Imagine a world without protection against life’s unpredictable events—no safety net for your family, no financial cushion in times of loss. It’s in this world that the concept of life insurance was born, evolving into one of the most vital tools for wealth building, debt management, and financial security. Over time, life insurance has transformed from a basic means of covering burial costs into a powerful financial strategy.

This shift highlights how life insurance has become an integral part of The Perpetual Wealth Strategy™, offering much more than a death benefit—it’s a foundational tool for long-term financial planning and asset protection.

The Evolution of Life Insurance

The Beginning: 1759

The history of life insurance dates back to 1759, with the establishment of the Presbyterian Ministers Fund. This early form of life insurance was designed to provide financial relief to widows and children by covering funeral costs and sustaining families after the death of a breadwinner. Initially, life insurance was simple—focused solely on providing death benefits to help surviving family members with immediate expenses after a loss.

As life events, such as wars, natural disasters, and disease, became more unpredictable, the need for financial protection grew, leading to the evolution of life insurance into a much broader and more complex financial tool.

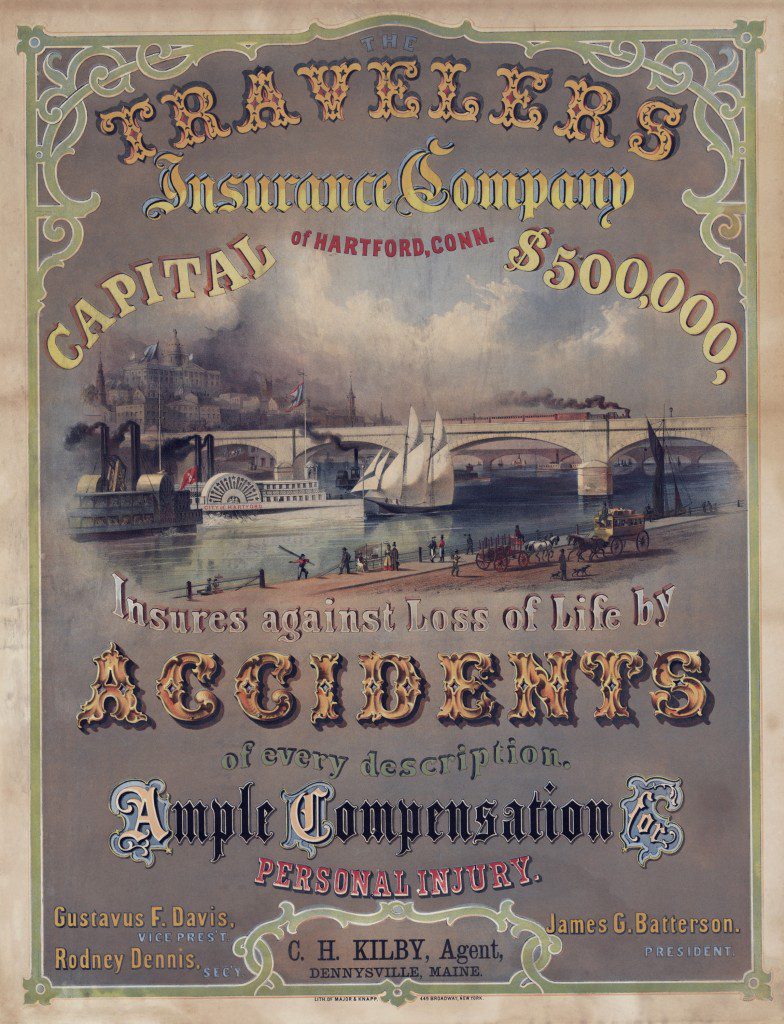

The 19th Century: The Birth of Life Insurance Companies

By the early 1800s, life insurance transitioned from a community-based system to a formalized industry. With the growth of urbanization, industrialization, and a middle class, demand for financial security increased, and life insurance companies began to take shape.

- 1812: The first life insurance company in the U.S., The Philadelphia Contributionship, was founded.

- 1820: Seventeen stock life insurance companies were operating in New York, marking the rise of life insurance as a fully-fledged financial service.

- 1843: New York Life Insurance Company was founded, becoming a major player in the industry and offering coverage for both individuals and businesses.

- 1847: The founding of Penn Mutual marked a significant milestone, providing whole life insurance as a means for wealth-building and asset protection.

