Straight life insurance is one of the oldest and most reliable types of life insurance, trusted for centuries to help policyholders grow and protect their wealth. Unlike other options like universal, variable, or term life insurance, straight life policies offer unique benefits, including guaranteed cash value growth, lifetime coverage, and level premiums.

At Paradigm Life, we take straight life insurance a step further by integrating it into The Perpetual Wealth Strategy™, a comprehensive approach to building, protecting, and transferring wealth. But how do you know if a straight life policy is right for you? Let’s explore its features and determine if it fits your financial goals.

What is a Straight Life Policy?

A straight life insurance policy, a type of whole life insurance has been trusted for generations to grow and protect wealth. It’s not just a tool for the wealthy—it’s a reliable solution for individuals and families seeking financial security and long-term stability.

Straight life policies stand out from other types of insurance, like universal life or term life, because of their unique benefits:

- Guaranteed Death Benefit: Provides financial protection for your beneficiaries.

- Level Premiums: Stay consistent throughout the life of the policy, making budgeting easier.

- Cash Value Growth: Builds a cash value account that grows steadily over time, functioning like a high-interest savings account you can access when needed.

With straight life insurance, part of your premium funds the guaranteed death benefit, while the other part grows your cash value account. This dual benefit makes straight life insurance a cornerstone of Paradigm Life’s Perpetual Wealth Strategy™, helping you build, protect, and transfer wealth with certainty.

The Benefits of Straight Life Policies

Straight life insurance is more than a safety net—it’s a versatile financial tool that supports long-term goals like building wealth, planning for retirement, and securing your legacy. As a type of whole life insurance, straight life policies combine guaranteed growth, asset protection, and financial flexibility to help you achieve lasting financial security.

When integrated into Paradigm Life’s Perpetual Wealth Strategy™, straight life insurance becomes the foundation of a plan designed to grow, protect, and transfer wealth efficiently. Here’s how it works:

1. Dividends and Interest: A Reliable Financial Asset

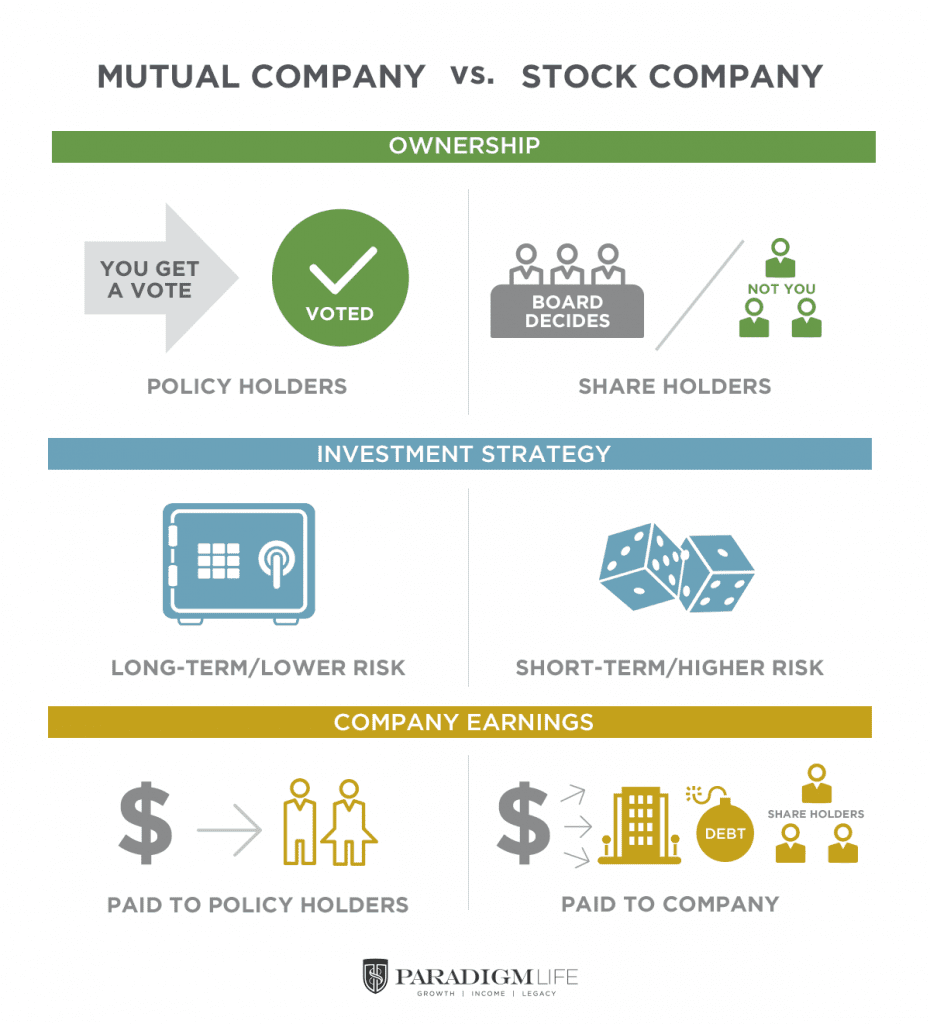

Straight life insurance policies are issued by mutual insurance companies, which operate under strict regulations at both state and federal levels. These companies guarantee a fixed interest rate on your cash value account, ensuring steady growth regardless of market conditions.

