It’s never too late to start planning for retirement. Although you want to start building your wealth as early as possible, you can make a meaningful impact on your retirement income no matter how old you are. And if you thought you were prepared for retirement but your portfolio has recently taken a hit due to a market downturn, it’s not too late to salvage it.

Here are the top wealth building strategies you can implement now if you’re over 50:

Proven Wealth Building Strategies

Reduce your spending immediately

Many people don’t make the same amount of income once they retire. For most people, that’s okay. Mortgages are nearly—if not fully—paid off, your children are likely grown and no longer relying on you financially, your own college tuition loans have long been paid, and you likely don’t have entrepreneurial costs associated with starting a business. But there are new expenses that arise during retirement you need to be prepared for.

According to Investopedia, the average 65-year-old retired couple will need $285,000 (after tax) to cover medical bills in retirement. Add to that the cost of long-term care or disability, which affect at least 1-in-4 retirees, and costs can increase an additional $100,000 or more. You also need to consider what kind of retirement you plan to have. Will you be traveling more? If so, you’ll need to factor that into your wealth building strategy.

Cutting back now helps you strategize for retirement in two ways:

- Reducing spending helps ease your transition into retirement, should you experience a decrease in your income.

- Reducing spending and funneling that money toward retirement can help increase your retirement savings, giving you a better chance of having enough income for life, particularly to cover your future lifestyle and health expenses.

Factor in inflation

When you’re trying to build wealth, you must consider how much less that wealth will be worth as inflationary forces take their toll. Financial website The Balance outlines inflation rates over the last 90 years, and while the Fed tries to keep the inflation rate at 2%, it has historically gone as high as 18% after WWII. Conversely, there have been years where deflation—not inflation—has occurred.

Because your future retirement dollars will likely not be worth as much as they are today, it’s important that your wealth building strategies earn a high enough return to outpace inflation. Simply stashing money in your savings account won’t cut it. While this is a ‘safe’ option, in that you’re not exposing your money to common types of investment risk, you’re essentially losing money in the long run as inflation devalues your dollar.

Stop trying to hit a magic retirement savings goal

How much do you really need for retirement? It depends on multiple factors:

- What kind of retirement lifestyle do you want to have?

- Will you work part-time or as a consultant during retirement?

- At what age do you plan to retire?

- At what age will you take Social Security (assuming it will still be available)?

- What does your balance sheet look like? Do you have outstanding debts? What about additional sources of passive income?

- Do you plan to leave a legacy for your children, a charity, or other benefactors?

Even if you answer these questions, there are so many financial factors out of your control, including how much you’ll have to pay in taxes on qualified plan and/or investment dollars. There’s also the question of knowing how long you’ll live. It’s unrealistic to try to hit a magic number for your retirement savings, such as $1 million. The real key is to develop a comprehensive wealth building strategy.

Divest from Wall Street

Wall Street’s never-ending financial volatility only means one thing for your retirement portfolio: Continued uncertainty and the possibility of dramatic losses. You cannot afford to put all of your financial eggs into Wall Street’s basket.

A common wealth strategy misconception is that because you’re invested in mutual funds and because you believe your retirement investments to be ‘diversified’ your money is safe. The truth is, more and more assets are becoming correlated, and regardless of your mix of stocks, bonds, and other exchange traded funds, they all lie in the same bucket.

