Life insurance policy riders are optional add-ons that let you tailor your coverage to meet your unique needs. These riders offer additional benefits like income protection, long-term care coverage, or extra support for your loved ones—all within your existing policy.

Riders provide the flexibility to adapt your policy as life evolves. Whether you’re safeguarding your family’s future, building cash value, or preparing for unexpected expenses, they enhance your policy’s value without requiring a new one.

At Paradigm Life, we integrate these benefits into The Perpetual Wealth Strategy™, helping you select the right riders to optimize your coverage and align with your long-term financial goals. By choosing the right riders, you can turn your life insurance policy into a powerful tool for building, protecting, and transferring wealth efficiently.

The Benefits of Life Insurance Policy Riders

Life insurance policy riders enhance your coverage by adding flexibility, extra protection, and cost-effective options. Here’s how they can help you:

1. Customization: Tailor Your Policy to Fit Your Needs

Riders let you adjust your policy as your life circumstances change, ensuring your coverage remains relevant.

- Growing families: Add a child term rider for your children or a spouse rider to cover both partners.

- Temporary needs: Use a renewable term rider to cover short-term obligations like a mortgage or tuition.

- Health changes: Riders like a long-term care rider or accelerated death benefit rider help cover medical expenses if needed.

2.Additional Coverage: Go Beyond The Basics

Riders provide extra benefits that extend the functionality of your base policy, protecting you and your loved ones in more ways.

- Disability protection: A waiver of premium rider keeps your policy active if you’re unable to work.

- Illness coverage: An accelerated death benefit rider can help pay for chronic or terminal illness expenses.

- Family income support: A family income rider ensures additional income to replace lost earnings, providing financial stability.

3.Cost-Effectiveness: Affordable Enhancements

Many riders are low-cost or included in your policy, making it easy to upgrade your coverage without overspending.

- Low premiums: Riders like accidental death benefit or child term riders usually add minimal costs.

- Flexible options: Paid-up additions riders let you grow cash value based on your budget.

- Long-term savings: Investing in riders now can prevent higher expenses for future needs like healthcare or disability.

Essential Life Insurance Policy Riders

Life insurance policy riders are customizable options that enhance your coverage and provide additional benefits tailored to your specific needs. While many insurance companies offer unique names and structures for their riders, the core features remain consistent. With the help of a Paradigm Life Wealth Strategist, you can identify the riders that best fit your financial goals and ensure comprehensive protection.

Paid-Up Additions Rider

If you’re considering a whole life insurance policy for the purpose of earning dividends and guaranteed interest, a paid-up additions rider is a must-have life insurance rider. It allows you to overfund your policy in such a way that it immediately and rapidly starts increasing in cash value, giving you access to policy loans. By using a paid-up additions rider, you’ll also increase the overall policy of your value in the long run, resulting in more retirement income and a greater death benefit.

Structuring a whole life insurance policy with a paid-up additions rider can be tricky; overfund the policy too much and you’ll risk it becoming a MEC (modified endowment contract) subject to taxes by the IRS. The Wealth Strategists at Paradigm Life are experts at customizing and buying life insurance policies with paid-up additions riders; in fact, it’s a key component of our Perpetual Wealth Strategy.

Guaranteed Insurability Rider

The guaranteed insurability rider guarantees that you can renew or increase your amount of coverage at a later date without a new medical exam or other proof of insurability. You are typically given the option to renew or increase your coverage every three or five years on the anniversary date of your policy, but it may vary depending on your insurance carrier.

Also referred to as a guaranteed purchase option, there may be minimum and maximum amounts of coverage you qualify for. This life insurance rider it’s ideal if you expect future life changes, such as starting a family or growing your financial responsibilities. With a guaranteed insurability rider, you lock in favorable rates now while retaining the flexibility to expand your coverage when needed.

Term Conversion Rider

A term conversion rider lets you upgrade your term life insurance to whole life insurance without a medical exam or proof of insurability. It’s a simple way to enhance your coverage when you’re ready.

Whole life insurance provides benefits like cash value growth, policy loans, tax advantages, and retirement income. While its premiums are higher than term insurance, a term conversion rider helps you lock in a lower rate now and transition later.

