Repay the Loan On Your Terms

- Policyholders decide when and how to repay the loan, giving them flexibility.

- Any unpaid loans are deducted from the death benefit when the policyholder passes away.

4. Tax Advantages

- Policy loans are not considered taxable income.

- The death benefit is typically tax-free for beneficiaries.

The Role of Whole Life Insurance in Infinite Banking

Nash determined that the best financial tool for Infinite Banking is whole life insurance.

Infinite Banking is NOT whole life insurance. But the Infinite Banking concept works best when the banker—you—utilizes properly structured whole life insurance as your bank.

Using whole life insurance as a financial tool for building wealth wasn’t a new concept in the 1980s. Business moguls like John Rockefeller built fortunes using whole life insurance and used their insurance policies to pass on wealth that has lasted for generations. Large companies hold millions of dollars in whole life insurance to help fund business expenses and earn favorable tax advantages. Even banks use whole life insurance as Tier 1 assets.

In fact, whole life insurance was even taught as a college course at the Wharton School in Pennsylvania. The curriculum? How to use the cash value of insurance policies to fund business expenses, entrepreneurial ventures, investment opportunities, get out of debt, purchase real estate, and more.

By the time Nash created the Infinite Banking Concept®, the idea of using policy loans as an alternative to banks and as a way to privatize family wealth wasn’t new. The name “Infinite Banking” was Nash’s way of marketing the concept to his clients, putting a fresh spin on a centuries-old strategy. At Paradigm Life, we call it The Perpetual Wealth Strategy™.

What Are the Advantages of Infinite Banking?

Infinite Banking is not a rapid money making scheme. Infinite Banking means control over your money. It eliminates wasteful spending. This lets you use your money to grow your assets.

Infinite Banking requires you to own your financial future. For goal-oriented people, it can be the best financial tool ever. Here are the advantages of Infinite Banking:

Liquidity

Arguably the single most beneficial aspect of Infinite Banking is that it improves your cash flow. You don’t need to go through the hoops of a traditional bank to get a loan; simply request a policy loan from your life insurance company and funds will be made available to you. Whole life insurance coverage is an extremely liquid asset compared to other assets like real estate, stocks, bonds, or qualified plans like your 401(k) or IRA.

Because whole life insurance is liquid, it can make up a valuable part of your financial foundation, acting as your emergency savings. Whether you run into unforeseen medical bills, job loss or costly home repairs, policy loans offer peace of mind. You can even use your insurance policy to pay yourself an income if you decide to go on sabbatical, return to school or take time off work to care for loved ones.

