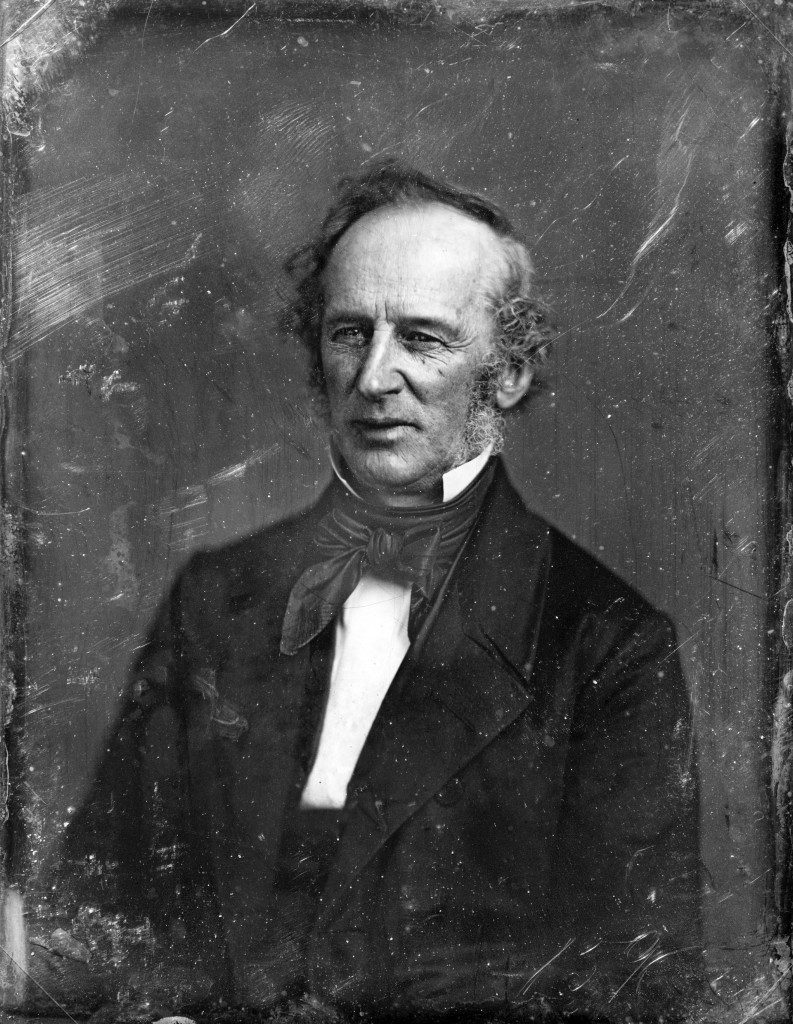

“Any fool can make a fortune; it takes a man of brains to hold onto it,” Commodore Vanderbilt, Fortune’s Children: The Fall of the House of Vanderbilt (Forbes.com).

“Any fool can make a fortune; it takes a man of brains to hold onto it,” Commodore Vanderbilt, Fortune’s Children: The Fall of the House of Vanderbilt (Forbes.com).

Though Vanderbilt amassed one of the greatest fortunes during The Gilded Age– $300M in today’s standards- by the late 1940s, the family’s 10 mansions in Manhattan were being torn down and their luxuries sold at auction. The Vanderbilt legacy is one of the great American tragedies. From rags to riches to rags again, this family was once perceived like royalty, but due to poor estate planning and overspending, by the 5th generation all of their money was practically gone (cnnmoney.com). The heirs squandered a fortune that could have still been thriving today.

The Banking Families

While the Vanderbilt’s made their fortune alongside the industrial age’s Banking Families, they were not “bankers” themselves. During that period, the still currently famous banking families included, the J.P. Morgan Family, the Rothschilds, and the Rockefeller’s – J.P Morgan, Rothschild and Rockefeller all had a part in the creation of the Federal Reserve (Bloomberg.com).

Though Vanderbilt had a fortune that outweighed most of the other millionaires of the past, it’s the banking families of yesterday that are still in control of their money today. These families, among others – like the Mellon Family – gained their initial wealth through industry, but kept their prosperity thriving by owning and operating banks, trusts, and philanthropies.

Creating Your Family Bank

It might be easy to discredit your wealth when comparing it to families with legacies that span over centuries and have fortunes fit for a king; but many of the tycoons from the past started with nothing. It was opportunity and good decision making that helped to preserve their wealth.

Actually, the same wealth building opportunities still exist now, in the information age. There are more millionaires and billionaires today than in the history of the world.

One of the most common forms of wealth preservation is life insurance. Permanent Life Insurance is a vehicle for your money. With it, you can be your own banker. You can lend to yourself, borrow, earn an interest rate, and leave your legacy.

Permanent Life Insurance and the Banking Concept

Properly structured Permanent Life Insurance, or Whole Life Insurance, provides a shelter for your money. When you save into a life insurance account, your money steadily grows tax–deferred with a rate of return, and provides the policy owner with liquidity.

This liquidity, known as Cash Value, is what gives your money velocity of motion. Just like fractional reserve banking and lending, your money stays inside your policy still earning interest while being simultaneously borrowed against the cash value of your policy. This infinite banking process is what allows an individual to take control of their money by maximizing its leverage. Instead of financing investments or large purchases through a bank, you can finance a project yourself and still earn interest.

In addition to utilizing the infinite banking principle with your policy (reaping the living benefits of life insurance), a policy owner still has a death benefit. Using your policy to build wealth while you’re still alive, gives you more of an opportunity to leave a legacy for your family at the time of passing. With the death benefit, you can also add spend-thrift clauses that determine how your heirs use the money.

Many wealthy families use permanent life insurance and the banking concept to grow and preserve their wealth; and teach their children lasting financial principles.

Just like the great financial families of the past, as well as those of today, you have the opportunity to reap the same type of financial freedom with permanent life insurance.

Read: Banking on Long Term Success

Watch: Successful Family Banking

Listen: The Wealth Standard

Discover our FREE guides: