Having a private family banking system is easier than you think.

In this article, we’ll explain what family banking is, show you which financial tool to use for optimal growth and protection of your family’s wealth, and outline the benefits of having your own family banking system. Plus, we’ll explain how to use your private family bank to pass on a legacy for generations to come.

What is a Private Family Bank?

The common definition of a bank is a financial institution where you can make deposits or take out loans. Banks are profit-driven. When they do well financially, bankers make big bucks. They will always charge more in interest on a loan than they will pay in interest on money in your savings or checking accounts. This is how banks make money. They will charge you a much higher amount to borrow a dollar from them than they pay you to borrow one of your dollars.

Most of us have become so accustomed to the way traditional banks work that we don’t stop to consider, “What if there were a better way?”

Private family banking is a system where you save money in mutually traded whole life insurance companies instead of in a bank. The insurance company is your bank. They pay you a guaranteed rate of interest—much higher than you would earn in even a high-interest savings account or CD—and will also pay out non-guaranteed dividends based on annual performance. It’s worth noting that the mutually traded whole life insurance companies Paradigm Life works with have paid out dividends for well over 100 years. If you need a loan, it’s a private contract between you and your insurance carrier, not a bank. Interest rates are typically lower and you decide the pay-back terms.

When you create a private family bank using whole life insurance, banks (or the Feds) don’t tell you what to do with your money—how to save it, how to borrow it, and what to spend the borrowed money on. Even better, when you borrow money, you don’t need approval from a bank, you don’t need a certain credit score or a credit check, and you don’t have to put up loan collateral like a home, car, or business.

The private family banking system is a concept that’s easy to implement and understand, and one that has been proven successful for hundreds of years, provided you use whole life insurance as your banking vehicle.

Whole Life Insurance: The Ideal Banking Tool

Many individuals, when they hear about life insurance, assume it has everything to do with a death benefit, which is true, but it’s not the whole truth. The whole truth depends on what type of insurance you buy.

The most common type of insurance—term life insurance—offers a death benefit to beneficiaries if the policyholder dies within a specified time period (term). If the policyholder is still surviving at the end of the term, the policy is cancelled and no death benefit is issued. The key reason why term life insurance policies are often so inexpensive is because the likelihood of a payout for the insurance company is small. Most of the time, any money spent on policy premiums for term life insurance is lost.

Whole life insurance can be quite a bit more expensive than term life insurance, but a payout from the insurance company is guaranteed. The “term” of a whole life insurance policy is your whole life. It won’t expire. But a guaranteed death benefit isn’t the only perk of a whole life policy.

Whole life insurance comes with a built-in savings component. When you pay your policy premium, part of it goes toward your death benefit, but the rest goes toward the cash surrender value of the policy, also known as cash value. Every time you make a premium payment, you’re increasing the cash value of the policy, much like you increase savings in a bank account. Plus, your guaranteed interest from your mutual insurance company and potential dividends also go toward increasing your cash value.

The cash value is what allows you to borrow against yourself (typically tax-free), earn an annual rate of return, and provide your family with a legacy. Cash value also allows you to build wealth through your private family banking system.

Your cash value compounds over time. As with any account earning compound interest, the earlier you start and the more money you put into it, the quicker your wealth will grow and you’ll end up with much greater wealth in the long run.

Loans and Private Family Banking

There are two ways you can access the cash value of your whole life insurance policy. One way is to take a withdrawal, which has tax implications. Because the interest and dividends you earn from your insurance company are tax-deferred, the IRS requires there cut when you make a permanent deduction from the cash value of your policy.

The other way to access the cash value of your whole life insurance policy is to take out a policy loan. Policy loans allow you to use your earned interest and dividends tax-free. As previously mentioned, when you take out a policy loan, you’re not required to go through a credit check or have a certain credit score, you don’t need bank approval—simply submit a request to your insurance company and funds are usually transferred to your preferred bank account within a few days—and you don’t have to put up personal assets as collateral. Plus, you choose the payback schedule.

