What if you could take complete control of your finances—eliminating the middleman, growing your wealth tax-efficiently, and creating a financial legacy that lasts for generations?

With a private family banking system, this isn’t just a dream—it’s a proven strategy that people have been using for over a century.

In this article, we’ll show you how private family banking works, why it’s so powerful, and how you can use it to grow and protect your wealth. Whether you’re looking to save smarter, invest more effectively, or leave a lasting legacy, creating your own family banking system can put you in the driver’s seat of your financial future.

What is a Private Family Bank?

Most people think of a bank as a place to deposit money, take out loans, or manage finances. But have you ever wondered how banks actually make money? They profit by charging you more in interest when you borrow than they pay you to save. In other words, they lend your money to others at a higher rate and keep the difference for themselves.

We’ve become so used to this system that we rarely stop to ask, “Is there a better way?”

Enter private family banking.

A private family bank replaces the need for a traditional bank by using a mutually traded whole life insurance policy as your banking system. In this setup, the insurance company essentially acts as your bank. Here’s how it works:

- You save money in the policy, earning a guaranteed rate of interest that’s typically higher than what you’d get from a savings account or CD.

- You can also receive non-guaranteed dividends, which many of the companies Paradigm Life partners with have consistently paid for over 100 years.

- Need a loan? You can borrow against your policy’s cash value through a private contract with your insurance carrier. No banks, no credit checks, no collateral, and you decide the repayment terms.

With private family banking, you’re in control. Traditional banks—or even government policies—don’t dictate how you save, borrow, or spend. This system provides flexibility, privacy, and peace of mind.

It’s a concept that’s simple to implement, easy to understand, and has been successfully used for centuries—so long as whole life insurance serves as your financial foundation.

Whole Life Insurance: The Ideal Banking Tool

When most people hear the term “life insurance,” they immediately think of a death benefit. While that’s certainly part of it, there’s much more to the story—depending on the type of life insurance you choose.

Let’s start with the basics.

The most common type of life insurance is term life insurance. It provides a death benefit to your beneficiaries, but only if you pass away within a specified time frame (the term). If you outlive the term, the policy expires, and no death benefit is paid. This is why term life insurance is often so inexpensive—there’s a low chance the insurance company will ever have to pay out. Unfortunately, this also means any money you’ve spent on premiums is typically lost.

On the other hand, whole life insurance works very differently. While it may have higher premiums than term insurance, it guarantees a payout. Why? Because the “term” is your entire life—it doesn’t expire. But the guaranteed death benefit isn’t the only reason why whole life insurance is so powerful.

Whole life insurance also comes with a built-in savings component, known as the policy’s cash surrender value. Here’s how it works:

- When you pay your premium, a portion goes toward the death benefit, while the rest is added to the policy’s cash value.

- Over time, the cash value grows—similar to a savings account—thanks to guaranteed interest and potential dividends from your mutual insurance company.

The cash value is what makes whole life insurance an essential tool in private family banking. It allows you to:

- Borrow against yourself, typically tax-free. Instead of relying on traditional loans, you can access your policy’s cash value to fund major purchases or investments on your terms.

- Earn compound interest over time. Your cash value grows consistently, meaning the earlier you start, the more wealth you can build.

- Create a financial legacy. Beyond the death benefit, the cash value ensures you’re building wealth that can be passed down to future generations.

With its ability to provide guaranteed growth, flexible borrowing options, and tax advantages, whole life insurance is far more than just a safety net—it’s a wealth-building powerhouse. And when used as part of a private family banking system, it can help secure your family’s financial future while giving you greater control over your money.

Loans and Private Family Banking: Unlocking Your Cash Value

Your whole life insurance policy provides two flexible ways to access its cash value, offering unparalleled financial control and freedom:

- Withdrawals: You can withdraw from your policy’s cash value, but this comes with tax implications. Since your interest and dividends grow on a tax-deferred basis, the IRS requires its share when you permanently reduce your cash value.

- Policy loans: A smarter, more tax-efficient option is to take out a policy loan. Unlike a traditional bank loan, policy loans give you access to your cash value tax-free—without the red tape. Here’s how it works:

- No credit checks or minimum credit scores are required.

- No need for bank approval or lengthy loan applications.

- No collateral like your home, car, or business is needed.