20th Century: Expanding Beyond Life Insurance

The 20th century saw life insurance evolve from a simple death benefit to a multifaceted financial tool for wealth building, debt management, and financial security.

- 1901: The Afro-American Life Insurance Company was founded to offer affordable life insurance options to the African American community, which had previously been excluded from many financial opportunities.

- 1935: The Social Security Act transformed financial security by introducing unemployment compensation and old-age benefits. This increased the demand for additional financial protection, leading life insurance companies to innovate and offer broader coverage, including disability insurance and long-term financial planning solutions.

- 1950s: With the rise of the middle class and growing personal wealth, life insurance expanded into wealth accumulation products like whole life insurance, which began to serve as both a financial protection tool and a way to grow assets over time.

- 1970s: As the financial landscape shifted, life insurance companies began to introduce universal life policies, allowing policyholders to accumulate cash value and access greater flexibility in how their premiums were managed, further advancing the role of life insurance in comprehensive financial planning.

The Shift to Whole Life Insurance and Its Modern Applications

Over time, life insurance policies have evolved into powerful financial tools, with Whole Life Insurance leading the charge. Unlike term life policies, which offer temporary protection, Whole Life Insurance provides lifelong coverage and accumulates cash value over time.

Modern-day Uses:

Today, Whole Life Insurance is used to build wealth, protect assets, and manage debt. The accumulated cash value of these policies offers a stable, predictable resource for families to leverage throughout their lifetime—whether to fund education, manage debt, or cover major expenses.

- Wealth Building: The cash value in a Whole Life Insurance policy grows steadily and predictably, providing families with a reliable financial tool to protect wealth and create generational wealth.

- Debt Management: The cash value in Whole Life Insurance also offers a means to cover unexpected expenses, such as medical bills or home repairs, without accumulating high-interest debt.

The Role of Life Insurance in Financial Security

The Role of Life Insurance in Financial Security

From debt management to wealth building, life insurance has evolved into a cornerstone of modern financial planning. Originally designed to provide protection in the event of death, today’s Whole Life Insurance policies serve as much more than just a death benefit. They are multi-purpose financial tools that contribute significantly to a comprehensive financial strategy, ensuring long-term financial security for individuals and families.

As a perpetual wealth building tool, Whole Life Insurance provides a range of benefits that adapt to various financial needs. Beyond offering peace of mind by safeguarding your family’s future, these policies help secure asset protection, accumulate wealth, and manage debt efficiently, all while ensuring you can continue to meet your financial goals and protect your wealth across generations.

How Life Insurance Plays a Role in Today’s Financial Planning

Modern Whole Life Insurance policies are now integral to a well-rounded financial plan. They address multiple needs simultaneously, making them central to sustainable wealth-building and asset protection. Here’s how they contribute to your broader financial strategy:

Protection

The most traditional and fundamental role of life insurance is to provide financial protection for your loved ones in the event of your death. The death benefit ensures that your family will have the necessary funds to cover funeral expenses, maintain their standard of living, and settle any debts or liabilities you may leave behind. This protective function offers essential financial peace of mind and helps shield your family from the financial burdens that can arise when the primary breadwinner passes away unexpectedly.

Beyond just replacing lost income, the death benefit from Whole Life Insurance can also provide much-needed funds to support other long-term goals, such as paying for your children’s education or maintaining homeownership.

Wealth Accumulation

One of the most powerful aspects of Whole Life Insurance is its ability to accumulate cash value over time at a guaranteed rate. Unlike term life insurance, which only offers a death benefit, Whole Life Insurance grows in value as you pay premiums. This cash value grows tax-deferred, making it a stable, low-risk asset that can provide liquidity when needed.

The accumulated cash value can be accessed in the future, offering families a reliable financial resource. This is particularly valuable for covering major expenses, such as funding a child’s education, purchasing a home, or starting a business. You can also borrow against this cash value, ensuring flexibility and financial options even in times of need.

Debt Management

In times of financial stress, Whole Life Insurance provides a unique tool for debt management. The cash value that accumulates over the life of the policy can serve as an accessible resource to cover unexpected expenses or manage debt. This eliminates the need to resort to high-interest loans, credit cards, or other more costly forms of borrowing.

For example, if you face medical bills, home repairs, or other financial challenges, you can borrow from the accumulated cash value to pay off these expenses or reduce the burden of debt. This flexibility not only provides a financial safety net but also ensures that you can manage your liabilities in a way that doesn’t hinder your long-term wealth-building goals.

