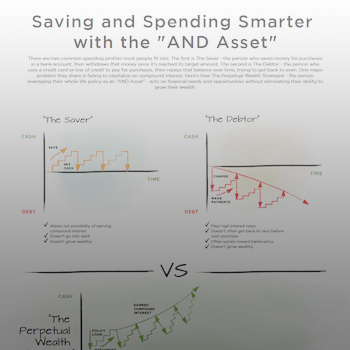

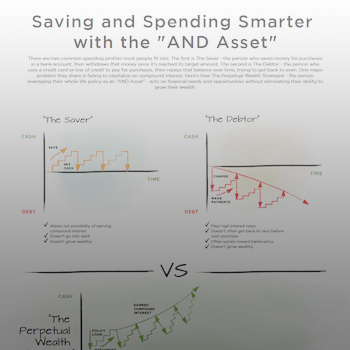

There are two common spending profiles most people fit into. The first is The Saver – the person who saves money for purchases in a bank account, then withdraws that money once it’s reached its target amount. The second is The Debtor – the person who uses a credit card or line of credit to pay for purchases, then repays that balance over time, trying to get back to even. One major problem they share is failing to capitalize on compound interest. Here’s how The Perpetual Wealth Strategist – the person leveraging their whole life policy as an “AND Asset” – acts on financial needs and opportunities without eliminating their ability to grow their wealth.

A Wealth Maximization Account is the backbone of the Perpetual Wealth Strategy™