Well-known Stamford Connecticut philanthropist Thomas Ruddmucker passed away last week. And while he was known for his generosity, his last act in life is seen as beyond ‘generous’: more like completely outrageous to many.

Well-known Stamford Connecticut philanthropist Thomas Ruddmucker passed away last week. And while he was known for his generosity, his last act in life is seen as beyond ‘generous’: more like completely outrageous to many.

Ruddmucker’s last will and testament revealed that he had bequeathed the entirety of his Whole Life Insurance policy to his most prized possession. A mint condition 1964 Aston Martin DB5 received upwards of nearly 3.5 Million dollars in death benefit from Ruddmucker.

Ruddmucker was no James Bond, however he was often featured in the Hartford Courant for his eccentric deeds. With a true affinity for inanimate objects, Ruddmucker was often seen visiting national landmarks where he would have detailed conversations with statues to make sure they were doing ok.

While he was never seen driving the ’64 Aston Martin, it is rumored that he “saved” it from an unfit owner, restored it back to its original style and glory, and provided it accommodations fit for royalty.

Ruddmucker obtained his exuberant wealth through sound financial decisions provided through strategic wealth building techniques.

Utilizing Whole Life Insurance practices, Ruddmucker accessed the cash value from his Whole Life policy to invest in “And” assets; pragmatically increasing his personal economy and providing himself with a plush retirement. A retirement that afforded him to financially take care of the many things and people he held dear over his lifetime; living, breathing and otherwise.

While he also gave open-handedly to many living recipients, it was no secret the level of love he had for the unfeeling and inanimate objects of this world.

As for his Whole Life beneficiary, endearingly named ‘Charlie’, the ’64 Aston Martin is awaiting final confirmation on the money bestowed. Thus far, ‘Charlie’ has declined to comment.

For the Rest of Us with Beneficiaries…..

APRIL FOOLS! However there is some truth that we can glean from the story above.

One of the most productive ways to increase your personal economy and secure a fruitful retirement is in the purchase of a Whole Life Insurance Policy.

The Infinite Banking Concept, a truly ingenious way to take total control of your money without dependency on qualified retirement plans or the ever decreasing government assisted social security programs.

Infinite Banking is a time proven system that provides 100% liquidity, potential tax free growth, a way to earn interest on money you spend, and potential creditor protection.

What is so magnificent about a Whole Life policy is that you are financially planning for your beneficiaries when you are gone while simultaneously providing for them while you are still alive.

This is possible through the cash value that is available from your Whole Life policy. You can pull your cash value for anything you need.

Learn Today How Whole Life Can Improve Your Tomorrow

Simply purchasing a Whole Life Insurance policy isn’t enough to garner wealth and financial stability. One has to be aware of how to make it work for them.

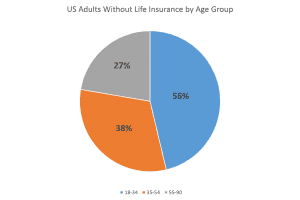

Roughly 39% of US adults do not have any form of life insurance. The percentages by age group is rather shocking. 38% of adults in the US ages 55 and up do not have any form of life insurance, of ages 35-54, its at 38%, and a staggering 56% of US adults 18-34 do not have any form of life insurance in place.

Perhaps even more surprising is the percentage of US adults who have a form of life insurance but yet do not have a clear understanding of what their policy is, or how it can and will benefit them.

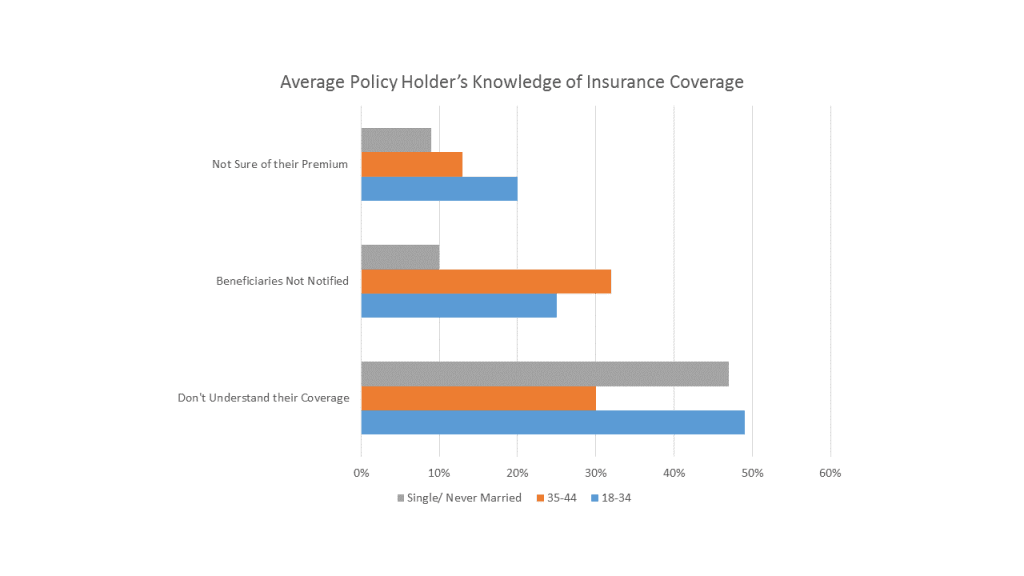

Of the age groups 18-44, and single/ never married policy holders; on average, 42% do not clearly understand their coverage. Of this same demographic, on average, 22% have not notified their beneficiaries, and 14% are not sure of their premium cost.

We can learn much from the late Mr. Ruddmucker when it comes to how he handled his financial affairs and utilized his Whole Life Insurance policy.

Ruddmucker took advantage in how he utilized his Whole Life Insurance policy during his lifetime. He had a clear understanding of how Whole Life Insurance works. He was clear on his premiums in that he also knew how to apply the cash value to fuel his financial needs and wants.

And more than likely he made it known to his beneficiary ‘Charlie’ that he was in line to receive his death benefits. Until ‘Charlie’ provides a comment, we can’t know for sure.

Become Your Own Version of a ‘Ruddmucker’

While the fictional example of Ruddmucker is made in jest, The Infinite Banking Concept and Whole Life Insurance is used by wealthy entrepreneurs and business people to achieve the financial success and freedom they are looking for.

Wouldn’t you like to be able to do the same? Be so financially well off that you too can travel the world and talk to monuments, or restore that expensive classic car you’ve always admired. Ultimately to leave this world having lived a financially sound life, and be able to leave behind said financial stability to anyone you choose; even if they are inanimate?

The reality is that you can. Start today toward a better tomorrow with a Whole Life Insurance policy. You are never too young, or too old to begin efforts to increase your personal economy, plan a plush retirement, and be, if you so choose, wealthy enough to be like the eccentric ‘Ruddmuckers’ of this world.