Most term conversion riders are valid for up to 10 years from the policy’s start date, giving you plenty of time to make the switch. If you want a flexible, cost-effective path to whole life insurance, a term conversion rider is a smart choice.

Disability Waiver of Premium Rider

A disability waiver of premium rider ensures your life insurance policy remains active if you become unable to work due to a disability. Once you’re deemed totally disabled (as defined by your insurance carrier), this rider waives your premium payments, so you don’t have to worry about losing coverage.

Here’s how it works:

- If your disability ends, you resume regular premium payments.

- If the disability continues for life, the rider permanently waives your premiums, but your coverage—including cash value growth and death benefit—remains intact.

With this rider, you’ll keep the benefits of your policy, like liquidity, tax advantages, and access to policy loans, even if you stop paying premiums. It’s a practical way to protect your financial plan and maintain peace of mind during challenging times.

Accelerated Death Benefit Rider

Sometimes called a living benefit rider, this option provides access to a portion of your death benefit if you’re diagnosed with a terminal illness. The funds can be used for medical expenses, hospice care, or other financial needs, offering peace of mind during difficult times.

The accelerated death benefit rider is useful for helping families cover medical bills, hospice care, or any other outstanding financial needs while you are still alive. The benefit is typically paid out in one lump sum and the remainder of your death benefit will go to your designated beneficiaries. Essentially it’s a cash advance on your death benefit.

Accidental Death Benefit

With an accidental death benefit rider, if your death is classified as accidental, sometimes doubling or tripling the payout. It’s a cost-effective way to provide extra financial security for your loved ones in case of unexpected events.

Should you opt to add an accidental death benefit rider to your insurance policy? Ultimately it depends on the cost of the premium and the amount of increased death benefit your beneficiaries will receive. Speak with a Wealth Strategist or your insurance carrier to discuss your individual case.

Family Income Rider

The family income rider ensures your loved ones receive steady payments, either as installments or a lump sum, after your passing. It’s ideal for families who depend on the policyholder’s income and need support until other benefits, like retirement or Social Security, begin.

Child Term Rider

A child term rider is essentially a optional add on to a term life insurance policy taken out on a child where the premium is factored into the total payment of the policyholder—the parent. It’s typically very inexpensive to add on a child term rider. If the child dies before a specified age, a death benefit is paid. If the child reaches maturity, the term insurance can be converted into a permanent insurance plan—usually with up to five times the coverage and no need for a medical exam.

Child term riders are ideal for families who utilize the Perpetual Wealth Strategy, also known as the family banking system or cash flow banking. By adding this life insurance rider onto a parent’s policy, the child has both financial protection and an opportunity to hold a whole life insurance policy with the lowest possible premium as an adult.

Spouse Rider

A spouse rider provides term life insurance coverage for your spouse. Like the child term rider, it offers the flexibility to convert to a permanent policy later, helping families lock in lower premiums and create a lasting financial foundation.

Spouse riders are another great way for families to utilize the Perpetual Wealth Strategy and help lock in a lower premium on a whole life insurance policy for a spouse at a later date.

Long-Term Care Rider

Long-term care insurance on its own can be costly, and oftentimes people don’t think to apply for this kind of insurance until they’re already experiencing health issues that make it harder to become insured. Adding a long-term care rider onto a life insurance policy at the time of issue is an ideal and often cost-effective way to cover medical expenses not covered by insurance.

With a long-term care rider in place, your life insurance company helps cover costs like nursing homes and hospice care with regular monthly payments. Considering how expensive assisted living is and the fact that your adult children may likely be the ones left with the bill, this rider may save you and your loved ones hundreds of thousands of dollars.

Renewable Term Rider

A renewable term rider provides extra insurance coverage for temporary needs, even if you already have whole life insurance. It’s perfect for covering short-term expenses like a child’s college tuition, starting a business, or paying off a mortgage. These costs can leave loved ones with financial strain if income suddenly stops.

This rider lets you renew term insurance yearly without needing a medical exam. While premiums increase annually, it’s a flexible way to address short-term obligations. You can also convert this term insurance into a permanent policy later, similar to a convertible term rider. It’s a practical option for added protection when you need it most.

Life Insurance Supplement Rider

For those who want the benefits of whole life insurance but are concerned about costs, the supplement rider combines term and whole life coverage. This blended approach offers lower premiums while providing cash value growth, liquidity, and access to policy loans.

