Corporate America has relied on Wall Street for decades, starting with the Initial Public offering to the commercial paper markets that assist in short term financing, all the way to the administration of the predominant company retirement plan, the 401(k).

Small Business Owners and their employees also rely on Wall Street for the administration of their respective retirement plans. The tie of small to medium business to Wall Street has created one of the most lucrative opportunities for Wall Street and for Washington DC, leaving the financial future of Americans and their employers in jeopardy.

It wasn’t always that way, and fortunately, there is an alternative to the pension benefits and 401(k) benefits, and it has a 150 year win ratio that is still holding strong today. This Perpetual Wealth System for Business provides liquidity, stability and certainty to a failing retirement services industry.

To understand the power of The Perpetual Wealth System, it is important to review the history of retirement benefits given to employees. Pension and Retirement plans were designed to keep an employee for life, reducing the need to constantly be hiring and re-training. For employees, the promise that if you committed your career to one employer you would receive a paycheck for the rest of your life after you retired was compelling. However, pension plans proved to be too expensive and risky to the long term well-being of a business.

This risk existed because the employer guaranteed income to the employee even after they stopped working. This required the need to stock away money that couldn’t be used to fund the growth of the business. In addition, the improvement in health care was prolonging the average lifespan, requiring money to be paid out longer than anticipated. Both of these factors hurt the business world significantly, but employers needed to incentive employee retention. So, what was the solution? Where’s the Money Going?

The Retirement Solution… or is it?

When the traditional pension plan no longer proved feasible to the long term stability of a business, the 401(k) became the ideal choice. It shifted the all the risk to the employee. The odd thing is, the 401(k) was never designed as a retirement plan. Originally, it was meant for executive end of the year bonuses.

“401(k)s were never designed as the nation’s primary retirement system,” said Anthony Webb, a research economist at the Center for Retirement Research. “They came to be that as a historical accident.”

A benefits consultant named Ted Benna realized the provision could be used as a retirement savings vehicle for all employees. In 1981, the IRS clarified that 401(k) plan participants could defer regular wages, not just bonuses, and the plans began to proliferate.

And proliferate it did. The advent of the 401(k) came at the perfect time as pensions started to weigh heavily on the long term plans of businesses. It seemed to make all the sense in the world. Fortunately for Wall Street, the idea dug roots and the money started flowing in and hasn’t stopped.

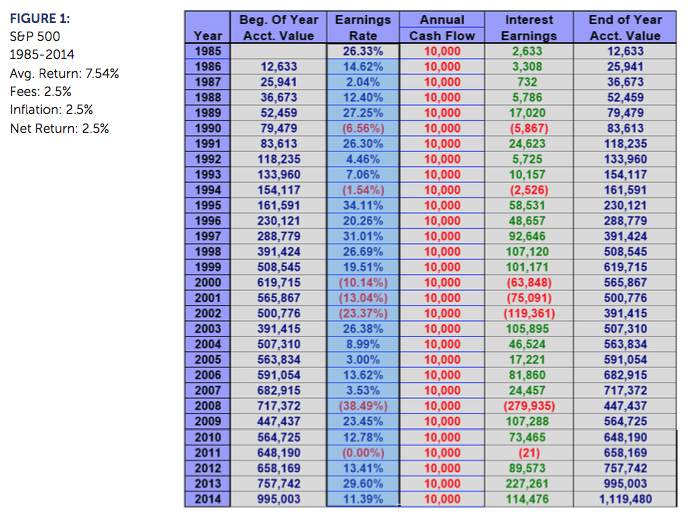

At the end of 2014 the US retirement system held just shy of 25 Trillion dollars of assets. 401(k) structures make up almost $7 Trillion of that. The monstrous figures have given US financial services an excess of power to market and lobby their way into every business. They have created a compelling idea that the 401(k) is the ideal retirement play, for both the small and medium business owners, as well as their employees. Unfortunately, for these business owners and their employees, the 401(k) has turned out to be a disaster. After accounting for fees, which range from 2-3.25% of the account balances, stock market volatility and inflation of 2-3%, the actual returns are much lower than advertised.

If the average employee wants to retire off of $50,000 per year for 20 years they must amass a sum equal to $1.25M.

Right now, the average employee saves less than 3% of the wages into a 401(k) and the average balance of a 401(k) for those over the age of 55 is only $150,000.

The Perpetual Wealth System – A Better Solution

For a business owner, the Perpetual Wealth System for Business combines a uniquely designed participating insurance policy as the primary funding vehicle for retirement. The ownership of the plan can be the business, as a key person structure, or the individual business owner, or both. The policy is structured through a mutual insurance company, who guarantees financing against the accumulated balance at anytime for anything. This financing can be used for business purchases such as equipment, technology and marketing without having to rely on banks.

Employee plans can be structured through IRS code 162, giving the business owner deductions similar to the 401(k) without having to provide the benefit to 100% of the employees, as required by 401(k)’s. In addition, the structure of a Cash Bonus plan for other employees has been shown to create incentive for employees to remain committed to their employer. These plans don’t accumulate a percentage for the employee, but can be held in the employer account and earn interest and dividends for them, as well as provide capital for the guaranteed financing feature mentioned above.

The Perpetual Wealth System for Business also accommodates for buy sell agreement funding, stock redemption funding, as well as key person insurance funding. When retirement day occurs, part or all of the accounts are converted to the Perpetual Wealth System Legacy structure which provides a paycheck for life, which is guaranteed by highly rated insurance companies.

Conclusion

There are over 12 ways to design the Perpetual Wealth System for Business to accommodate the ideal incentive plan for business owners, executives, and employees. Contact us today at 1.800.870.8670 orparadigmlife.net/business for a no obligation consultation. We will walk you through the steps to take that will turn your business retirement plan around.

Contact Us –

info@paradigmlife.net

1.800.870.8670

paradigmlife.net/business