Joint life insurance insures two people on the same policy and is most commonly purchased by couples or business partners, but how does joint life insurance compare to individual policies, and which is right for your situation?

In this article, we’ll explain how joint life insurance coverage works, how much it costs, and the pros and cons of a joint policy. Plus, use the Joint Life Insurance Checklist to help decide if it’s the right kind of life insurance coverage for you.

How a Joint Life Insurance Policy Works

Joint life insurance covers two people and pays out a death benefit when one of the two people insured on the policy dies. Typically, whole life insurance is used because it guarantees coverage for life. There are two main types of policies: first-to-die and second-to-die.

First-to-die

With a first-to-die joint life policy, the surviving spouse or business partner is considered the policy’s beneficiary. A death benefit is paid to the surviving individual and insurance coverage terminates. This provides the surviving individual with income that can be used to cover living expenses, continue business operations, or to be used in retirement.

First-to-die policies are often used by young families and/or families with large debts or expenses like a mortgage or outstanding student loans.

Second-to-die

With a second-to-die joint life policy, also called survivorship insurance, a death benefit is paid to a third-party individual not insured on the joint life insurance policy — usually a child/children of the deceased — and coverage terminates. This policy structure provides lifetime insurance coverage for both of the insured individuals while still leaving a death benefit for loved ones, however, the surviving spouse will be responsible for continuing to pay insurance premiums.

Second-to-die policies are often used in estate planning and to help distribute generational wealth. It can reduce estate taxes and facilitate the transfer of assets without probate. Although it’s most commonly used among family members, a this type of policy can also be used to transfer business assets and create a business succession plan, or to leave a large donation to charity.

Cost & Benefits of Joint Life Insurance Policies

Joint life insurance is rarely offered as a term policy, which only pays out if the insured dies within the specified term. For this reason, it’s best to compare joint universal life insurance policies to individual whole life insurance policies when discussing costs and benefits.

Joint coverage can be significantly less expensive than two separate insurance policies because there is only one death benefit payout. Generally, rates are based on an average of the ages and health of the insured. If both people are in relatively good health, joint life insurance can be a more affordable option than individual whole life insurance policies.

Regardless of whether you choose a joint policy or an individual policy, whole life insurance offers key benefits not found with other types of life insurance, including:

Certainty: Whole life insurance offers a guaranteed rate of return. When purchased through a mutual insurance company, it also pays non-guaranteed dividends. Together, these earnings help grow wealth and offer more income to a surviving spouse or beneficiaries compared to term insurance.

Control: Whole life insurance offers tax advantages and asset protections to help your family keep more wealth, including tax-free death benefit payouts, tax-free policy loans, tax-deferred growth, and estate tax benefits.

Liquidity: Whole life insurance earns cash value, which can be accessed at any time or any age without penalty. Cash value can be used in the form of withdrawals or tax-free policy loans. Alternately, you always have the option of surrendering your policy for a payout.

Protection: Whole life insurance from mutual insurance companies is protected from market volatility and can act as a volatility buffer in retirement, especially in years following a market downturn when qualified retirement funds take a hit.

Cash flow: Regardless of whether you purchase a first-to-die permanent policy or second-to-die joint life insurance policy, whole life insurance provides cash flow that can be used by either insured partner during their lifetime.

Legacy: Whole life insurance is an ideal vehicle to pass down generational wealth in a second-to-die joint life insurance policy and helps heirs avoid estate and/or gift taxes.

Joint Life Insurance Pros & Cons

Like any insurance product or financial tool, joint life insurance has pros and cons. Determining what type of insurance is right for you depends on your financial goals and individual situation. Here are the benefits and disadvantages of choosing a joint life policy:

Pros

It offers affordable coverage for dual-income families

If you and your spouse both work and bring home roughly equal incomes, you both need insurance coverage. If one of you were to pass away, there would be significant hardship for the surviving spouse. Joint life insurance provides an affordable option compared to two separate policies, especially if you and your spouse are both healthy. A first-to-die policy would provide adequate income replacement if earnings were cut in half due to a spouse’s death.

It can provide coverage if one individual is in poor health

Although the best insurance rates go to individuals in good health, a joint life insurance policy can be an option for individuals who are otherwise uninsurable. For some couples where coverage is needed for both individuals, a joint policy makes more sense than a less expensive, single policy for the healthy partner and no insurance coverage for the other.

It functions as a succession planning tool for business partners

If you and a business partner are equally invested in your company and/or earn the same salary, joint life insurance coverage helps protect each other’s investment and can function as a business succession tool in the event a partner passes away. First-to-die policies allow the surviving partner to cover expenses related to hiring or recruiting a new partner or pay down any outstanding debts. A second-to-die policy would help transfer business assets to new ownership.

It aids in estate planning and lowering tax liability

Wealthy families are often faced with large estate tax bills and inheritance tax. There is also probate involved with distributing assets and generational wealth via a will that life insurance policies can help avoid. Joint life insurance provides tax advantages that can help families retain more wealth, pay estate taxes, and distribute assets efficiently without probate. Joint policies facilitate the transfer of generational wealth and can be used in a number of ways to fund retirement, education, charitable giving and investment opportunities, with even more power when held in a life insurance trust.

It pays out regardless of when you pass away or who dies first

When purchased as whole life insurance or permanent life insurance, joint life insurance policies are guaranteed to pay out, provided premiums are paid. It doesn’t matter when one spouse of the insured passes away or who dies first. This can take some of the guesswork out of retirement and/or estate planning and provide couples with peace of mind.