Which Policies Work Best with Life Insurance Policy Riders?

Not all life insurance policies are created equal, and the type of policy you choose plays a big role in how effectively riders can enhance your coverage. At Paradigm Life, we focus on policies that align with The Perpetual Wealth Strategy™, ensuring they provide maximum flexibility, protection, and financial growth.

Whole Life Insurance

Whole life insurance is the cornerstone of The Perpetual Wealth Strategy™. These policies work exceptionally well with riders because they offer guaranteed cash value growth, a stable death benefit, and the ability to tailor coverage. Riders like Paid-Up Additions (PUA) and Accelerated Death Benefits amplify the living benefits of whole life insurance, making it a versatile tool for building and protecting wealth.

Term Life Insurance with Convertible Options

For those looking for affordability with future flexibility, term life insurance with conversion options can be a smart choice. Riders like Waiver of Premium or Child Term Riders work seamlessly with these policies. The ability to convert term coverage into a permanent policy later ensures your strategy can evolve with your financial needs.

Universal Life Insurance

While not as central to The Perpetual Wealth Strategy™, universal life insurance can accommodate certain riders like Long-Term Care or Guaranteed Insurability, offering additional support for specific life stages.

How Does a Waiver Work?

You’ve done the hard part—comparing different types of life insurance and choosing the coverage that fits your budget. But did you know you can take your policy even further with customizable features called policy riders?

Policy riders are like bonus insurance, offering extra benefits to enhance your coverage. They provide additional protection for you and your family, often at little to no cost. These riders allow you to adapt your policy to meet your unique needs, giving you greater flexibility and peace of mind.

Depending on the type of insurance you buy and your carrier, you can add policy riders when your policy is issued or later down the road. It’s never too late to customize your coverage and secure your family’s future.Have questions about policy riders? Schedule a free virtual consultation with a Paradigm Life Wealth Strategist today.

How Much Do Life Insurance Premium Payments Costs?

