A straight life insurance policy is one of the oldest types of insurance. It’s been used for centuries to grow and protect policyholders’ money—and not just by the wealthy. Straight life policies have many benefits not found in other types of life insurance, like universal life, variable life, term policies, or indexed policies. But is straight life insurance right for you?

What is a Straight Life Policy?

Straight life insurance is a type of whole life insurance. Like other forms of whole life insurance, the death benefit of a straight life policy is guaranteed to remain in place for life if premiums are paid. Premium payments are level; they won’t go up, regardless of age or health. You can usually choose when you pay your premiums (monthly, annually, etc.), and your policy can be tailored to fit your budget and financial goals.

Premium payments on straight life policies are divided among two ‘accounts’. Part of your premium goes toward your death benefit, which will be passed on to your beneficiary. The other part of your premium goes toward a cash value account, which functions like a high-interest savings account and grows in value over time.

What Are the Benefits?

In addition to a death benefit for your beneficiary and cash value for you, straight life insurance offers a variety of benefits not found in other policies.

Dividends and Interest

While a life insurance policy itself isn’t considered an investment (it’s a financial asset), the cash value of a straight life policy grows like an investment. It also provides the policyholder leverage to take advantage of outside investment opportunities with policy loans. Unlike most market-based investments, however, money inside a straight life policy grows securely and reliably.

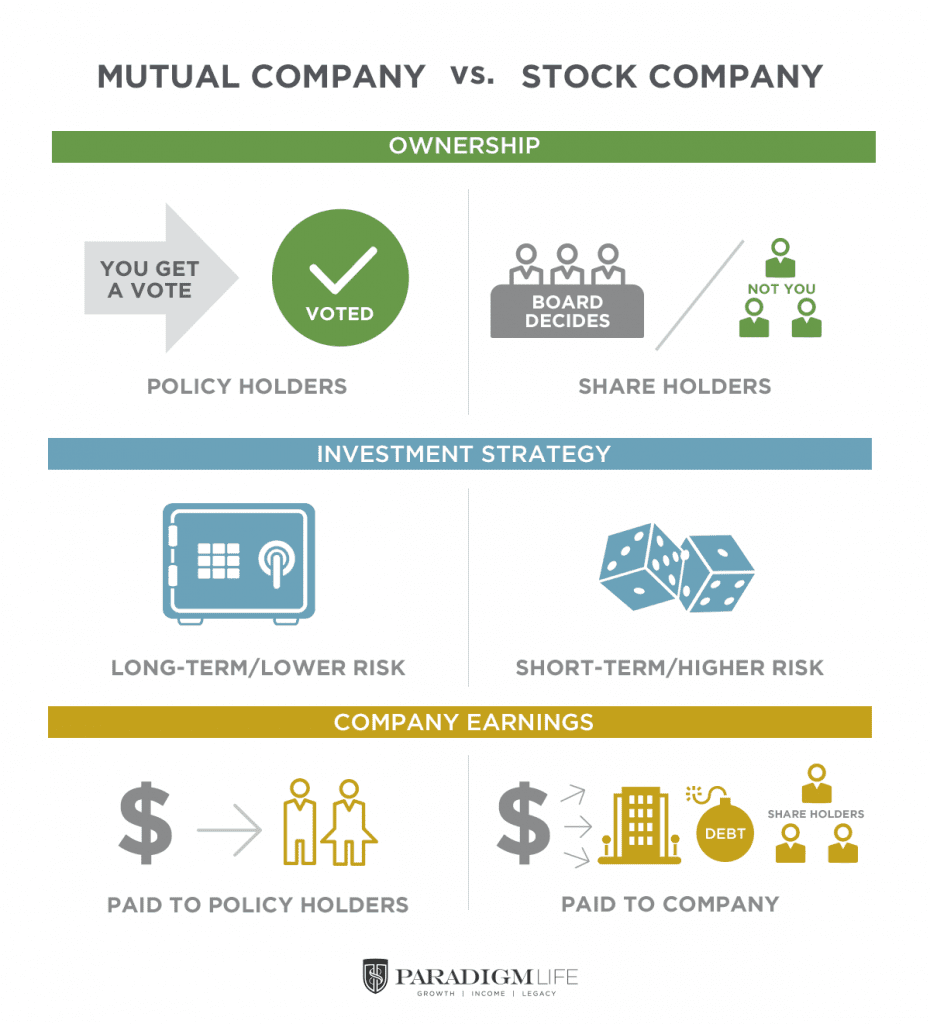

Mutual insurance companies are regulated at both state and federal levels. They must have enough liquid assets in reserve to pay 100% of their claims. Because of this requirement, insurance companies base their business models off of inevitability instead of probability. Mutual insurance companies use precise actuarial science, not market predictions or assumptions, to remain profitable for their policyholders. Their calculations are so precise, you earn a guaranteed rate of interest on your policy. This guaranteed rate makes it easier to plan financially for your future, compared to other qualified plans like 401(k) or IRA accounts. For this reason, straight life policies are popular vehicles for retirement income.