As a policyholder, you’re not just a client—you’re part-owner of the mutual insurer. This ownership often entitles you to dividends, which are additional earnings paid on top of the guaranteed interest. While dividends aren’t guaranteed, mutual insurers have a long history of paying them consistently, even during economic downturns.

Why it matters: The combination of guaranteed growth and potential dividends makes straight life insurance a dependable financial asset for building wealth and achieving long-term goals.

2. Policy Loans: Unlock Financial Flexibility

One of the most powerful features of a straight life policy is the ability to borrow against your cash value through a policy loan. Unlike traditional loans, policy loans are:

- Credit-free: No credit checks or bank approvals required.

- Flexible: You decide how and when to repay.

- Efficient: Borrowing doesn’t interrupt your policy’s growth.

Even while borrowing, your cash value continues earning guaranteed interest on the full amount—meaning each dollar works twice as hard. This allows you to use your policy for a variety of needs:

- Fund investments or business opportunities.

- Pay off high-interest debt.

- Cover unexpected emergencies.

Policy loans offer unmatched flexibility, empowering you to access liquidity without sacrificing long-term growth.

3. Tax-Free Growth and Payouts

Straight life insurance offers several tax advantages that maximize your policy’s efficiency:

- Tax-free policy loans: Borrowing against your policy doesn’t trigger taxable events.

- Tax-deferred growth: The cash value grows without immediate tax liabilities, allowing your wealth to accumulate faster.

- Tax-free death benefit: Your beneficiaries typically receive the death benefit tax-free

- , shielding them from income, inheritance, or estate taxes in most cases.

These tax benefits provide an efficient way to grow and access wealth while minimizing tax burdens for both you and your loved ones.

4. Designed to Protect Your Assets

Straight life insurance is designed to protect your assets with uniquely structured to safeguard your assets from financial risks:

- Privacy: Transactions involving your cash value account, policy loans, and death benefits are private, shielding them from public asset searches.

- Protection from creditors: In many states, life insurance assets are exempt from creditor claims, ensuring your wealth remains secure.

- Legal safeguards: Life insurance is often protected from lawsuits, garnishments, and bankruptcy, offering peace of mind that your assets are safe.

These protections make straight life policies ideal for preserving your wealth from unexpected challenges while ensuring a secure future for your beneficiaries.

Why Straight Life Insurance Is an Essential Financial Tool

Straight life insurance combines stability, growth, and protection in a way few other financial tools can:

- Steady growth: Guaranteed interest and potential dividends provide reliable returns over time.

- Financial flexibility: Policy loans give you access to liquidity without interrupting wealth-building.

- Tax efficiency: Tax-free loans, tax-deferred growth, and tax-free death benefits maximize your policy’s value.

- Asset protection: Shields your wealth from creditors, lawsuits, and other risks.

When integrated into Paradigm Life’s Perpetual Wealth Strategy™, straight life insurance becomes more than just a policy—it’s a cornerstone for achieving financial independence and leaving a lasting legacy.

Comparing Straight Life Insurance to Other Types of Coverage

When choosing life insurance, the reasons are often the same: protecting your family from unexpected loss, ensuring financial stability, or creating a secure way to grow and protect wealth. But your financial goals and needs will determine the type of policy that’s best for you.

Let’s explore how straight life insurance compares to term life and convertible term insurance so you can make an informed decision.

Straight Life vs. Term Life Insurance

Term Life Insurance

Term life insurance provides coverage for a set period, typically in increments of 5 to 30 years. If you pass away during the term, your beneficiaries receive a death benefit. However, if you outlive the policy, neither you nor your beneficiaries receive any payout.

The cost of your premium for term life insurance is generally much lower than that of a straight life policy. This is because term life is designed for temporary needs and only pays out in specific cases, such as an untimely death. It’s often chosen to cover short-term financial responsibilities, like:

- Mortgage payments

- College tuition

- Other debts that could burden loved ones if you pass away unexpectedly

While term life is affordable, it doesn’t offer the long-term benefits or flexibility of a permanent policy.

Straight Life Insurance

Unlike term life, straight life insurance is a type of whole life insurance that provides:

- Lifelong coverage: Your policy remains active for your entire life as long as premiums are paid.

