Congratulations! You have received a clean bill of health from your doctor, you are going to enjoy life to a ripe old age! So why aren’t you celebrating?

If you are like many soon to be retirees, your lack of excitement to news of longevity could be because you may not be financially secure enough to afford living a long time.

Either you know you are not financially prepared, or worse, you don’t know and are worried about it.

Due to a recent emphasis on healthy living, the average age of life expectancy for the baby boomer generation has increased dramatically.

Unfortunately, many have focused on their physical health, but not their financial health. Living longer doesn’t equal to very much if you aren’t able to afford it.

How to Make Your Money Live Longer than You do

There is a plethora of advice on how to live longer and be both physically and financially fit. Both provide credible and not so credible options. Just as you would seek proper advice regarding your physical health, so should you when it comes to your financial health.

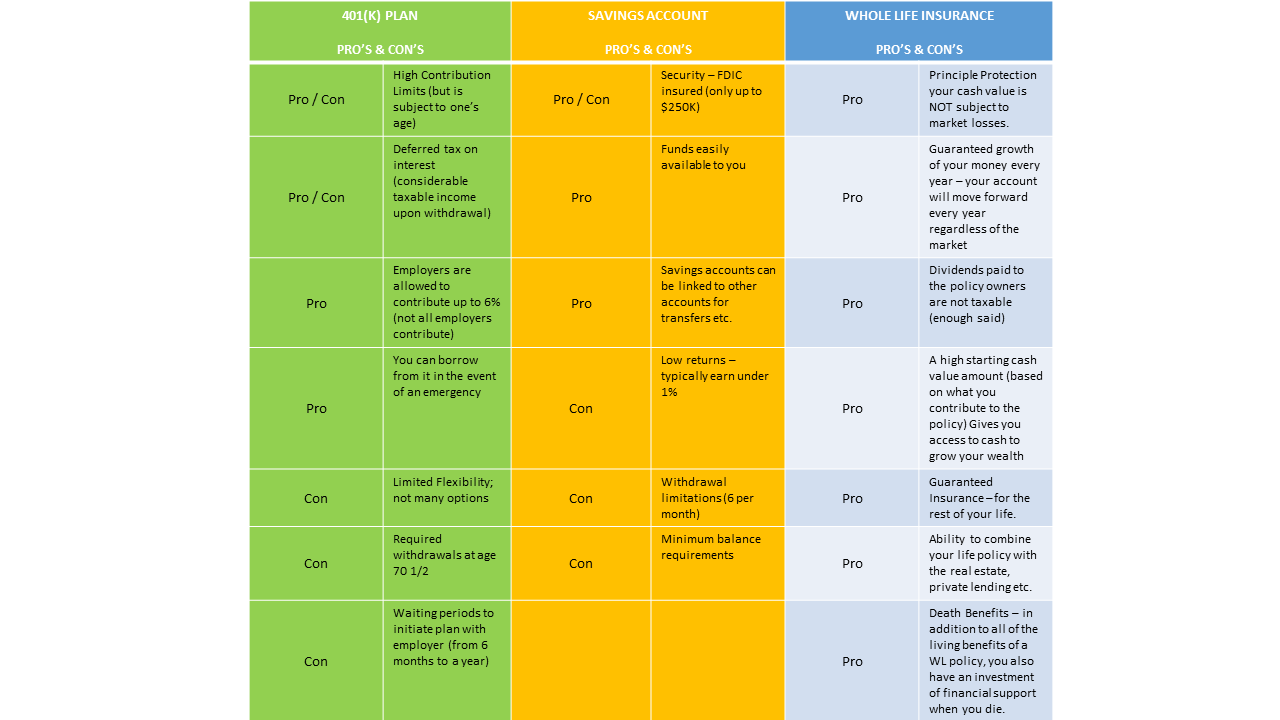

Of Retirement options, the ones that receive the most recognition tend to be: 401K’s, Standard Savings Plans, and Whole Life Insurance.

The choices of your retirement are yours. You have worked your entire life toward that day when you can finally say, “I am retired.” That day when you can do whatever you would like to do, go anywhere you would like; no obligations, just what you want.

But what if you have not planned and prepared for that day? There is still hope, there is still a way for you to have every day the way you want it when you retire; and still be able to afford it financially.

Below is a comparison of the most well-known retirement options: Pro’s and Con’s.

The 401(K)

Perhaps the most “well-known” plan when it comes to retirement options. Most usually due to the many corporations who adopt this type of retirement plan for their employees and themselves.

While there are many positive points to a 401(K), there are about as many negatives as well. The ultimate goal of a successful retirement is being able to retire at an age where you can still enjoy your later years and in a financially successful way.

Top pro’s to utilizing a 401(K) for your retirement; most employers contribute, therefore maximizing what you can hope to save and have available when the time comes. And you are able to pull money from it (with penalties) before you retire if you have an emergency.

If you are one of the many ‘soon to be’ retirees that has not yet begun to plan your retirement, or you work for a company that does not offer a 401(K) as an option, you may be worried that you don’t have enough time left to retire with any funds.

In truth, with a 401(K) plan, this a very likely potential. Some companies do not even offer employees the option to sign up for their 401(K) plan until they have been with the company for at least 6 months; in some cases employees are not eligible for a year.

Add the fact that your ‘investment’ is based on stock options, that are limited in their choice. If you are not well-versed in the stock market, your choices tend to be random.

Since you are not the one managing your “stock options” this leaves your 401(K) account and plan volatile to what the market dictates.

If you already have a 401(K) account, realize the amount of money you currently see on your statements may not exactly be what you end up with once you retire and are able to retrieve the funds.

Remember also that you will be taxed when you remove your money for retirement or anything else that you find you need financially. Just a note to be sure to remember.

Standard Savings Account

The standard savings account is just that, standard and very basic. Not a bad thing, but when you put your money somewhere for future retirement, ideally one would hope for the ultimate returns.

With a standard savings account, you only have the option to accumulate what you have put into the account. The return rate is quite minimal, and there are penalties on both your ability to withdrawal and the minimum balance required.

While your savings is not based on the volatility of the stock market, and unless you started saving very young, the likelihood that you will have enough to retire on is still minimal.

A potential ‘pro’ for some, is that it is easily accessible, and usually connected to a main checking account which makes for trouble-free transfers between accounts for emergencies.

However, it may be too easy to access which could result in less than you need in the end.

A Whole Life Insurance Policy

Perhaps the best option when it comes to retirement planning is a Whole Life Insurance policy.

The pros are constant and two-fold. Not only are you able to retire financially successful, but it also supplies you with a death benefit. Neither a 401(K) nor a standard savings plan offers this.

A Whole Life policy also provides living benefits, known as cash value. Cash that you can access for emergencies and anything you like….anything. And unlike pulling cash from your 401(K), with Whole Life you are not taxed on the cash you pull you withdrawal nor penalized for early distribution.

The most important reason to consider a Whole Life policy as your retirement vehicle, is that even if you have not invested the years saving for your retirement, you will still see serious gains.

And what you accrue is NOT based on the stock market, therefore your money is not susceptible to volatility.

So keep eating your veggies, try not to skip that workout, and know that even if you just started planning for your retirement, with Whole life, you can still have an amazing retirement: One to last you as long as you like.

Read: The Whole Truth About Whole Life Insurance

Watch: Preparing for Your Complete Retirement Journey

Listen: Determining Capital Value

[analytify-stats metrics=”ga:pageValue” permission_view=”administrator”][analytify-stats metrics=”ga:uniquePageviews” permission_view=”administrator”][analytify-stats metrics=”ga:avgTimeOnPage” permission_view=”administrator”]