In addition to paying out claims and guaranteed interest, mutual insurance companies profit-share with their policyholders. Much like you own a piece of a credit union vs. a bank, straight life policy holders own a piece of the mutual insurance company who writes their policy. Mutual insurance companies recognize this ownership by paying out dividends on top of your guaranteed interest. Although dividends are not guaranteed, most mutual insurance companies have been paying out dividends for nearly 200 years, even during recessions.

The Policy Loan

You can borrow from the cash value of your straight life policy in the form of a policy loan. You don’t need credit or bank approval for a policy loan; your collateral is your insurance policy. The insurance company will charge you interest on the amount you borrow (typically less than a bank or other creditor). Any unpaid loans will be deducted, plus interest, from your death benefit.

The policy loan feature of your straight life insurance policy makes it an “AND” asset.

When you borrow from your insurance policy, you continue to earn guaranteed interest on the full cash value of your policy. In this way, each dollar works twice as hard to grow your wealth. Consider how this compares to other forms of borrowing and saving.

Saving in a bank account

When you save money in a bank savings or money market account, you earn interest over time on the funds in your account. When you withdraw those funds, your account balance drops back down to zero. Any future money you deposit has to start at square one earning interest.

Borrowing with credit

When you make purchases on credit, you owe a debt to your creditor. You pay back your debt, plus interest, over time until you have a zero net balance. The cycle repeats itself the next time you make a purchase.

Saving and borrowing with policy loans

When you save money in a straight life policy, you earn interest and potential dividends over time on the funds in your policy. When you borrow from your cash value, you pay back your debt, plus interest, over time—but you continue to earn interest on the full cash value of your account. You save AND borrow without negatively affecting interest earned.

The policy loan may be the single greatest benefit of a straight life policy. You’re essentially borrowing your own money and earning interest on yourself. Plus, you dictate the payback terms of your loan. There are no limits to what you can use a policy loan for. The leverage this offers is what sets the wealthy apart from the typical investor.

Tax Advantages

Straight life policies are funded with after-tax dollars. Once inside a policy, your dollars grow tax deferred. When you withdraw from your policy for retirement funds, you may be taxed on your earnings over what you’ve paid in policy premiums. In other words, the interest and dividends earned may be taxable.

You won’t be taxed on cash value borrowed in a policy loan, and the interest and dividends you earn grow tax-free. When distributed to your beneficiary, your death benefit typically is not charged estate tax/inheritance tax or income tax. This means your beneficiary will not have tax liabilities.

Asset Protections

Straight life insurance is designed to protect your assets. It guards against major financial risks and liabilities in four major areas:

Asset Searches

Cash value, death benefits, and policy loans are private transactions between you and your mutual insurance company. This structure shields assets in your straight life policy from many of the common risks bank and investment accounts are exposed to.

Creditors

Life insurance assets can rarely be accessed by creditors. Rather than being seized as a collection measure on defaulted loans, the cash value in your straight life policy can be leveraged to repay any creditors you owe.

Judgements

In most states, the cash value in your policy is protected from garnishments and seizure that might otherwise be incurred from legal judgements. Your assets remain available to you and are passed to your beneficiary when you die.

Lawsuits

Insurance assets are protected against lawsuits and bankruptcy in many states. They are separate from corporate and business assets, and generally protected as a personal asset. In most cases, money in your straight life policy can’t be touched by outside parties, even in the event of a damaging lawsuit.

How Does Straight Life Compare to Other Types of Insurance?

The reasons people buy life insurance are usually the same: they’re looking for a way to protect their family from unexpected loss or hardship, or they want a secure and private way to grow and protect their wealth. In the case of permanent life insurance, people want both. It’s important to know why you’re buying life insurance and what your financial goals are. This determines what type of insurance is right for you.

