The rising cost of college tuition presents an emotional conundrum for many families. Should you take on student loans as an investment in the future, or does emotional investing in higher education lead to financial strain?

For students and parents alike, this decision is about more than just numbers—it’s about financial security, opportunity, and the ability to create wealth. But what if there was a different way to approach paying for college—one that didn’t require years of debt?

The Cost of Emotional Investing in Higher Education

Many people view a college degree as an essential investment, believing it will lead to higher earning potential and career stability. But what many don’t consider is the long-term financial impact of student loans—until they find themselves struggling under decades of repayment.

The Emotional Conundrum of Student Debt

For many students and parents, the decision to borrow for college is driven by emotion rather than strategy. The promise of a prestigious degree, the pressure to keep up with societal expectations, and the fear of missing out on opportunities can lead to emotional investing—where financial decisions are made based on feelings rather than long-term financial security.

But the reality is that student loan debt can be a silent wealth killer. The question isn’t just to invest or not to invest in student loans—it’s about whether that investment is truly working for you.

Emotional Investing: How Does that Even Happen?

Anytime something that matters to you, i.e. loved ones, possessions, your money, is involved, it’s nearly impossible to remove all emotions. Emotions defined is, “a state of feeling that results in physical and psychological changes that influence our behavior”.

Therefore, our everyday actions truly are governed by emotion, and especially when it comes to major decisions, such as deciding to invest.

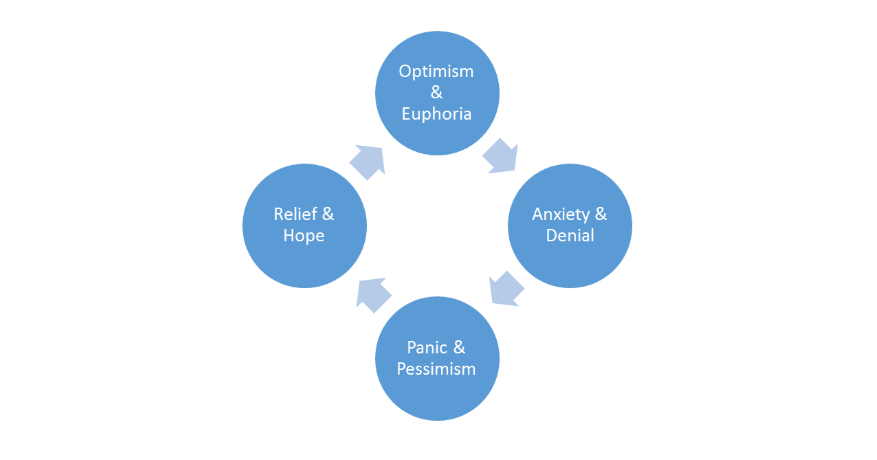

According to Bedel Financial Consulting, there are four phases in the emotional cycle of an investor.

A kin to the cycle of an addict, there are highs and lows, excitement and euphoria at the ‘first hit’ when one initially decides to invest in the next “sure thing”

When bad news comes or economic paradigms shift, inevitable anxiety and fear sets in as the investor ‘withdrawals’ from the investment high. If anxiety continues, then desperation may set in, and the investor desperate for relief, either vows to never invest again, or is emotionally charged to impulsively invest again to feel that ‘high’ felt when they first invested.

The True Cost of Borrowing: How Student Loans Affect Lifetime Wealth

Borrowing for education doesn’t just affect your cash flow in the short term—it can significantly reduce your ability to build wealth, invest, and achieve financial independence over your lifetime.

How Student Loans Drain Wealth-Building Potential

When a significant portion of your income goes toward student loan payments, you have less money available for:

- Investing in assets that grow over time, such as real estate, stocks, or business ventures.

- Building an emergency fund, which protects against financial shocks.

- Funding retirement accounts, missing out on the power of compound growth.

Instead of your money working for you, it’s working against you—flowing to lenders in the form of interest payments rather than toward building personal wealth.

