Is Life Insurance an Asset?

Whole life insurance can play a pivotal role in your wealth strategy and is a valuable piece of a balanced financial portfolio, but many people don’t understand the full spectrum of benefits whole life insurance offers or why life insurance is an asset.

In this article, Wealth Strategist Bryan McCloskey explains how he helps clients build a solid financial foundation with life insurance coverage and how life insurance can help grow and protect your wealth.

Learning about Life Insurance Policies

Q. Bryan, using life insurance as an asset isn’t something many people have heard of. How do people react when they learn about the benefits of whole life insurance?

As a Wealth Strategist, one of the interactions I enjoy most is teaching clients how to implement a whole life policy into their everyday life. I savor these teaching sessions because typically, I receive the same excited, shocked, curious and amazed reactions when clients become enlightened to the life changing financial effects of whole life insurance as an asset.

The ideas of being your own bank, safely and securely growing wealth over time, using a dependable and proven strategy, maintaining control of your capital, and making your hard earned money work even harder for you are very powerful.

Q. And you own a whole life policy yourself, correct?

Yes. I opened my first policy at the age of 31 and I have 4 policies now.

Q. A lot of financial “experts” discredit whole life insurance because it costs more than term life insurance. Why do you think it’s a valuable asset for a financial portfolio?

I’ve learned that in order to succeed, you need to challenge common beliefs. To be frank, most of my clients will initially give me pushback when we talk about whole life insurance. “It’s too expensive,” is a common spoken phrase. I also hear, “I want ___ amount of death benefit, and I don’t want to pay more than ____ amount each month.”

I completely understand the resistance. Before I knew what whole life insurance was—excuse me, how whole life insurance worked—I had the same reservations. However, whole life insurance is completely different than the majority of people understand it to be.

Q. What don’t people understand about whole life insurance as an asset?

Traditional whole life insurance, also known as cash value life insurance, gives a policy owner wealth building opportunities.

The wealth building opportunities happen because money inside of a policy grows tax-deferred (and often tax-free), can be borrowed against tax-deferred (if not tax-free), and still earns a rate of return. In addition to these benefits, whole life insurance from a mutually owned insurance company is safe from stock market volatility, can be used to create generational wealth, provides cash flow and liquidity, and can even fund a tax-free retirement.

Q. When you say you can borrow tax-free against the policy and still earn a rate of return, what do you mean?

An individual can borrow against their policy while not risking the loss of capital, which means that the cash value from a life insurance policy can be used to invest in another performing financial asset. This strategy with whole life insurance makes the product an “and” asset. You don’t have to choose between buying a policy or buying a house; you can use cash surrender from the policy and buy the house.

For example, say you have $100,000 cash value in your whole life insurance policy and you decide to take a tax-free policy loan of $50,000 to use as a downpayment toward a real estate investment. You still earn interest on the full $100,000 cash value in your insurance policy.

Compare that to say, a high-interest savings account with $100,000 in it. If you take out half for a downpayment, you’re now only earning interest on the remaining $50,000.

Whole life insurance is an asset where every dollar earns a rate of return and can be borrowed at the same time.

Q. What about the death benefit of the policy? Isn’t that why people buy life insurance in the first place?

In short, we build policies backwards. Instead of determining how much you need for a policy’s death benefit alone, we first determine how much you need for living benefits.

For instance, let’s say you want to build an investment portfolio with a passive income goal of $1000 per month. To do this, you decide on purchasing rental properties. Knowing that your wealth building strategy is passive income through rental properties, your Wealth Strategist can appropriately build your policy to allow for flexibility and safety with your money. In addition to the flexibility and safety of your money, you are still earning interest on your policy’s cash value.

Essentially, because you are using life insurance as your vehicle, you are not only building wealth through your property investments, but also from your policy.

Q. Where does whole life insurance fit in a financial portfolio?

Once my clients, or anyone for that matter, realizes all the benefits and flexibility that comes with a whole life insurance policy, their paradigm of money changes. What also changes is their behavior with it. Instead of feeling shackled by the lack of choices that come when money is tied up, individuals who capitalize on money with whole life insurance feel liberated knowing they have more financial options.

