Avoiding the Ever Feared Audit

Being audited can be time consuming and nerve wracking. The IRS does not have the man power to audit more than about 1% of all

Being audited can be time consuming and nerve wracking. The IRS does not have the man power to audit more than about 1% of all

As healthcare costs rise, the need for long-term care (LTC) is a reality many Americans face. Unfortunately, traditional LTC insurance often falls short, with high

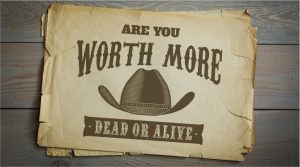

The idea of being “worth more dead than alive” may seem like an uncomfortable thought, but it’s one many people ponder when considering their life

True diversification is essential for long-term wealth, going beyond just holding stocks to include assets like bonds, real estate, precious metals, and insurance strategies. At

When it comes to retirement, the real question isn’t your age—it’s your strategy. At Paradigm Life, we believe building long-term financial security requires more

Most people invest with the hope of growing their wealth, but without a clear strategy, they may be gambling rather than planning. Relying on market

Whole Life Insurance is more than just a death benefit—it’s a living, liquid asset designed to help you build lasting financial security. When properly structured,

Life insurance as a bank? If you’ve never considered the living benefits of a life insurance policy, you’re not alone. The majority of people who

Once an individual or family has gotten their feet under them, financially speaking, they start to look toward the future. How can they make the

Adjustable life insurance is often referred to as a hybrid of term and whole life insurance. It’s permanent, provided premiums are paid, so you don’t

In October 1907, our country was seized by a serious financial panic during a time when we were already struggling through a recession. The NY

Simply put, banks are in business to make money – they profit by making money from our money. To ensure that this happens, most countries