What is Cash Flow Banking?

Cash flow banking is a concept that allows you to capture the opportunity cost of your dollars. It lets you be your own bank and earn interest on yourself. This is most commonly achieved using dividend-paying whole life insurance. Whole life insurance is used because it’s safe and financially strategic.

Here’s why.

Cash Value & Whole Life Insurance

Most people want to take care of their family after they die, so they buy term life insurance. When you buy term life insurance, you are only insured for a specified amount of years. If you don’t pass away during this term, you and your family get nothing in return. Further, renewing a term insurance policy later in life will likely cost you more in monthly premiums because your premium is determined by your age and health. Another downside to term life insurance is that you miss out on the living benefits of a whole life insurance policy.

Whole life insurance gets a bad reputation because its premiums are higher than term life insurance. The truth is, any type of insurance that isn’t properly structured can be expensive and a waste of money. With whole life insurance, you pay more upfront but your premium will never go up and you’re insured for your entire lifetime. You also earn cash value on your insurance policy, which acts as a high-interest savings account.

Whole life policies purchased through a mutual insurance company earn a guaranteed annual interest rate and non-guaranteed dividends. The mutual insurance companies we work with at Paradigm Life have paid out dividends to policyholders for over 100 years. Regardless of how well your mutual insurance company performs in any given year, you will still receive guaranteed interest and your policy won’t lose value. With whole life insurance, your family receives a death benefit and you earn money to spend during your lifetime.

Cash Flow Banking and the Wealth Maximization Account™

You may have heard cash flow banking referred to as the Infinite Banking Concept, the 770 Account, Private Family Banking, or a Life Insurance Retirement Plan (LIRP). When properly structured for maximum cash growth, we call this type of insurance policy a Wealth Maximization Account.

A Wealth Maximization Account is like a savings account that provides liquidity, a steady rate of return, security, and tax-benefits. It’s an asset based off of whole life insurance and is key to cash flow banking.

Not every whole life policy from a mutual insurance company is right for cash flow banking. The standard structure for a whole life insurance policy takes many years to grow cash value because your insurance premiums go primarily toward your policy’s death benefit.

A Wealth Maximization Account prioritizes cash value growth first; funding the death benefit is secondary. With a Wealth Maximization Account, your insurance premiums strictly represent how much you would like to cash flow bank with.

The History of Cash Flow Banking

Cash flow banking isn’t a new wealth strategy; the wealthy have used whole life insurance policies and cash flow banking for centuries. Famous businessmen like Walt Disney and Ray Kroc both supplemented their entrepreneurial visions with their whole life policy, and the concept dates back to before the Civil War.

In the early days of American settlers when many people relied on farming as a way of life, life insurance played a big role in financing a homestead, livestock, seeds, machinery, etc. While homesteaders utilized some bank loans, their mortgages were typically paid for with policy loans from life insurance. In the 1800s, most people weren’t able to pay off their mortgages before they died; by using policy loans, they were able to keep up with what they owed and the remainder of the farm mortgage would be taken out of the death benefit of their whole life insurance policy.

Policy loans were also used to pay for farm equipment and help buffer the family through years when the farm failed to yield sufficient crops. Policy loans allow the policyholder to determine the payback schedule of the loan, giving farmers more flexibility than strict bank loan terms where they were at risk of defaulting and losing the family farm.

As the American demographic shifted from rural farm work to urban businesses, whole life insurance policies transitioned to become tools used by corporations and banks as ways to increase liquidity, avoid paying high interest rates to banks, and generate more cash flow for the company, using policy loans to pay for new buildings and equipment, generate capital, and to take advantage of investment opportunities.

How Policy Loans Work

A common misconception with cash flow banking is that the money you borrow from your insurance policy is your own money. Really, you’re borrowing against the general fund of the life insurance company and using your policy as loan collateral. When you open a Wealth Maximization Account and front-load your policy for maximum cash growth, you’re rapidly increasing the amount of money you have access to from your life insurance company. You’ll also earn more interest and dividends faster, and increase the amount of interest and dividends you’ll earn over your lifetime.

Upon your passing, any unpaid policy loans and unpaid interest associated with your policy loans are deducted from the death benefit, not the cash value of your policy. The cash value, minus interest and dividends, returns to the life insurance company; in this sense it’s a “use it or lose it” benefit. Here are the most common things policyholders use policy loans for:

- Tax-free retirement income

- College tuition and children’s education

- Business expenses

- Real estate

- Investment opportunities

- Family vacations

- Cars

Effective Interest and Direct Recognition

The number one benefit of using a policy loan vs. a bank loan or even your own cash savings is the effective interest rate.