- Funds are typically transferred to your bank account within days.

- You control the payback schedule—on your terms.

What makes policy loans so secure is that they’re backed by your policy’s death benefit. This means:

- Any unpaid loan amount is simply deducted from the death benefit when the policy matures.

- You can never “default” on a policy loan, unlike traditional loans tied to assets.

How Life Insurance Loans Differ from Traditional Bank Loans

Mutual insurance companies—owned by policyholders—operate differently from banks. Traditional banks use fractional reserve lending, loaning out up to 90% of a depositor’s funds while keeping only 10% in reserves. In contrast, insurance companies lend out 100% of the policyholder’s dollar because the death benefit reserves fully back the loan.

This ensures:

- Stability and security: There’s no risk of “bank insolvency” or abrupt regulatory changes impacting your access to funds.

- Flexibility: You control the terms of your loan, and your financial future is shielded even if investments in other assets don’t perform as expected.

Why Policy Loans Are a Game-Changer

With a whole life insurance policy, you gain a foundational asset that enhances your financial flexibility. Whether you’re using your cash value to seize investment opportunities, cover major expenses, or fund personal goals, policy loans provide a risk-free way to access funds without jeopardizing your long-term wealth.

Whole life insurance doesn’t just build wealth—it keeps it safe while offering you the financial freedom banks can’t match.

For more on bank loans vs. policy loans, download this free infographic.

The Benefits of Private Family Banking

Private family banking offers more than just a built-in savings feature, a guaranteed death benefit, and easy access to policy loans. Here’s how this powerful system can transform your financial future:

1. Tax Advantages

One of the standout benefits of private family banking is its unique tax advantages:

- Tax-free access: When you take out a policy loan, you avoid taxes on the interest and dividends your policy earns.

- Tax-free retirement income: Policy loans can fund your retirement, providing tax-free income. Upon your passing, any remaining death benefit is paid to your beneficiaries tax-free, and your estate often remains tax-exempt.

- Generational wealth transfer: These tax benefits make it easier to pass on wealth to your loved ones without burdensome taxes eating into your legacy.

💡 Want to learn more about these tax advantages? Download our free infographic for a deeper dive.

2. The “AND” Asset

The “AND” asset is one of the most compelling aspects of private family banking:

- When you take out a policy loan, your policy continues to earn interest on its full cash value—even while you’re borrowing against it.

- This means your money works twice as hard: once as a loan and again as an interest-earning asset.

Here’s why the “AND” asset stands out:

- In a traditional savings account (even a high-interest one), when you withdraw money to make a purchase, the value of your account decreases, and you lose the ability to earn compound interest on that amount. With a whole life insurance policy, there’s no loss of compounding momentum—you continue to grow your wealth even while using it.

- Compared to bank loans or credit cards, where you pay high interest and follow rigid terms, private family banking puts you in control. You can use your policy loans to finance large expenses like a home, car, or education while still earning interest on your original cash value.

Curious how the “AND” asset works? Download our free infographic to see it in action.

3. Asset Protection

Private family banking is designed to safeguard your wealth:

- Privacy and security: Policy loans don’t require collateral (like your home or car), a credit check, or external financial statements.

- Protection from asset searches, Judgments, and Lawsuits: Money stored within a whole life insurance policy is protected from bankruptcy, legal settlements, and creditors. In most cases, these funds cannot be seized—even if you default on other loans.

- Peace of mind: Because a whole life policy is a private contract between you and your insurer, it remains shielded from many external financial risks.

Want to know more about protecting your assets? Download our free infographic for detailed insights.

Private family banking is more than just a financial strategy—it’s a system that helps you grow, protect, and control your wealth while creating a lasting legacy for future generations.

How to Build Generational Wealth

One of the greatest uses of private family banking is to grow and protect wealth for future generations. We call it The Perpetual Wealth Strategy.