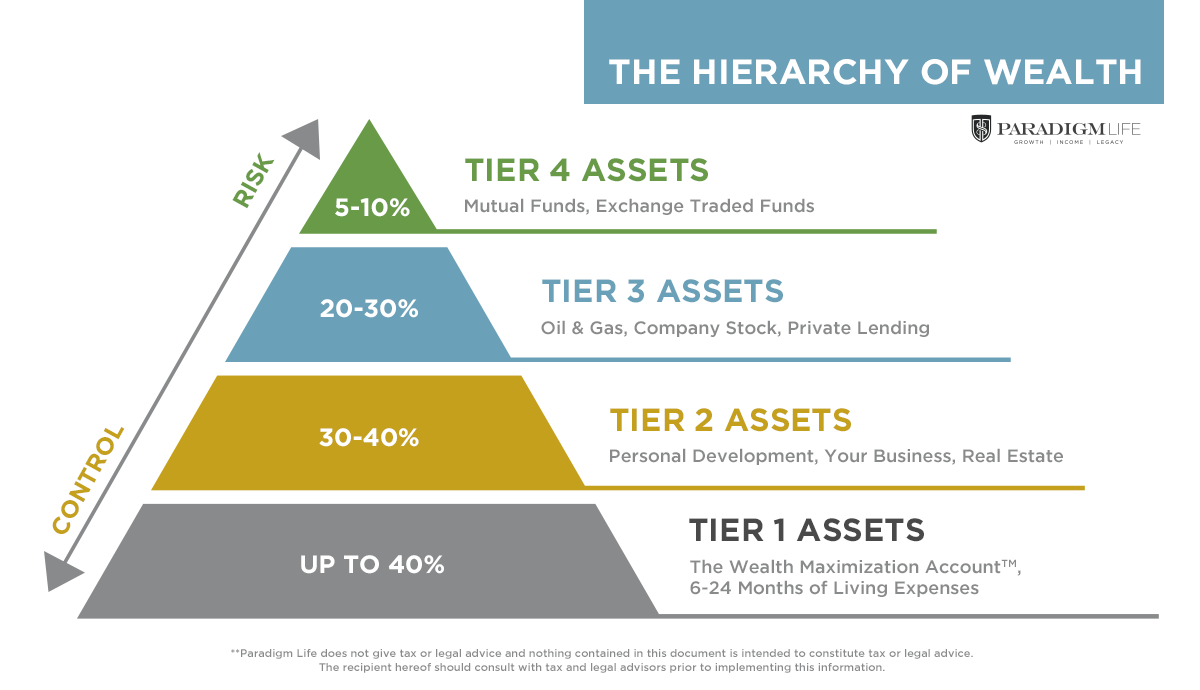

At Paradigm Life, we advocate funding a whole life insurance policy as a savings vehicle before considering other investment strategies like real estate or the stock market as part of our Perpetual Wealth Strategy™, and refer to this type of portfolio structure as The Hierarchy of Wealth™.

Control

Dividend-paying whole life insurance is very low risk and offers you, the policyholder, a great deal of control. The control that Infinite Banking offers can best be grouped into two categories: tax advantages and asset protections.

Tax Advantages

One of the reasons whole life insurance is ideal for Infinite Banking is how it’s taxed. In addition to tax-free policy loans and tax-free growth of interest and dividends inside your whole life insurance policy, the death benefit of a whole life policy is tax-free to your beneficiary and often is exempt from estate taxes as well.

Asset Protections

When you use whole life insurance for Infinite Banking, you enter into a private contract between you and your insurance company. This privacy offers certain asset protections not found in other financial vehicles. Although these protections may vary from state to state, they can include protection from asset searches and seizures, protection from judgements and protection from creditors. Plus, any policy loans you utilize won’t affect your credit score.

Protection Against Volatility

Whole life insurance policies are non-correlated assets. This is why they work so well as the financial foundation of Infinite Banking. Regardless of what happens in the market (stock, real estate, or otherwise), your insurance policy retains its worth.

Too many individuals are missing this essential volatility buffer that helps protect and grow wealth, instead splitting their money into two buckets: bank accounts and investments. The problem with this approach is that, while money in a bank account is safe, it offers a very low rate of return. Market-based investments grow wealth much faster but are exposed to market fluctuations, making them inherently risky. What if there were a third bucket that offered safety but also moderate, guaranteed returns? Whole life insurance is that third bucket.

Certainty

Not only is the rate of return on your whole life insurance policy guaranteed, your death benefit and premiums are also guaranteed. These certainties are another reason why properly structured whole life insurance is the ideal tool for Infinite Banking.

Consider other assets, like those associated with your 401(k) or IRA. In the event you pass away with money left in either of these qualified plans, the remaining funds will be passed onto your beneficiary—but first it will be taxed. You can guarantee your beneficiary will receive something but you can’t be certain how much, due to future tax rates.

While there are other types of permanent life insurance, whole life insurance is guaranteed to have the same premium for the duration of the policy. You can be certain your premium won’t increase as you get older. This is invaluable when it comes to setting and achieving your financial goals.

Cash Flow

Many individuals rely on Infinite Banking for a tax-free retirement. Because insurance policies are paid for with after-tax dollars, you don’t have to worry about your future tax rate like you would with a 401(k). So long as you utilize the policy loan feature of your whole life policy, you don’t have to pay taxes on the growth of your cash value. Simply fund your retirement with policy loans and your insurance company deducts the outstanding loan from the death benefit after you pass away.

When your retirement funds are linked to market-based investments, running out of money in retirement is a very real and valid concern for millions of Americans. Infinite Banking using properly structured whole life insurance can ensure you won’t run out of money in retirement, because your cash flow won’t be at risk if the market experiences a downturn. For this reason, some individuals opt to stop funding qualified plans like 401(k)s or IRAs all together and rely solely on the Infinite Banking strategy for retirement.

Legacy

Infinite Banking with whole life insurance is a proven method for building generational wealth, in part because the death benefit is tax-free and generally not subject to estate taxes.

In the case of large estates where federal or state estate taxes may kick in, it’s possible to utilize Infinite Banking inside of an Irrevocable Life Insurance Trust (ILIT). By naming the trust as the policyholder of your whole life insurance policies, even the largest of estates can be eligible for tax advantages that provide significantly more wealth to future generations.

The Hierarchy of Wealth™: A Simple Financial Blueprint

The Hierarchy of Wealth™ is a framework that organizes your financial life into four tiers, prioritizing safety, growth, and control. Developed by Paradigm Life, it helps you build a strong financial foundation while minimizing risk.