Most financial institutions use direct recognition when it comes to paying you interest or dividends. This means if you have $20,000 in savings or an investment fund and you withdraw $10,000, you only earn interest on the remaining $10,000. Mutual insurance companies don’t use direct recognition. If you have $20,000 in cash value in a whole life insurance policy and you borrow $10,000, you continue to earn interest on the full $20,000 cash value.

The interest rate your insurance company charges is typically less than what a bank would charge and less than the interest on a credit card. If you were to pay 6% interest on your $10,000 policy loan but you’re earning 5% interest annually from your insurance company, your effective interest rate is only 1%.

If you’re earning 5% on the full cash value of your policy (in this case $20,000), you would hypothetically still earn $400 after paying your loan interest. This is why policy loans are ideal for cash flow banking. Every dollar can be used twice: you can borrow it and earn interest from it at the same time.

Other benefits of policy loans include:

- Flexible pay-back terms (if you don’t pay back the loan, the balance and interest are deducted from the death benefit)

- No paperwork or credit applications

- Interest rates typically lower than banks, credit unions, or other outside financing

- Tax benefits (Policy loans are tax-free)

- Liquidity (Policy loans can be taken out at any time for any reason, provided cash value is sufficient to cover the loan amount)

The Cash Flow Banking Illustration

To see how a Wealth Maximization Account is structured for cash flow banking, take a look at this helpful case study provided by Wealth Strategist Jared Lainhart.