- Guaranteed cash value growth: Your policy builds a savings component over time, which you can access through loans or withdrawals.

- Living benefits: Use the cash value to fund opportunities, cover emergencies, or supplement retirement income.

While the cost of your premium for straight life insurance is higher than term life, you’re investing in a policy that grows in value and provides financial security for a lifetime. Over time, the cash value and living benefits make straight life insurance a cornerstone for achieving long-term financial goals.

Convertible Term Insurance: The Best of Both Worlds

If you’re looking for the affordability of term life insurance but want the option to transition to a permanent policy later, convertible term insurance might be the right choice.

Convertible term policies allow you to:

- Start with lower-cost term coverage.

- Convert to a straight life policy within a set timeframe (typically 10 years) without undergoing a new medical exam.

This option provides flexibility for those who anticipate evolving financial needs, such as growing families or changing career paths.

Straight Life vs. Universal Life Insurance: Which Is Right for You?

Both straight life and universal life insurance provide lifelong coverage and cash value growth, but they serve different financial goals. Understanding their key differences can help you choose the policy that best aligns with your needs.

Guaranteed Interest vs. Variable Returns

Straight life insurance guarantees a fixed interest rate on your cash value and may also pay non-guaranteed dividends. This steady, reliable growth makes it an ideal choice for long-term goals like retirement or creating a financial safety net.

Universal life insurance, on the other hand, offers variable returns that depend on the policy type—whether traditional, indexed, or variable universal life. While this flexibility might result in higher returns during favorable market conditions, it also introduces uncertainty, making cash value growth harder to predict.

Variable Premiums vs. Level Premiums

One of the biggest differences between these policies is the premium structure:

- Universal life insurance: Premiums are variable, allowing you to adjust or skip payments if your cash value is sufficient. However, this flexibility comes with risks. Reducing payments can drain the cash value, lower the death benefit, and potentially lead to higher future premiums.

- Straight life insurance: With straight life insurance, you pay a fixed level premium for the policy’s lifetime. This consistency simplifies budgeting, provides predictable costs, and ensures steady coverage. Over time, dividends from the policy can even cover the premiums, potentially lowering your out-of-pocket costs to zero.

Why it matters: A level premium offers peace of mind, allowing you to plan confidently without worrying about unexpected increases.

Why Straight Life Stands Out

Straight life insurance provides:

- Guaranteed growth: Reliable cash value accumulation with predictable returns.

- Stability: A fixed level premium ensures steady costs and lifelong coverage.

- Certainty: Ideal for those who value financial security and long-term planning.

While universal life insurance may appeal to those who prioritize flexibility and are comfortable managing market risks, straight life insurance is hard to beat for dependable wealth-building

Straight Life Insurance and The Perpetual Wealth Strategy™

At Paradigm Life, we integrate straight life insurance into The Perpetual Wealth Strategy™, a proven approach to building and protecting wealth. The policy’s level premium ensures predictable costs, while guaranteed growth and cash value accumulation provide a reliable foundation for achieving your financial goals.

Straight Life Policies for Business

Straight life insurance offers unique advantages for business owners, making it a valuable tool for financial planning and risk management.

Succession Planning for Family-Owned Businesses

Straight life policies help ensure a smooth transition for family-owned companies. The death benefit provides an immediate payout to family beneficiaries, offering financial support to keep the business running. While the owner is alive, the policy’s cash value can be accessed to fund business expenses, all with tax advantages.

Key Person Insurance

Businesses often use straight life policies for key person insurance. The company purchases a policy on a vital employee whose loss would create financial strain. The death benefit helps cover the cost of replacing the employee, including salary expenses and recruitment efforts. Meanwhile, the policy’s cash value can fund business needs or employee incentives, making this insurance a practical choice for companies of all sizes.

Buy-Sell Agreements

Straight life insurance is also integral to buy-sell agreements. A co-owner purchases a policy covering their share of the business, naming a business partner or co-owner as the beneficiary. If the policyholder passes away, the death benefit provides the funds needed for the beneficiary to buy the available shares, ensuring business continuity.

Straight life insurance not only protects businesses but also helps them thrive by offering financial flexibility, security, and peace of mind.

Who Can You Purchase a Whole Life Insurance Policy For?