Straight Life vs. Term Life Insurance

Term life insurance is typically purchased in five-year increments, for up to 30 years of coverage. If you die during your covered term, the insurance company pays out a death benefit to your beneficiary. If you outlive your covered term, neither you nor your beneficiary receive anything.

Premiums are typically much cheaper than a straight life policy because this type of insurance usually only sees a pay out in the event of an accident or unexpected terminal illness. The typical candidate for term life insurance is usually looking to cover the costs of debt, like college tuition or a mortgage they’re responsible for paying, that would be a hardship on their spouse, child, or other family member if the policyholder passed away unexpectedly.

Term insurance does not have a cash value component, or any other living benefits for the policyholder. If you think you may want the benefits and growth of a straight life policy, but are concerned about premium costs, a convertible term policy might be right for you. With convertible term, you get the temporary coverage of term life insurance now, but are able to “roll over” your coverage into a straight life policy at a later date (usually within 10 years) without needing an additional medical exam to qualify.

If you purchase term life insurance outside of a convertible policy and decide you need more coverage at a later date, the cost of your premium is likely to increase. Premiums are based off of your health, which tends to deteriorate with age. This is why it’s important to get the right insurance coverage for your needs as early as possible.

Straight Life vs. Universal Life Insurance

Universal life insurance shares some similarities with straight life insurance. Both will pay out a death benefit to the policyholder’s beneficiary for life, so long as the premiums are paid. Both have cash value components and can grow your wealth over time. But there are a few big differences between straight life and universal life.

The interest you earn in a straight life policy is guaranteed, plus you can earn non-guaranteed dividends. Universal life policies don’t have guarantees. The interest you earn varies from year to year, and in different ways, depending on if you have traditional universal, indexed universal, or variable universal insurance. If you are planning on using the cash value of your policy for retirement, you might prefer to know exactly how much you’ll have to spend; universal life won’t offer you that peace of mind.

The cash value of a universal life policy can also have an effect on the policy premium. Universal life policies have variable premiums, and you can decrease the amount you pay, or possibly skip a payment, if you have sufficient cash value accumulated. However, decreasing your premium can mean a decrease in coverage, leaving your beneficiaries with an insufficient death benefit. There is also a very real possibility that your premium will go up over time.

A straight life policy has a level premium—it won’t change over the life of your policy. In fact, when dividends accumulate over time they can be used to cover premiums, effectively lowering your out-of-pocket cost to net zero in later years. This level of certainty can be helpful in financial planning for your future.

Straight Life Policies for Business

Permanent life insurance in the form of a straight or whole life policy has certain advantages for business owners that other types of insurance can’t beat.

For family-owned companies, straight life insurance held by the business owner can provide a succession plan for the company. The death benefit offers an immediate payout to existing family listed as beneficiaries to help keep the business running. While the business owner is still living, the policy earns tax-advantage and the cash value can be used to fund business expenses.

Another popular use of straight life policies among businesses is key man or key person insurance. In this instance, policies are bought by the company on key employees whose passing would incur a hardship on the company. The death benefit goes toward replacing said employee, both in salary and time to scout and train a new hire. The cash value of the policy can be used to fund business expenses or to fund various employee incentives. Key man insurance is commonplace among companies of all sizes.

The third common way straight life policies are used in business is called a buy-sell agreement. In a buy-sell agreement, a co-owner of a business purchases an insurance policy with sufficient coverage for their portion of the business. The policyholder then names a business partner or another co-owner as the beneficiary. Upon the policyholder’s passing, the beneficiary has sufficient funds to buy up available shares from the policyholder’s family or other owners.