- Tier 1: safe and liquid assets – These are low-risk, highly accessible assets like cash reserves and the cash value of whole life insurance. They provide financial stability and quick access to funds.

- Tier 2: cash flow-producing assets – Investments like rental properties or secured loans that generate consistent income while maintaining moderate risk.

- Tier 3: growth-oriented assets – Higher-risk, long-term investments such as stocks and mutual funds, offering potential for significant wealth growth.

- Tier 4: speculative investments – High-risk, high-reward opportunities like cryptocurrencies or venture capital, meant for money you can afford to lose.

By focusing on Tiers 1 and 2 first, the Hierarchy of Wealth™ ensures financial security while creating a pathway for long-term growth and smart, calculated risks. This structure aligns perfectly with the principles of the Perpetual Wealth Strategy™.

The Strengths of Infinite Banking

Infinite Banking appeals to those seeking greater financial control. Here are its main benefits:

- Liquidity and accessibility: Policy loans provide immediate access to funds without the restrictions of traditional bank loans.

- Tax efficiency: The cash value grows tax-deferred, and policy loans are tax-free, making it a tax-efficient tool for building wealth.

- Guaranteed growth: Whole life insurance policies offer predictable, guaranteed growth, providing stability in your financial plan.

- Asset protection: In many states, the cash value of life insurance is protected from creditors, adding an extra layer of financial security.

Why Infinite Banking Isn’t the Best Alternative

While Infinite Banking has its merits, it isn’t a one-size-fits-all solution, and it comes with significant drawbacks. Here’s why it may not be the best approach:

1. Complexity and misunderstanding

- Infinite Banking often requires intricate policy structuring, which can confuse policyholders.

- Mismanagement can lead to lapses, reduced benefits, or unintended tax consequences.

2. High costs

- Whole life insurance premiums are significantly higher than term insurance, making it inaccessible for those with tight budgets.

- Overfunding policies to maximize cash value requires substantial financial commitment.

3. Limited scope

- Infinite Banking focuses narrowly on leveraging whole life insurance as a personal banking system, ignoring broader wealth-building strategies.

4. Risk of underperformance

- If policies are not properly structured or funded, the cash value may grow too slowly to achieve financial goals.

5. Better alternatives exist

Paradigm Life’s Perpetual Wealth Strategy™ builds on the principles of Infinite Banking but offers a more holistic, flexible, and personalized approach.

Perpetual Wealth Strategy™: A Superior Alternative

At Paradigm Life, we’ve modernized the concepts behind Infinite Banking to create the Perpetual Wealth Strategy™, a comprehensive system that combines the strengths of whole life insurance with proven financial planning principles.

How the Perpetual Wealth Strategy™ works

- Build a financial foundation: Start with the cash value of whole life insurance as your safe, liquid foundation.

- Create cash flow: Use your policy loans to fund investments or other income-generating activities.

- Optimize tax efficiency: Leverage the tax advantages of whole life insurance to grow and protect your wealth.

- Protect and grow wealth: Incorporate additional strategies, such as the Hierarchy of Wealth™, to ensure balanced growth and risk management.

Why the Perpetual Wealth Strategy™ Is Better

1. Holistic Financial Planning

Unlike Infinite Banking, which focuses solely on policy loans, the Perpetual Wealth Strategy™ considers your entire financial picture, including cash flow, investments, and legacy planning.

2. Personalized Guidance

Paradigm Life’s Wealth Strategists tailor every plan to your unique needs, ensuring your policy is structured for maximum benefit.

3. Broader Applications

The Perpetual Wealth Strategy™ integrates seamlessly with other financial tools, such as real estate, business funding, and retirement planning.

4. Ongoing Support

Our Wealth Strategists provide continuous education and support, helping you adapt your plan as your goals evolve.

The Paradigm Life Difference

When you choose Paradigm Life, you’re not just buying an insurance policy—you’re gaining a lifelong financial partner.

What we offer

- Expert consultations: Get a customized plan that aligns with your goals.

- Educational resources: Access free eCourses, case studies, and webinars to deepen your understanding.

- Proven success: Thousands of clients have used the Perpetual Wealth Strategy™ to achieve financial freedom.

How to Get Started

Paradigm Life specializes in providing clients with the proper tools and education so as to take advantage of the benefits of Infinite Banking. In addition to structuring your policy correctly, we’ll make sure it’s personalized to fit your unique financial needs and goals. We take an active role in continuing to educate and provide guidance to our clients, even after your policy is in place.

To learn more about the Infinite Banking strategy, access our free eCourse Perpetual Wealth 101™ here.

Consultations with Paradigm Life Wealth Strategists are also free. For a personalized illustration.