Adjustable Life Insurance: The Real Cost of Flexibility

Adjustable life insurance is often referred to as a hybrid of term and whole life insurance. It’s permanent, provided premiums are paid, so you don’t

Adjustable life insurance is often referred to as a hybrid of term and whole life insurance. It’s permanent, provided premiums are paid, so you don’t

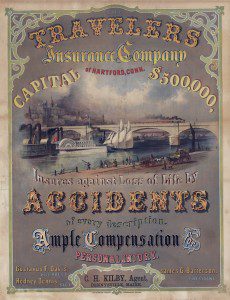

Imagine a world without protection against life’s unpredictable events—no safety net for your family, no financial cushion in times of loss. It’s in this world

Most people think of insurance as something you buy to protect against loss—auto accidents, health emergencies, or property damage. And while those types of coverage

When most people hear the word “dividends,” their minds jump to stocks or investment accounts. But one of the most strategic and often overlooked sources

Doctors, dentists, counselors, and life insurance agents. They all have something in common; there are key factors that need to be present before we officially

Protecting your family’s future starts with making intentional, strategic choices today—and life insurance is one of the most powerful tools you can use. Whether you’re

Life insurance is a cornerstone of financial planning, but it’s far from a one-size-fits-all solution. With various types of life insurance available, selecting the right

With the April 15th deadline for filing your personal income taxes looming, I figured it a good time to review the tax benefits of permanent

At Paradigm Life, we view life insurance as more than just a safety net—it’s a cornerstone of a comprehensive wealth-building approach. Through The Perpetual Wealth

American Dream The American Dream has been a driving force for entrepreneurs in the United States for many years. America cultivates an environment in which

Understanding Life Insurance Dividends from Life Insurance Policies Life insurance dividends play a pivotal role in the benefits of life insurance policies offered by mutual

The great wealth transfer is a term used to describe the transfer of wealth from Baby Boomers and the Silent Generation to their heirs—and it’s