Recently, I was watching a program about the myth of 15th century Europeans believing the world was flat. For years I was told, and probably everyone else was too, that Columbus sailed the ocean blue to disprove that the world was not flat, but round (livescience.com). It dawned on me, just like we commonly believed that 15th century civilians thought the world was flat, a lot of us commonly perceive money to be “flat.”

Recently, I was watching a program about the myth of 15th century Europeans believing the world was flat. For years I was told, and probably everyone else was too, that Columbus sailed the ocean blue to disprove that the world was not flat, but round (livescience.com). It dawned on me, just like we commonly believed that 15th century civilians thought the world was flat, a lot of us commonly perceive money to be “flat.”

Linear Investing

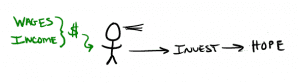

For instance, a person earns money – maybe a lot of money. They are told that to really build wealth they need to invest their money into the stock market. That advice has been heard since they can remember. So this individual looks to Wall Street’s investing horizon for hope.

Because the individual is ignorant to how money can be simultaneously leveraged, they choose to put their dollars to work ONLY ONCE, with each investment made on the market. A dollar goes into the market, then hopefully comes back out and into their pocket at a return higher than 0%. One way in, one way out.

After making these linear transactions again and again, the HOPE is that wealth will follow. Their linear investing strategy looks like this:

Circular Investing

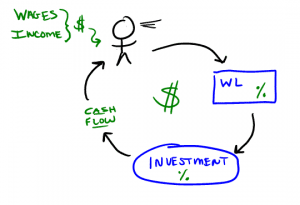

I advocate Permanent Life Insurance as an asset and as an investment because it allows for circular investing. Instead of making one transaction link to one outcome, with whole life insurance, you can transact while simultaneously keeping your principal safe and earning interest. Whole Life Insurance doubles your dollar’s earning power – which exaggerates your gains much faster than one time in, one time out.

I enjoy teaching folks that their investment money does not have to be “flat.” They do not have to succumb to lazy dollars sitting in an investment account waiting for their momentum to be realized. What I teach them to do is put their dollars to work in multiple places. The Whole Life Insurance cycle allows their money to go round with safety, returns, and liquidity. Circular investing looks like this:

Whole Life Insurance provides flexibility and growth. Dollars are leveraged twice by financing a purchase or investment, while still earning a rate of return inside of a policy. As the dollars cycle back, Net Worth grows. The circular process can continue again and again.

Because of this process, we like to refer to Whole Life Insurance as an “AND” asset – with it, you provide yourself the opportunity to invest in more performing assets.

For more information watch President and CEO, Patrick Donohoe, discuss Infinite Banking Simplified.

Bryan McCloskey

Listen: Be the Bank