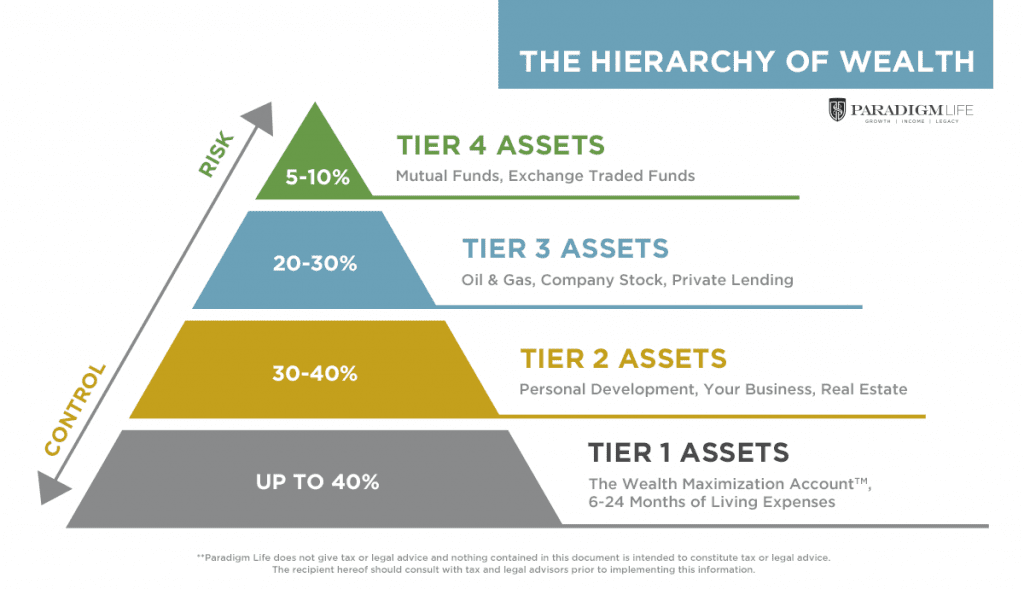

This concept can be illustrated with what we call The Hierarchy of Wealth. Here, a whole life insurance policy becomes your Tier 1 asset and may take the place of emergency savings, which experts recommend having 6–24 months of living expenses.

Whole life insurance can play a pivotal role in your wealth strategy and is a valuable piece of a balanced financial portfolio, but many people don’t understand the full spectrum of benefits whole life insurance offers or why life insurance is an asset.

In this article, Wealth Strategist Bryan McCloskey explains how he helps clients build a solid financial foundation with life insurance and how life insurance can help grow and protect your wealth.

Q. Bryan, using life insurance as an asset isn’t something many people have heard of. How do people react when they learn about the benefits of whole life insurance?

As a Wealth Strategist, one of the interactions I enjoy most is teaching clients how to implement a whole life policy into their everyday life. I savor these teaching sessions because typically, I receive the same excited, shocked, curious and amazed reactions when clients become enlightened to the life changing financial effects of whole life insurance as an asset.

The ideas of being your own bank, safely and securely growing wealth over time, using a dependable and proven strategy, maintaining control of your capital, and making your hard earned money work even harder for you are very powerful.

Q. And you own a whole life policy yourself, correct?

Yes. I opened my first policy at the age of 31 and I have 4 policies now.

Q. A lot of financial “experts” discredit whole life insurance because it costs more than term life insurance. Why do you think it’s a valuable asset for a financial portfolio?

I’ve learned that in order to succeed, you need to challenge common beliefs. To be frank, most of my clients will initially give me pushback when we talk about whole life insurance. “It’s too expensive,” is a common spoken phrase. I also hear, “I want ___ amount of death benefit, and I don’t want to pay more than ____ amount each month.”

I completely understand the resistance. Before I knew what whole life insurance was—excuse me, how whole life insurance worked—I had the same reservations. However, whole life insurance is completely different than the majority of people understand it to be.

Q. What don’t people understand about whole life insurance as an asset?

Traditional whole life insurance, also known as cash value insurance, gives a policy owner wealth building opportunities.

The wealth building opportunities happen because money inside of a policy grows tax-deferred (and often tax-free), can be borrowed against tax-deferred (if not tax-free), and still earns a rate of return. In addition to these benefits, whole life insurance from a mutually owned insurance company is safe from stock market volatility, can be used to create generational wealth, provides cash flow and liquidity, and can even fund a tax-free retirement.

Q. When you say you can borrow tax-free against the policy and still earn a rate of return, what do you mean?

An individual can borrow against their policy while not risking the loss of capital, which means that the cash value from a life insurance policy can be used to invest in other performing assets. This strategy with whole life insurance makes the product an “and” asset. You don’t have to choose between buying a policy or buying a house; you can use the policy and buy the house.