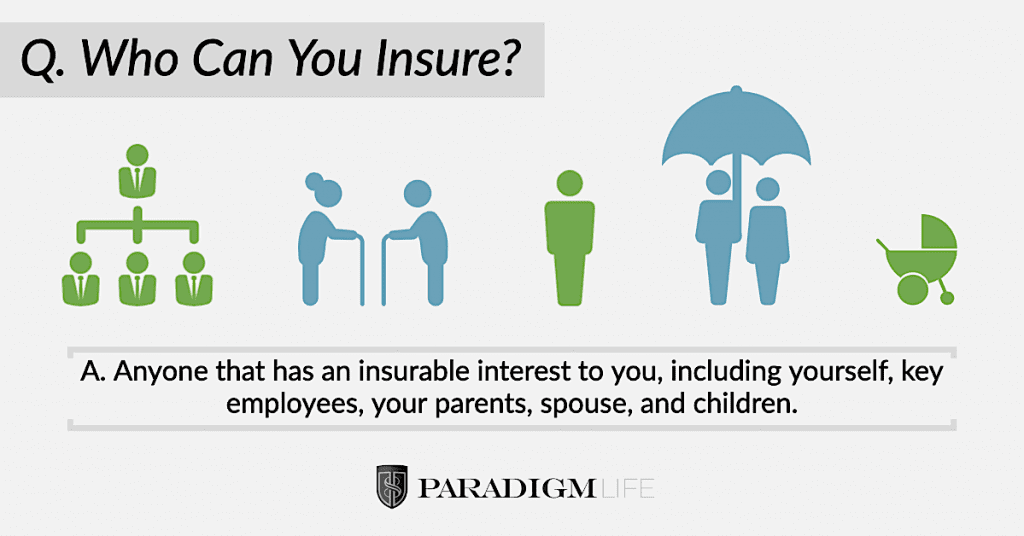

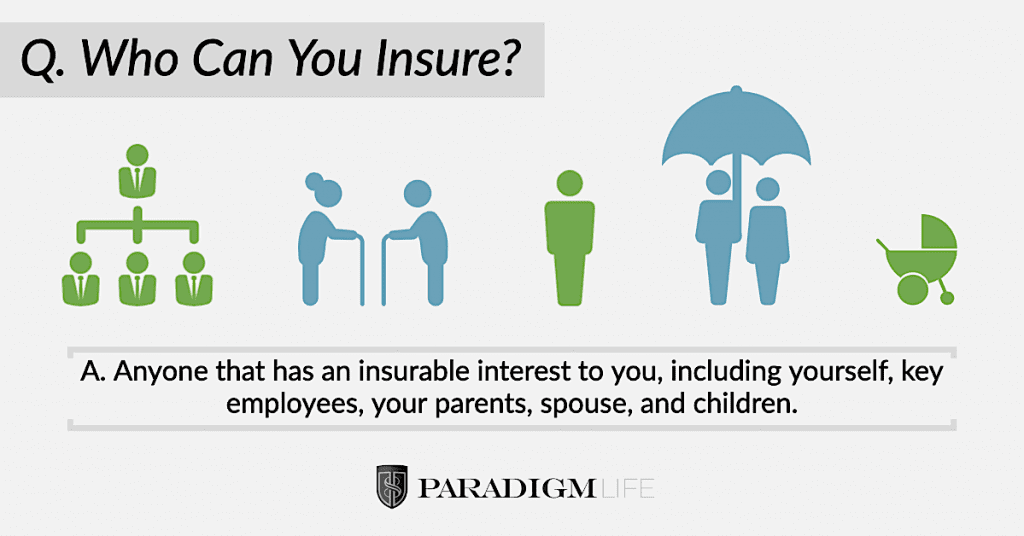

Who Can I Purchase a Policy On?

You can purchase life insurance policies on anyone with whom you have insurable interest. Not only does this include key business personnel, as mentioned in the section above, you can also insure your loved ones.

It is common for families to purchase straight life policies for parents, spouses, and children. When you hold multiple whole life insurance policies, you increase the spending and earning power of your family bank. It’s how wealthy families continue to grow their wealth and pass it on for generations.

Straight life insurance can be utilized within a family trust, allocated for educational costs, used to purchase family property like vacation homes or for other real estate investments, provide care for ailing parents, and foot out-of-pocket medical costs or other unexpected expenses.

Why Should I Choose Paradigm Life for My Insurance Policy?

It’s important to work with a Wealth Strategist or other insurance expert who can get you the coverage you need, but also make sure you have cash value on hand for other expenses and investment opportunities, at a price you can afford. We work with a variety of top-rated mutual insurance companies to find you the best straight life policy for your financial goals.

We can also customize your policy with a variety of life insurance policy riders to fit your needs, such as a disability rider, chronic illness rider, paid-up additions rider, guaranteed insurability rider, and more. Many of these riders can be added at no additional cost.

If you’re shopping for a straight life policy, or want to learn more about cash value insurance for growing and protecting wealth, our team is here to help.

At Paradigm Life we can customize a policy to fit your financial situation. Our expert Wealth Strategists are available to answer your questions and show you customized illustrations, outlining an individual plan of action to help you achieve your goals.