Because mutually insurance companies are owned by policyholders, these types of life insurance companies can use the death benefit reserves as collateral when a policy owner wants to take out a loan. Essentially, your death benefit is your collateral. Unlike fractional reserve lending, which is authorized to lend out 90% of a depositor’s dollar and keep only 10%, life insurance companies lend out 100% of the policy owner’s dollar because the dollar coincides with the amount of death benefit on reserve. This is also why it’s practically impossible to default on a policy loan. Any unpaid loan amount is deducted from the death benefit of the policy.

This lending strategy ensures certainty and security. With life insurance, there is no such thing as “bank” insolvency or regulation laws suddenly changing. A mutually owned life insurance company is a private business with a private contract between themselves and policyholders.

If you’re ever investing your cash value into other performing assets and something goes awry, you are financially safe. You determine the terms of your policy loan. This concept is what makes whole life insurance a foundational asset. You can find ways to enhance your wealth without being at risk.

For more on bank loans vs. policy loans, download this free infographic.

The Benefits of Private Family Banking

In addition to the built-in savings feature and death benefit of a whole life insurance policy, plus easy access to policy loans, these are the benefits of private family banking:

Tax Advantages

As previously discussed, when you take out a policy loan, you avoid paying taxes on interest and dividends, but this isn’t the only tax advantage of family banking. You can use policy loans to fund retirement, effectively generating tax-free retirement income that is deducted from the death benefit of the policy at the end of your life. Any remaining death benefit will be paid to your beneficiary(ies) tax-free and your estate usually remains tax-free too.

These tax advantages are one of many ways family banking helps pass on wealth for generations.

For more on the tax benefits of family banking, download this free infographic.

The “AND” Asset

Perhaps the biggest benefit of family banking, the “AND” asset refers to the way a whole life insurance policy earns interest and provides loans. When you take out a policy loan, you still earn interest on the full value of your policy. In this way, your dollar works twice as hard.

Compared to a traditional savings account, high-interest savings account, or CD, when you withdrawal money to make a purchase, the value of your account drops by the amount of the purchase. You lose your upward momentum of compound interest and must start earning again from zero. With whole life insurance, there is no loss of momentum. You can borrow and earn interest at the same time.

Or consider when you rely credit or bank financing for big purchases, in which case you’re paying high interest rates and agreeing to loan terms you don’t control. Instead of using a traditional bank to finance high-priced items, like a home, cars, or an education, your whole life policy can finance those big purchases. When you use your whole life policy as a “bank,” you are still earning interest on your original cash value.

For more on how the “AND” asset works, download this free infographic.

Asset Protections

Private family banking is just that—private. We’ve already discussed how policy loans don’t require personal collateral like your home, car, or business, and how you don’t need a credit check or need to provide outside financial statements to qualify for a policy loan. But there are more ways a private family banking system helps you protect your assets.

The four main categories of protection offered with a whole life insurance policy, which is a private contract between you and your insurer, are asset searches, judgements, creditors, and lawsuits. This means that money within a private family bank structured with whole life insurance can’t be called on in the event of a bankruptcy, legal settlement, or if you default on a loan outside of a policy loan.

For more on asset protections in family banking, download this free infographic.

How to Build Generational Wealth

One of the greatest uses of private family banking is to grow and protect wealth for future generations. We call it The Perpetual Wealth Strategy.