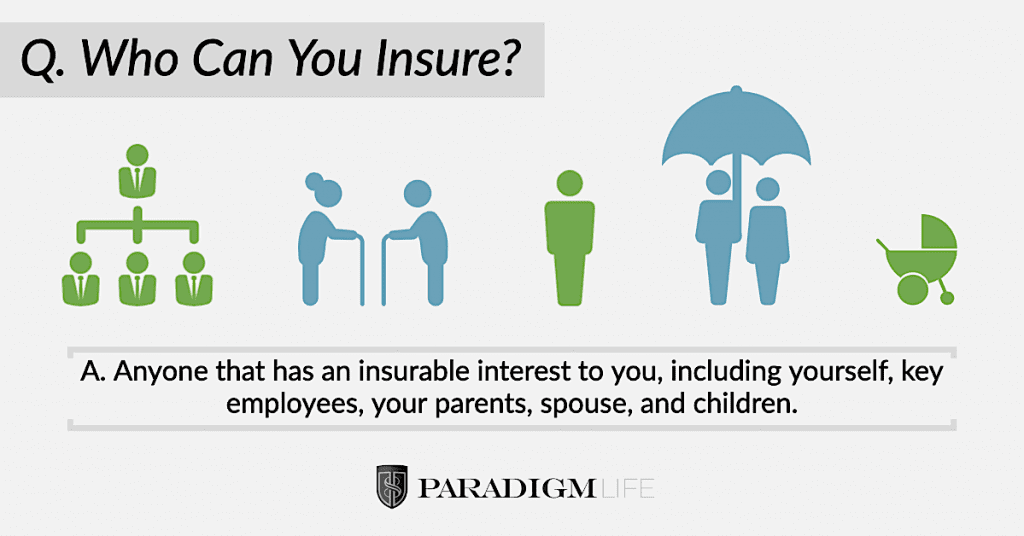

Life insurance policies, including whole life insurance, can be purchased for anyone with whom you have an insurable interest. This means you can protect not only your family members but also key business personnel whose loss could financially impact your business.

For families, it’s common to purchase straight life policies for parents, spouses, and children. By holding multiple whole life insurance policies, you can significantly increase the spending and earning power of your family’s financial foundation—often referred to as a “family bank.” This approach is how wealthy families continue to grow their wealth and pass it on to future generations.

How Straight Life Insurance Can Be Used

Straight life insurance, a type of whole life insurance, offers versatility and flexibility in supporting various family and financial goals. Here are some practical ways families and businesses can leverage these policies:

- Family trusts: Fund a trust to protect and grow wealth for future generations.

- Education costs: Cover tuition or other educational expenses for children or grandchildren.

- Real estate investments: Use cash value to purchase family property, such as vacation homes or other real estate ventures.

- Care for aging parents: Provide financial support for medical expenses, in-home care, or assisted living.

- Unexpected expenses: Use the policy’s cash value to cover unforeseen medical costs, emergencies, or other financial needs.

The Power of a Family Bank with Whole Life Insurance

By holding multiple whole life insurance policies, families can create a family bank—a financial system where policies are used to provide liquidity, fund opportunities, and support generational wealth-building. Here’s how it works:

- Liquidity: The cash value in each policy grows steadily and is accessible through tax-free policy loans, ensuring you have funds available when needed.

- Generational wealth: Policies can be structured to maximize the transfer of wealth to future generations, minimizing taxes and ensuring financial security.

Aligned goals: With multiple policies working together, you can strategically fund education, investments, and other goals while maintaining long-term financial growth.

Why Should I Choose Paradigm Life for My Insurance Policy?

Paradigm Life specializes in tailoring straight life insurance policies to align with your financial goals, whether you’re building wealth, planning for retirement, or protecting your family. By partnering with top-rated mutual insurance companies, we ensure your policy offers guaranteed growth, tax advantages, and stability backed by highly regulated providers.

With Paradigm Life, you gain access to expert Wealth Strategists, ongoing support, and free educational resources to maximize your policy’s benefits. Through our proprietary Perpetual Wealth Strategy™, we help you create generational wealth, maintain financial control, and achieve long-term security. Schedule a free consultation today and start building a stronger financial future.

Take the Next Step with Paradigm Life

Straight life insurance is more than just protection—it’s a cornerstone for achieving lasting financial success. When integrated into Paradigm Life’s Perpetual Wealth Strategy™, it becomes a powerful tool to grow, protect, and transfer wealth while securing your family’s future.

Whether you’re building wealth, safeguarding your loved ones, or planning for retirement, Paradigm Life provides the tools, expertise, and guidance to help you reach your financial goals.

Here’s How to Get Started:

- Learn: Access free resources to understand how straight life insurance fits into your financial strategy.

- Consult: Schedule a free consultation with a Paradigm Life Wealth Strategist to explore your options.

- Act: Let us create a personalized policy tailored to your unique needs and long-term vision.

Start building a secure financial future today with Paradigm Life and the Perpetual Wealth Strategy™—your path to financial independence and generational wealth.

If you’re shopping for a straight life policy, or want to learn more about cash value insurance for growing and protecting wealth, our team is here to help.

At Paradigm Life we can customize a policy to fit your financial situation. Our expert Wealth Strategists are available to answer your questions and show you customized illustrations, outlining an individual plan of action to help you achieve your goals.  , no strings attached.

, no strings attached.