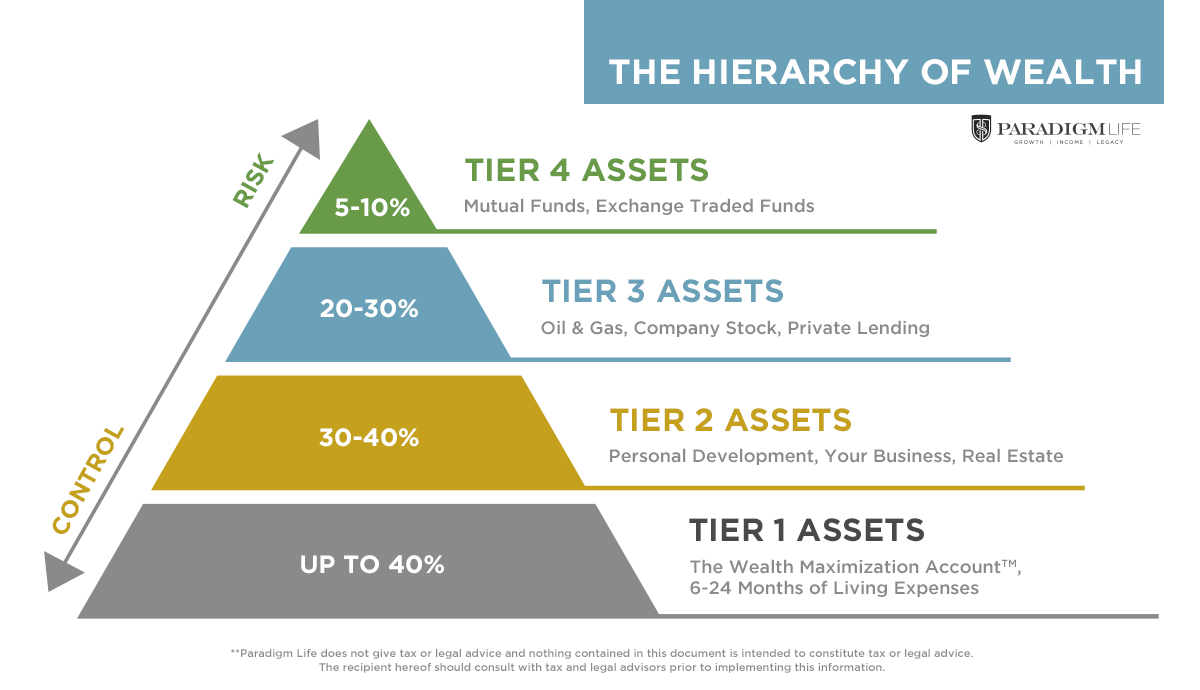

The Hierarchy of Wealth, outlined in the pyramid below, shows where a whole life insurance policy for family banking (we call it a Wealth Maximization Account™) fits in terms of asset allocation.

Placing up to 40% of your expendable income in a Wealth Maximization Account™ with whole life insurance provides your family financial security, both as an emergency fund and by offering guaranteed growth with the very least amount of risk. Next, focus on placing 30-40% of expendable income into Tier 2 Assets like your business and real estate investments. These help build generational wealth as they are often passed down in the family.

This is very important: Don’t forget to focus on investing in your own personal development (you are your best asset) and teach your children to do the same. Generational wealth isn’t just about money. Private family banking works best when you have the financial education to optimize your money and teach your children to do the same.

One of the ways you can teach children to bank for themselves is by getting them their own whole life insurance policies. Paradigm Life CEO Patrick Donohoe outlines how to do this (and why you should) in this article: The Most Valuable Benefit of Life Insurance for Children.

Likewise, you can also take out insurance policies on your spouse and sometimes your parents. The more policies in the family bank, the greater your banking power. Overtime, the interest and dividends in one policy grow sufficiently to cover the policy premiums of another in perpetuity and the remaining death benefit(s) can be placed in certain types of family trusts, growing wealth exactly the same way the Rockefeller family and other wealthy families have.

Create Your Own Family Bank

Private family banking isn’t just for the ultra-wealthy—it’s a financial strategy accessible to anyone, at any stage of life. Whether you’re looking to protect your wealth, build a legacy, or take control of your finances, it’s never too late to start using a whole life policy to create your own family bank.

At Paradigm Life, we’ve helped thousands of families across all 50 states—people of all ages and economic backgrounds—unlock the benefits of private family banking. Our expert Wealth Strategists are here to guide you every step of the way, tailoring a solution that works for your unique goals.

Take the first step toward perpetual wealth. Schedule a FREE consultation with a Wealth Strategist today and explore how private family banking can transform your financial future.