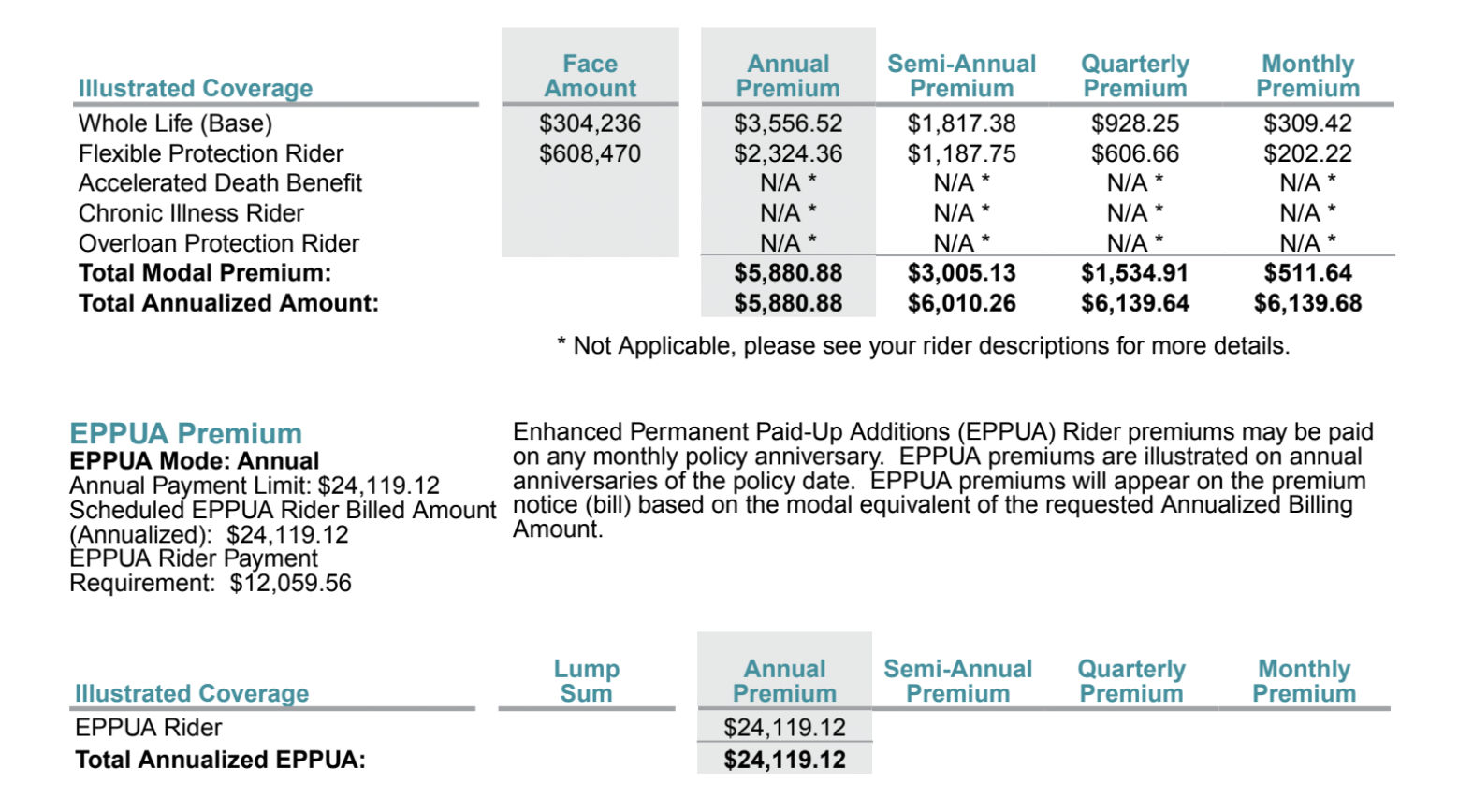

Policy riders vary in cost—and some are free. Each premium payment is determined by the type of rider, the terms of the rider, and often your health. Here is an example of what various policy riders may look like on your life insurance policy illustration:

In this example, you see the whole life insurance base premium and flexible protection rider premium, which totals $5,880.88 per year. Next, the accelerated death benefit rider, chronic illness rider, and overloan protection rider are shown. All of these riders are included in the policy at no extra cost, however the insurance company may charge a percentage to the policyholder if the rider is used. For example, the overloan protection rider, which helps prevent the policy from lapsing if policy loans exceed a certain value, has no annual premium but will typically incur a one-time charge of up to 5% if activated.

In the section below, the paid-up additions rider is listed. Recall this rider is used to “overfund” a policy for rapid cash value growth. The value shown in the Annual Premium column is the MAXIMUM amount the policyholder is allowed to pay into his/her policy each year. The required MINIMUM for this rider (effectively, the premium for the rider) is $12,059.56 per year. This policyholder must pay the minimum premium to keep this rider.

Making Riders Work for You

Life insurance policy riders are powerful tools for enhancing your coverage and adapting to life’s changes. By carefully selecting riders that align with your goals, you can maximize your policy’s value and ensure comprehensive protection for you and your loved ones.

At Paradigm Life, our Wealth Strategists specialize in creating tailored policies that integrate riders into The Perpetual Wealth Strategy™. Schedule a free consultation today to explore how life insurance policy riders can support your financial journey.

A Premium Rider Can Protect Your Policy Benefits and Policy Contract

Life insurance policy riders can greatly increase and enhance your traditional whole life insurance policy. The best way to choose riders for your specific needs is to set up a policy with premiums that fit your budget.

At Paradigm Life we can customize a policy to fit your financial situation. Our expert Wealth Strategists are available to answer your questions and show you customized illustrations, outlining an individual plan of action to help you achieve your goals. Request a free virtual consultation, no strings attached.

Conclusion: Maximizing the Value of Life Insurance Policy Riders

Life insurance policy riders are more than just add-ons; they’re powerful tools that help you customize your coverage, adapt to life’s changes, and achieve long-term financial goals. Whether you’re enhancing protection with a Disability Waiver of Premium Rider, growing wealth with a Paid-Up Additions Rider, or preparing for unforeseen events with a Long-Term Care Rider, the right riders make your life insurance policy a versatile financial asset.

At Paradigm Life, we integrate these riders into The Perpetual Wealth Strategy™, ensuring they work seamlessly to support your financial objectives. This strategy not only optimizes your coverage but also aligns your policy with broader goals like cash flow growth, wealth protection, and legacy planning.