Teaching Kids About Credit: Being An Example of Financial Responsibility

What message does it send to children when they are given control of their parent’s purchasing power? IPad for seven years olds, cell phones for

What message does it send to children when they are given control of their parent’s purchasing power? IPad for seven years olds, cell phones for

It can happen in the blink of an eye, no warning, no fair way to prepare. In one minute you’re immersed in your daily routine,

One of the aspects I like most about my role in advising clients is that we get to talk about a lot of topics! We

Well-known Stamford Connecticut philanthropist Thomas Ruddmucker passed away last week. And while he was known for his generosity, his last act in life is seen

He answered the call from HR, expecting a quick update—only to be reminded it was his turn to meet with the company’s “retirement specialist.” With

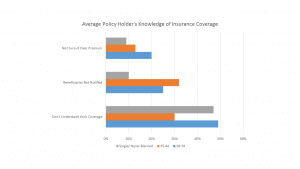

Life insurance is often included as an employee benefit, but not all policies offer the coverage or flexibility you need. While employer-provided term life insurance

When properly structured, overfunded life insurance can become one of the most effective tools for growing and protecting your wealth, especially when utilized with whole

As healthcare costs rise, the need for long-term care (LTC) is a reality many Americans face. Unfortunately, traditional LTC insurance often falls short, with high

When we look to the ultra-wealthy, we see the embodiment of perpetual wealth. They seem to never worry about running out of money, and they

Building a family legacy is more than just amassing wealth; it’s about laying the foundation for a lasting financial heritage. In an ever-changing financial landscape,

Cash life insurance, commonly referred to as cash value life insurance, combines the security of a life insurance policy with an investment feature that can

e transforms into a dynamic financial tool—providing tax-efficient growth, liquidity, and protection. In this article, we’ll uncover why this asset deserves a central role in