For example, say you have $100,000 cash value in your whole life insurance policy and you decide to take a tax-free policy loan of $50,000 to use as a downpayment toward a real estate investment. You still earn interest on the full $100,000 cash value in your insurance policy.

Compare that to say, a high-interest savings account with $100,000 in it. If you take out half for a downpayment, you’re now only earning interest on the remaining $50,000.

Whole life insurance is an asset where every dollar earns a rate of return and can be borrowed at the same time.

Q. What about the death benefit of the policy? Isn’t that why people buy life insurance in the first place?

In short, we build policies backwards. Instead of determining how much you need for a death benefit, we first determine how much you need for living benefits.

For instance, let’s say you want to build an investment portfolio with a passive income goal of $1000 per month. To do this, you decide on purchasing rental properties. Knowing that your wealth building strategy is passive income through rental properties, your Wealth Strategist can appropriately build your policy to allow for flexibility and safety with your money. In addition to the flexibility and safety of your money, you are still earning interest on your policy’s cash value.

Essentially, because you are using life insurance as your vehicle, you are not only building wealth through your property investments, but also from your policy.

Q. Where does whole life insurance fit in a financial portfolio?

Once my clients, or anyone for that matter, realizes the flexibility that comes with a whole life insurance policy, their paradigm of money changes. What also changes is their behavior with it. Instead of feeling shackled by the lack of choices that come when money is tied up, individuals who capitalize on money with whole life insurance feel liberated knowing they have more financial options.

This concept can be illustrated with what we call The Hierarchy of Wealth. Here, a whole life insurance policy becomes your Tier 1 asset and may take the place of emergency savings, which experts recommend having 6–24 months of living expenses.

The cash value inside your insurance policy serves as your emergency fund, and because you can access it easily through a tax-free policy loan, you don’t have to worry about liquidity. You also don’t have to worry about market volatility like you would with stocks or other types of market-based assets.

Q. How is whole life insurance protected from market volatility?

Whole life insurance is an asset that isn’t tied to market performance. Regardless of what happens with say, the stock market or real estate market, it won’t affect the guaranteed rate of return you receive from your insurance company.

On top of your guaranteed rate of return, whole life policies from mutual insurance companies have also historically paid out dividends. In fact, the mutual insurance companies we work with at Paradigm Life have consistently paid out dividends for over 100 years.

Following a market downturn, you can use your insurance asset to fund retirement or expenses, allowing time for your other investments to rebound. In fact, some of my clients rely on their whole life insurance assets to fund 100% of their tax-free retirement.

Q. Are all types of life insurance considered assets?

No, in order for life insurance to be an asset it needs to earn cash value. For example, term life insurance only provides a death benefit. It’s considered a “pure” insurance policy.

There are multiple types of life insurance that earn cash value outside of whole life insurance, including universal and variable life insurance, but none offer the guarantees and protections of whole life. If you’re looking to use life insurance as an asset, whole life policies aren’t exposed to market volatility and are the most reliable for a financial foundation.

I regularly meet with potential clients whose permanent life insurance policies are no longer serving their financial goals—a lot of universal life insurance policies with diminishing returns and rising premiums. Fortunately we can use a 1035 exchange to help people transfer their subpar policies into whole life insurance policies without losing all their tax-advantaged cash value.

Q. Can anyone use whole life insurance as an asset? Who is this strategy for?

I believe whole life insurance is an asset just about anyone can use. Premium payments are fixed, so as long as you have a steady source of income and are in decent health, you shouldn’t have a problem qualifying for a policy—and the sooner you apply, the better insurance rating you may receive, locking in a favorable premium for life.

If you own a business, I would argue you can’t afford not to have whole life insurance. It’s an asset that can provide capital and allow your company to function as its own bank.

Regardless of your financial goals, I would urge people to explore the free educational courses we offer on our website, especially Perpetual Wealth 101. It’s a series of short videos that illustrate the concepts of cash flow banking with whole life insurance. And if you’re looking to diversify for your portfolio for a more secure retirement, I recommend the Volatility Buffer Toolkit. It explains in depth how to use life insurance products as assets to offset market downturns.

Q. How does someone go about setting up a whole life insurance policy for cash value?

That’s a great question. Any insurance company will set up a whole life policy for you, but chances are it won’t be structured properly to grow cash value. If you’re interested in using life insurance as an asset, it needs to have an emphasis on growth.