Compound Interest: Working Against Borrowers Instead of for Them

Compound interest is a powerful tool in wealth-building—but when it applies to debt, it works in reverse. The longer you take to pay off student loans, the more you’ll end up paying in total.

Consider this example:

- You take out $50,000 in student loans at 6% interest with a 20-year repayment term.

- Your monthly payment is $358.

- Over 20 years, you will pay $85,920 total—more than double the original loan amount.

Now, imagine instead of making those loan payments, you invested $358 per month in an account earning a 6% average return.

- After 20 years, your investment would grow to $165,000.

- After 30 years, that same investment could reach over $400,000—without any additional effort.

This is the opportunity cost of student loans—rather than accumulating wealth, borrowers are stuck paying off past expenses, often delaying major financial milestones.

The Ripple Effect: How Student Debt Delays Financial Freedom

The financial burden of student loans can have a ripple effect on other wealth-building opportunities:

- Delaying Homeownership – High student loan payments increase debt-to-income ratios, making it harder to qualify for a mortgage.

- Postponing Retirement Contributions – Many graduates can’t afford to invest early, missing out on years of compound growth.

- Risking Financial Instability – Without savings or investments, borrowers are vulnerable to job loss, economic downturns, or medical emergencies.

A Different Path: The Family Bank Strategy

For many families, student loans feel like the only way to afford higher education. But what if you could create a financing system that keeps money in your family—rather than sending it to banks and lenders?

Through The Family Bank Strategy, you can take control of your education financing by leveraging a properly structured Whole Life Insurance policy. Instead of burdening yourself or your children with decades of student loan debt, you can access tax-efficient capital while maintaining flexibility and financial certainty.

How The Family Bank Strategy Works

Rather than borrowing from external lenders, you borrow from yourself—using the cash value built up in a Whole Life Insurance policy. This allows you to fund education while keeping your wealth within your personal financial system.

- Builds a Tax-Advantaged Fund – Unlike student loans, which require years of interest payments to banks, the cash value in Whole Life Insurance grows tax-efficiently. This means you can access funds for tuition while maintaining a financial reservoir for future needs—such as home purchases, investments, or even retirement.

- Eliminates the Need for Banks – Student loans often come with variable interest rates, repayment restrictions, and financial stress. With The Family Bank Strategy, you can bypass banks entirely and borrow from yourself, on your own terms, while continuing to grow your wealth.

- Maintains Financial Control – Traditional college savings accounts like 529 Plans restrict how and when you can use funds, and 401(k) loans come with penalties for early withdrawals. In contrast, Whole Life Insurance policies offer liquidity and flexibility—allowing you to access funds for any financial need, not just education.

Why Wealthy Families Have Used This for Generations

Many generationally wealthy families—such as the Rockefellers—have successfully used The Family Bank Strategy to:

- Fund higher education without student debt

- Start and grow businesses

- Create intergenerational wealth

- Provide financial security for future generations

By adopting this strategy, you’re not just solving the problem of paying for college—you’re building a long-term wealth foundation that can benefit your family for generations to come.

What if your education funding strategy didn’t just cover tuition but also helped build a legacy of financial independence? In the next section, we’ll explore how The Volatility Buffer Strategy can help protect your wealth from market downturns while keeping your financial future secure.

The Volatility Buffer: Protecting Your Future from Market Risks

For many graduates, student loan payments compete with their ability to invest for the future. They enter the workforce burdened with debt, limiting their cash flow and making it difficult to build wealth. If the market experiences a downturn at the same time they begin investing, they can get trapped in a cycle of financial stress, delayed goals, and increased risk.

This is where The Volatility Buffer Strategy becomes essential.

The Risk of Relying on Market-Based Assets for Education

Traditional financial advice suggests saving for college through market-based investment accounts like 529 Plans or taxable brokerage accounts. While these accounts offer growth potential, they come with significant uncertainty and risk:

- Market Timing Risk – If the stock market declines when tuition is due, parents or students may be forced to sell investments at a loss.