Cons

The surviving partner loses insurance coverage

With a first-to-die policy, coverage terminates when the first of the two insured individuals passes away. Some joint life insurance policies include riders that allow the surviving partner to obtain single insurance coverage, but more often they will be left uninsured. If children are grown and the family is financially secure, this may not be an issue. But if income replacement is still needed for dependents, the surviving partner may face higher premiums or risk being denied coverage, depending on their own health issues.

It can be difficult to dissolve in a divorce

Depending on your insurer, a joint life insurance policy may not be able to be divided up into two individual policies in the event of a divorce. It’s always worth looking into a rider specifically designed to provide options in the event you and your partner split so you’re not left uninsured. Further, any cash value accumulated will factor as an asset in a divorce.

It’s less customizable than individual insurance

With a joint life insurance policy, coverage is the same for you and your partner. If you have different income levels or finances change, you don’t have the option of choosing different coverage levels. For this reason, it may be better to buy an individual whole life policy with a spouse rider or two separate policies for different coverage amounts.

JOINT LIFE INSURANCE CHECKLIST

If you’re considering a joint life insurance policy, this checklist can help you determine if it’s the right kind of coverage for you.

- My partner and I are both in good health

- My partner is not in good health, but I am (or vice versa)

- My partner and I are dual-income earners or are equally invested in a business

- My partner and I are trying to reduce tax liability for our heirs

- My partner and I have significant assets and estate planning needs

- My partner and I have lifelong dependents

- My partner and I are interested in earning cash value through life insurance

If you checked any of these 7 boxes, a joint life insurance policy may be worth considering. To learn more, request your complementary virtual consultation here. We work with the nation’s top mutual insurance companies to find policies that fit with your budget and financial goals.

FAQs

Can you get joint life insurance if you’re not legally married?

Yes. You can insure anyone with whom you have insurable interest, meaning your finances would be significantly impacted in the other person where to pass away. With joint life insurance, this not only includes your spouse, but can also include a business partner or domestic partner.

Can I have more than one life insurance policy?

Yes. In fact, multiple life insurance policies — especially when purchased through an irrevocable life insurance trust (ILIT) — can be a great strategy for optimizing tax advantages and growing and protecting wealth. It’s possible to have a joint life insurance policy for you and your spouse, another for you and a business partner, and also hold individual policies on yourself. A Wealth Strategist can help you determine your insurance needs and create the best insurance strategy for your situation.

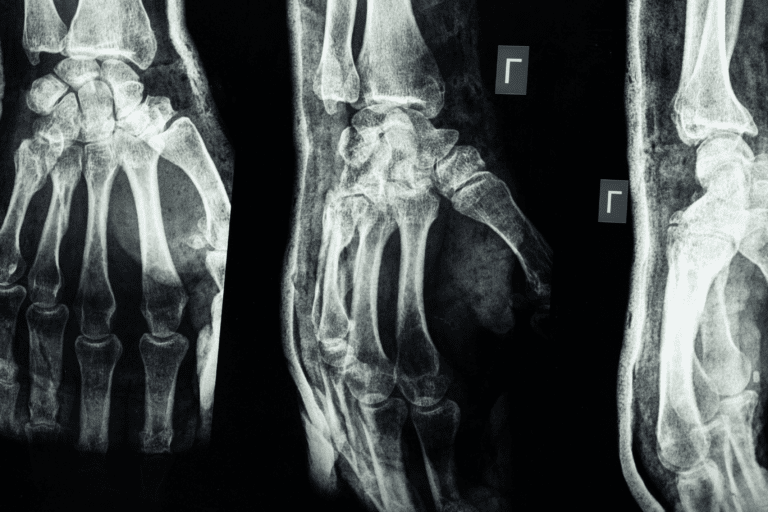

Do my partner and I need a medical exam to qualify?

Most insurance companies require a medical exam as part of the underwriting process. With whole life insurance, it’s likely you and your partner will need medical exams. Paradigm Life can help facilitate a paramedical to come to your home and complete any necessary exams.

When is the best time to buy joint life insurance?

With any type of life insurance, the best time to buy is now! The younger and healthier you are, the better your premiums will be. With whole life insurance, your premium is locked in for life, so applying for a whole life-based joint life insurance policy while you’re young ensures favorable rates for the duration of your lifetime.

How much coverage do I need?

How much insurance coverage you need depends on a number of factors. First, consider how much income you and your partner earn. This is especially important if you’re shopping for first-to-die joint life insurance, as you’ll want to have sufficient coverage to provide income replacement for the surviving partner. Also consider how many years of income replacement you’ll need. At minimum, at least 10 years is recommended.

If you’re shopping for second-to-die joint life insurance, you need to consider the value of your estate, including any existing life insurance policies not held in a trust. Sufficient coverage should be the amount needed to offset estate tax and/or gift tax obligations that will fall to your heirs.

Finally, if the primary purpose of your policy is to grow and protect wealth, utilizing cash value as your private family bank, consider your financial goals to determine how much coverage you need. Will you be using the cash value in your policy to purchase real estate or similar investment opportunities? Will it be used to fund children’s education or to consolidate outstanding debt? Are you relying on cash value for retirement income? A Wealth Strategist can help you plan for all of these scenarios and create an insurance policy that aligns with your unique goals.

At Paradigm Life, we know that millions of people follow out-of-date financial advice that prohibits the future they deserve. Perpetual Wealth 101 consists of a series of free videos that teach you The Perpetual Wealth Strategy™ and guide you to a secure financial future.