Estate Planning

Whole Life Insurance also plays a key role in estate planning by providing a tax-efficient means of passing on wealth to your heirs. The death benefit is typically paid out income tax-free, ensuring your beneficiaries receive the full value of the policy without having to pay taxes on the proceeds.

Additionally, life insurance can be used to cover estate taxes, helping your heirs avoid having to sell off assets (like property or investments) to settle any outstanding taxes upon your passing. By ensuring that your wealth is passed on intact, life insurance allows for a smooth transition of assets to the next generation, contributing to intergenerational wealth and legacy planning.

FAQs

What is the difference between Whole Life Insurance and Term Life Insurance?

Whole Life Insurance provides lifelong coverage, while Term Life Insurance only covers a set period, typically 10-30 years. Whole Life Insurance also builds cash value over time, which can be accessed or borrowed against. Term Life Insurance, by contrast, offers no cash value and expires after the term ends. Whole Life offers a more long-term wealth-building solution.

How does the cash value in a Whole Life Insurance policy accumulate?

The cash value in a Whole Life Insurance policy grows at a guaranteed rate over time. This growth is tax-deferred, meaning you don’t pay taxes on the cash value until you access it. The cash value can be used for emergencies, investments, or to take out loans. It offers a stable and predictable asset for your long-term financial security.

What are the benefits of using Whole Life Insurance for debt management?

Whole Life Insurance can serve as a tool for managing debt by allowing you to borrow against the cash value of the policy. This helps you avoid high-interest loans or credit card debt when facing unexpected expenses. Additionally, the loan terms are often more flexible than traditional loans. It provides a reliable resource to prevent further debt accumulation.

Can I access the cash value of my Whole Life Insurance policy while I’m still alive?

Yes, you can access the cash value of your Whole Life Insurance policy while you’re still alive. You can either take a loan or make a withdrawal from the cash value, depending on your policy’s terms. This allows you to use your policy as a financial resource for major expenses, investments, or emergencies. The flexibility makes it a valuable financial tool.

Is Whole Life Insurance a good tool for estate planning?

Whole Life Insurance plays a significant role in estate planning by providing a tax-efficient way to pass wealth to your heirs. The death benefit is typically paid income tax-free to beneficiaries, ensuring they receive the full value of the policy. It also helps to cover estate taxes, preventing heirs from needing to sell assets. This makes it an essential tool for wealth transfer.

How do the dividends in Whole Life Insurance work, and how can they benefit policyholders?

Many Whole Life Insurance policies pay dividends based on the company’s performance. These dividends can be used to increase the policy’s cash value, reduce premiums, or even buy additional coverage. This growth helps to accelerate wealth accumulation over time. Dividends provide an additional layer of financial growth, making the policy even more valuable.

What role does Whole Life Insurance play in creating generational wealth?

Whole Life Insurance helps create generational wealth by allowing policyholders to pass down assets to future generations. The cash value grows steadily, and the death benefit provides a financial legacy. It offers tax-free benefits to heirs, ensuring wealth is passed down intact. By using life insurance for wealth transfer, families can build a sustainable financial legacy.

Can Whole Life Insurance be used for purposes other than death benefit protection?

Yes, Whole Life Insurance can be used for much more than just death benefit protection. It can be a source of funds for large purchases, like a home, or used to pay for education or medical expenses. The cash value can be accessed through loans or withdrawals, providing flexibility and financial options. This versatility makes it a multi-purpose tool for comprehensive financial planning.

Moving Forward: Incorporating Life Insurance into Your Financial Plan

As we’ve explored, life insurance has evolved from a basic safety net to a versatile, multi-purpose financial tool. With the Perpetual Wealth Strategy™, families can now use Whole Life Insurance for far more than just a death benefit. It helps manage debt, build wealth, and create long-term financial security for future generations.

It’s time to rethink how you view life insurance. Whole Life Insurance is no longer just a product you purchase to protect your family after you’re gone—it’s an essential part of your financial blueprint. By incorporating it into your debt management and wealth-building strategy, you benefit from its unique ability to grow wealth tax-deferred while offering a secure and reliable resource throughout your lifetime. The cash value of your policy grows steadily over time, and can be leveraged for everything from investment opportunities to major purchases.