The Wealth Strategists at Paradigm Life are experts at setting up whole life insurance policies structured for growth—we’ve been doing it for over 14 years in all 50 states—and we work with top-rated mutual insurance companies to find the best dividend-paying policy for your financial goals.

The cash value inside your insurance policy serves as your emergency fund, and because you can access it easily through a tax-free policy loan, you don’t have to worry about liquidity. You also don’t have to worry about market volatility like you would with stocks or other types of market-based liquid assets either.

Q. How is whole life insurance protected from market volatility?

Whole life insurance is an asset that isn’t tied to market performance. Regardless of what happens with say, the stock market or real estate market, it won’t affect the guaranteed rate of return you receive from your insurance company.

On top of your guaranteed rate of return, whole life policies from mutual insurance companies have also historically paid out dividends. In fact, the mutual insurance companies we work with at Paradigm Life have consistently paid out dividends for over 100 years.

Following a market downturn, you can use your insurance asset to fund retirement or expenses, allowing time for your other investments to rebound. In fact, some of my clients rely on their whole life insurance assets to fund 100% of their tax-free retirement.

Is Every Permanent Life Insurance Policy Equal?

Q. Are all types of life insurance considered assets?

No, in order for life insurance to be an asset it needs to accumulate cash value. For example, term life insurance only provides a death benefit. It’s considered a “pure” insurance policy.

There are multiple types of life insurance that earn cash value outside of whole life insurance, including universal and variable life insurance, but none offer the guarantees and protections of whole life. If you’re looking to use life insurance as an asset, whole life policies aren’t exposed to market volatility and are the most reliable for a financial foundation.

I regularly meet with potential clients whose permanent life insurance policies are no longer serving their financial goals—a lot of universal life insurance policies with diminishing returns and rising premiums. Fortunately we can use a 1035 exchange to help people transfer their subpar policies into whole life insurance policies without losing all their tax-advantaged cash value.

Q. Can anyone use whole life insurance as an asset? Who is this strategy for?

I believe whole life insurance is an asset just about anyone can use. Premium payments are fixed, so as long as you have a steady source of income and are in decent health, you shouldn’t have a problem qualifying for a policy—and the sooner you apply, the better insurance rating you may receive, locking in a favorable premium payment for life.

If you own a business, I would argue you can’t afford not to have whole life insurance. It’s an asset that can provide capital and allow your company to function as its own bank.

Regardless of your financial goals, I would urge people to explore the free educational courses we offer on our website, especially Perpetual Wealth 101. It’s a series of short videos that illustrate the concepts of cash flow banking with whole life insurance. And if you’re looking to diversify for your portfolio for a more secure retirement, I recommend the Volatility Buffer Toolkit. It explains in depth how to use life insurance products as tangible assets to offset market downturns.

Q. How does someone go about setting up a whole life insurance policy for cash value?

That’s a great question. Any insurance company will set up a whole life policy for you, but chances are it won’t be structured properly to grow cash value. If you’re interested in using life insurance as an asset, it needs to have an emphasis on growth.

Integrating Life Insurance with The Perpetual Wealth Strategy™

Life insurance is an asset that plays a vital role in Paradigm Life’s Perpetual Wealth Strategy™, a framework designed to optimize cash flow, protect wealth, and build financial security. Here’s how whole life insurance enhances this strategy:

What Is The Perpetual Wealth Strategy™?

The Perpetual Wealth Strategy™ is a comprehensive wealth-building approach that emphasizes three core principles:

- Cash flow: Maximizing your ability to generate, manage, and utilize money efficiently.

- Protection: Safeguarding your wealth and income from unforeseen risks.

- Wealth: Strategically growing and preserving your assets while reducing risk and improving control.

Whole life insurance seamlessly integrates into this strategy, making it more than just a safety net—it becomes the engine that drives financial growth and stability.

Why Life Insurance Is an Asset in The Perpetual Wealth Strategy™

Life insurance is an asset that checks multiple boxes within a financial plan. Here’s why it stands out in the Perpetual Wealth Strategy™:

- Safety: Guaranteed growth shields your wealth from market volatility.

- Liquidity: Easy access to cash value means you’re always prepared for opportunities or emergencies.

- Flexibility: Whether funding investments, creating a Volatility Buffer, or planning your legacy, life insurance adapts to your needs.

The Wealth Strategists at Paradigm Life are experts at setting up whole life insurance policies structured for growth—we’ve been doing it for over 14 years in all 50 states—and we work with top-rated mutual funds and insurance companies to find the best dividend-paying policy for your financial goals.