- Sequence of Returns Risk – Graduates who begin investing while making student loan payments may experience poor market performance early in their financial journey, leading to lower long-term wealth accumulation.

- Liquidity Risk – 401(k) loans and other retirement-based withdrawals often come with penalties, taxes, or restrictions, making them less flexible than other funding options.

How The Volatility Buffer Strategy Works

Rather than relying solely on market-based assets to cover tuition, Whole Life Insurance provides a non-correlated financial asset—meaning its cash value is unaffected by stock market downturns.

- Provides a Market-Proof Financial Reserve – The cash value in a Whole Life policy grows consistently, without the volatility of stocks, ensuring a stable and accessible financial resource for education or any other need.

- Offers Liquidity and Flexibility – Unlike 529 Plans or retirement accounts, which restrict how funds can be used, Whole Life cash value can be accessed at any time, for any purpose—without penalties or tax consequences when structured correctly.

- Reduces Risk While Maximizing Long-Term Growth – Instead of being forced to sell investments in a down market, individuals can use Whole Life cash value as a temporary funding source during downturns, allowing their market-based investments time to recover.

What This Means for You

If you or your child are facing the emotional conundrum of whether to invest or not to invest in student loans, consider an alternative that protects your financial future.

- Break free from traditional debt by using a strategy that keeps your wealth within your family.

- Increase financial certainty with a properly structured Whole Life policy that offers guaranteed cash value growth, unlike market-driven investments that fluctuate.

- Retain control over your future by creating a personalized financing strategy that benefits your entire family instead of sending interest payments to lenders.

Instead of taking on uncertain market risk or locking yourself into decades of student loan payments, The Volatility Buffer Strategy allows you to fund education, protect your wealth, and maintain financial flexibility—all at the same time.

FAQs About Funding Education Without Student Loans

Is using Whole Life Insurance for education better than a 529 Plan?

529 Plans are market-dependent, restrictive, and taxable for non-education withdrawals, whereas Whole Life Insurance:

- Provides liquidity and flexibility—cash value can be used for any purpose, not just education.

- Is not tied to market volatility, ensuring consistent growth.

- Doesn’t impact FAFSA calculations, which can improve financial aid eligibility.

- Can be used beyond education, such as for real estate investments, business funding, or retirement.

How soon should I start a Whole Life policy if I want to use it for education funding?

The earlier, the better. Whole Life policies build cash value over time, so starting when children are young allows more time for growth. However, even starting later can still provide advantages over traditional student loans.

What happens if I borrow against my Whole Life policy for tuition?

Borrowing against your policy’s cash value means you are taking a loan from yourself. The policy continues to earn interest and dividends on the full value, while you pay back the loan on a flexible schedule. There are no penalties for early or late repayment, and the interest you pay goes back into your policy instead of to a bank or lender.

Can this strategy work if my child is already in high school or college?

Yes, while more time allows for greater cash value accumulation, even starting a policy later can provide liquidity and financial flexibility. Additionally, parents can use existing policies or set up policies on themselves to leverage cash value for tuition.

What are the risks of using Whole Life Insurance for college funding?

When structured correctly, Whole Life Insurance offers guaranteed cash value growth and flexibility, but it does require consistent premium payments. The main risk is not funding the policy properly, which is why working with a Paradigm Life Wealth Strategist ensures the strategy is optimized for education and long-term wealth-building.

Education Without the Burden of Debt

Student loans may seem like the only way to pay for college, but they come at a high cost—delaying financial independence, reducing investment opportunities, and limiting long-term wealth. Instead of borrowing from banks and sacrificing future financial security, The Family Bank Strategy offers a smarter way to fund education while building lasting wealth.

By leveraging Whole Life Insurance cash value, you can pay for tuition without taking on debt, losing financial control, or delaying other financial goals. This strategy ensures your money works for you, not against you, providing flexibility, certainty, and long-term financial growth.

To explore how The Family Bank Strategy can help fund education while securing your financial future, schedule a complimentary strategy session with a Paradigm Life Wealth Strategist today.