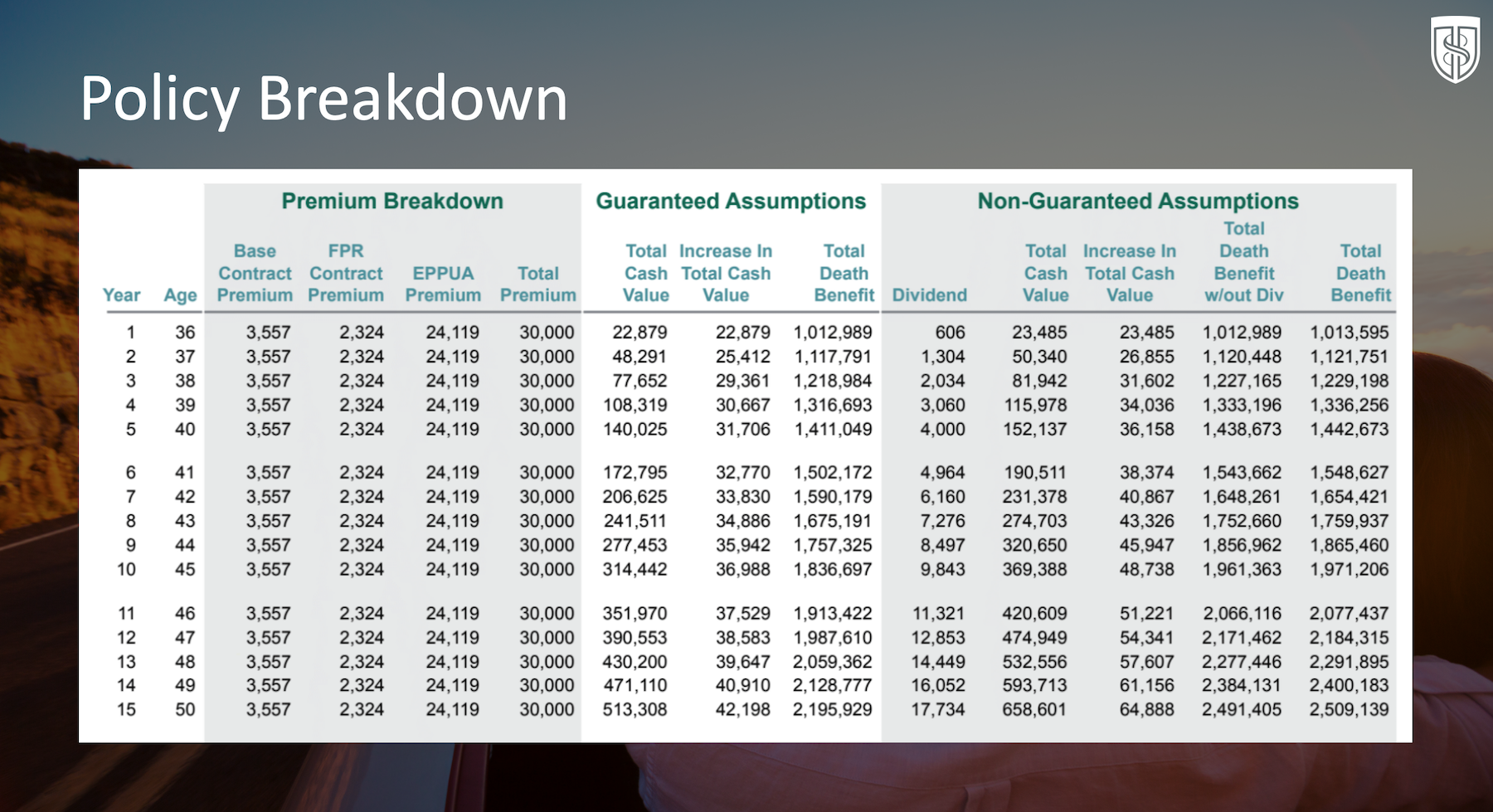

Because Wealth Maximization Accounts are personalized to meet each individual client’s financial goals, no two will look exactly alike, but there are commonalities among them. Each cash flow banking illustration outlines the base premium of the insurance policy and any additional policy riders (supplemental insurance that offers increased benefits) in the left-hand columns. Next, you’ll see the cash value of the policy and the death benefit. The far-right columns outline hypothetical gains based on historical performance from the insurance company.

Here is an example of what a cash flow banking illustration looks like:

In this example, the client’s contract premiums are about $5,900/yr, but by maximizing his policy for cash value with additional policy riders like the EPPUA (a paid-up additions rider) the majority of his premiums go toward cash value, not the death benefit. This means he has more money to cash flow bank with during his lifetime while still guaranteeing a large death benefit for his family.

Is Cash Flow Banking Right for Me?

Cash flow banking can be an ideal strategy to grow and protect wealth for certain people. Ask yourself if you’re looking for the following:

- Do you want to pay less taxes over your lifetime?

- Do you want to retire before age 59 1/2?

- Have you maxed out your 401(k) and/or Roth IRA contributions?

- Are you looking to diversify away from Wall Street?

- Are you risk averse?

- Do you want a guaranteed rate of return?

- Do you own a business?

- Do you have children?

- Do you want more financial liquidity and security?

- Do you want to leave a legacy for your family?

- Is a death benefit important to you and your heirs?

- Do you have a steady stream of income to reliably pay your premiums?

If you answered yes to any of these questions, cash flow banking may be the right strategy to help you achieve your financial goals. The next step is to meet with a Wealth Strategist to set up your Wealth Maximization Account. There is no minimum balance to start cash flow banking; your policy premium depends on your financial goals and your insurability. Even if you’re already in retirement, there are ways to structure a Wealth Maximization Account to fit your needs.

Conclusion: Becoming Your Own Bank

Mutually owned life insurance companies use a policy owner’s death benefit as collateral for policy loans. This allows you to receive a cash flow, or infinitely bank, instead of relying on a central bank for loans.

Central banks lend your wealth to other individuals and charge an interest rate. This is how banks make money. They earn interest on your bank account.

Cash flow banking lets YOU capture the opportunity cost of your dollars when you borrow against your policy. You can use policy loans to finance anything of your choosing—home buying, business start-ups, cars, college. Anything that you would typically turn to a bank for, you turn to the cash value in your policy for.

Cash flow banking provides you with flexibility and the opportunity to build lasting wealth. For help becoming your own bank,

Read: Powerful Cash Management Strategies

Watch: Preparing for Your Complete Retirement Journey

Listen: Exploring Mutual Insurance Dividends

FAQ

Q: What is Cash Flow Banking?

A: Cash Flow Banking is a financial strategy that utilizes whole life insurance policies to enhance personal and business cash flow management. This method involves leveraging the cash value of life insurance policies for various financial needs.

Q: How does Cash Flow Banking benefit individuals and businesses?

A: This approach offers benefits such as stable growth of funds, tax advantages, and the ability to access cash value for investments, emergencies, or business opportunities, providing both flexibility and financial security.

Q: What makes whole life insurance a key component in Cash Flow Banking?

A: Whole life insurance is crucial due to its stable growth, accessible cash value, and long-term financial security, making it a versatile tool for effective cash flow management.