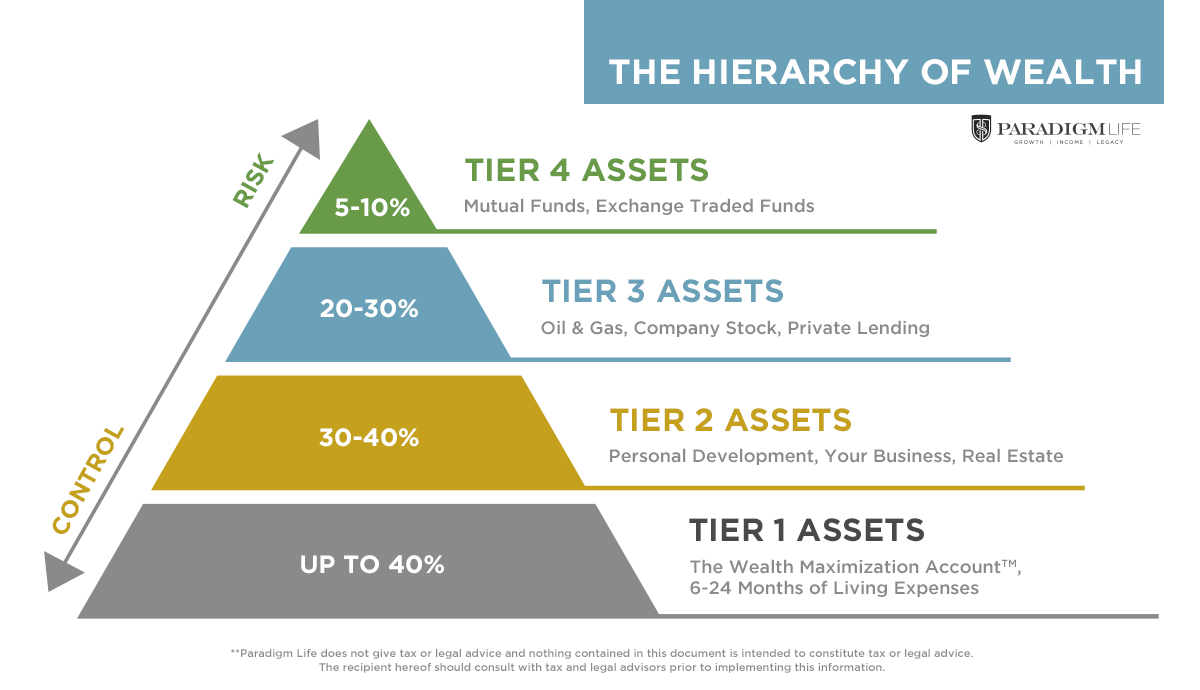

The Hierarchy of Wealth, outlined in the pyramid below, shows where a whole life insurance policy for family banking (we call it a Wealth Maximization Account™) fits in terms of asset allocation.

Placing up to 40% of your expendable income in a Wealth Maximization Account™ with whole life insurance provides your family financial security, both as an emergency fund and by offering guaranteed growth with the very least amount of risk. Next, focus on placing 30-40% of expendable income into Tier 2 Assets like your business and real estate investments. These help build generational wealth as they are often passed down in the family.

This is very important: Don’t forget to focus on investing in your own personal development (you are your best asset) and teach your children to do the same. Generational wealth isn’t just about money. Private family banking works best when you have the financial education to optimize your money and teach your children to do the same.

One of the ways you can teach children to bank for themselves is by getting them their own whole life insurance policies. Paradigm Life CEO Patrick Donohoe outlines how to do this (and why you should) in this article: The Most Valuable Benefit of Life Insurance for Children.

Likewise, you can also take out insurance policies on your spouse and sometimes your parents. The more policies in the family bank, the greater your banking power. Overtime, the interest and dividends in one policy grow sufficiently to cover the policy premiums of another in perpetuity and the remaining death benefit(s) can be placed in certain types of family trusts, growing wealth exactly the same way the Rockefeller family and other wealthy families have.

Create Your Own Bank

Remember, private family banking isn’t just for the ultra-rich, and it’s never too late to readjust your finances and start putting your money into a whole life policy.

At Paradigm Life, we work with hundreds of individuals from all ages and all economic backgrounds to help them set up their own family banks. We’ve helped thousands of families in all 50 states, and we can’t wait to help you too.