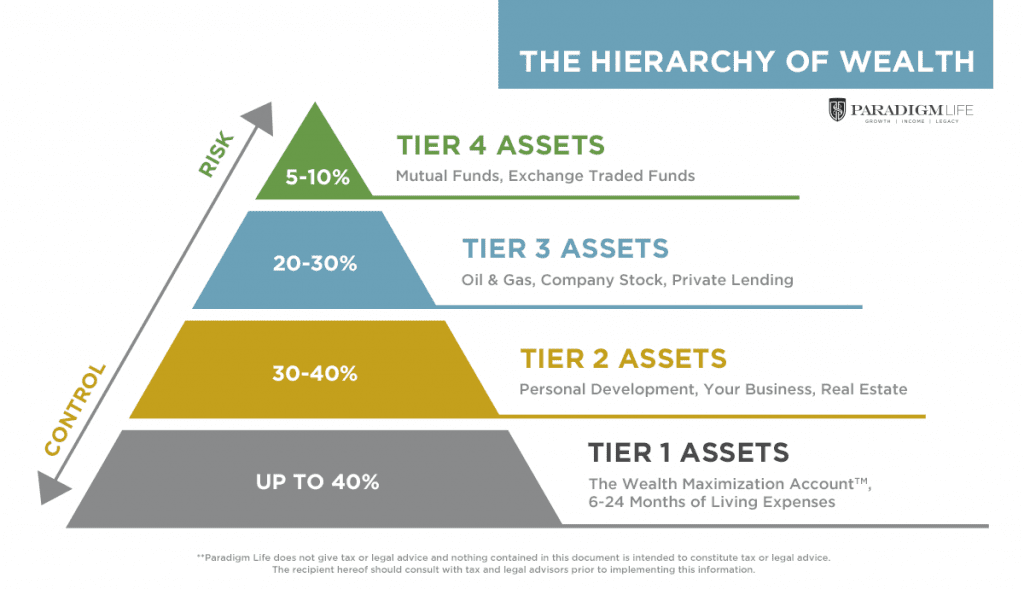

To truly divest from Wall Street, you need to put some of your retirement money into asset classes that are unaffected by market fluctuations. The Hierarchy of Wealth better outlines how to do this, ensuring you have a solid financial foundation that can successfully weather future market downturns.

Reduce your tax liability

Generally speaking, the more money you make, the more money Uncle Sam will take from you in taxes. Therefore, your wealth building strategy should include opportunities to put more of your wealth into tax shelters, such as real estate or a whole life insurance policy.

Often, people think that whole life insurance is an option to be used only after you’ve maxed out other retirement investment options, like a 401(k), IRA, or Roth IRA. The truth is, anyone can utilize whole life insurance as a tax shelter, but the earlier you explore this option, the better. Insurance rates are dependent upon your health, and the younger your are, the more likely you will be to receive favorable premium from your insurer.

Some of the tax benefits of whole life insurance in retirement may include:

- Tax-free policy loans

- Tax-free growth of cash value

- Tax-free death benefit to your beneficiary

- Tax-free retirement income

- Estate tax exemptions

- Earns interest and dividends tax-free

Utilize the cash value of whole life insurance

With a linear investing strategy, you put your money into a single investment product and then sit back and hope it earns you a steady rate of return. By contrast, a circular investing strategy keeps your money moving through multiple investment products.

The foundation of a circular investing strategy is one that provides full liquidity and security for your investment. A whole life insurance policy meets both of those criteria.

Not only does whole life insurance pay steady interest and dividend payments, but a whole life insurance policy also has a cash value that you can access in full at any time to fund your other investments. In this way, you are moving money through your policy. You still earn interest and dividends on your cash value, regardless of whether you’ve taken out a loan. This means each dollar invested in whole life insurance works double time for your retirement income.

Consider alternative investments

Life insurance products aren’t the only wealth building strategy that helps diversify your retirement portfolio away from Wall Street. You may also want to consider alternative investments like commodities and collectibles. Commodities range from precious metals like gold and silver to agricultural products, oil, and building materials. Collectibles range from fine art to fine wine to rare coins. These alternatives to the volatility of the financial markets are important for a diverse portfolio.

Before you invest in alternative markets, it’s essential to educate yourself on what you’re investing in. Paradigm Life CEO Patrick Donohoe outlines his tips for successful investments in Issue 5 of The Donohoe Bulletin: Uncommon Investments: Think Like LeBron James.

He outlines these traits to leverage:

- Core competencies – invest in what you understand

- Talents – invest in what comes naturally to you

- Strengths – invest in what you’re good at

- Professional training – invest in areas of expertise

- Experience – invest in the familiar

- Credentials – invest competently

- Relationships – invest with who you trust

- Business contacts – invest in your network

- Business opportunities – invest synergistically

- Your reputation – invest morally

Look at real estate

The housing bubble of 2008 aside, real estate is considered a relatively safe wealth building strategy and one of the most consistent places to invest for passive income in retirement. Real estate investments act as a tax shelter, as you can write off the costs associated with your investment gradually over multiple decades. All the while, you’re collecting rental income and building equity.

Whole life insurance structured for cash value can play multiple roles in your real estate investment strategy, depending on the situation.

- First, it is a place to save money and increase your liquidity.

- Second, policy loans can be used to fix an investment property, create a downpayment, or act as your hard money lender. It can also replace lost rent and function as a volatility buffer.

- Third, it acts as the best asset to pass on in an estate and give liquidity to your heirs.

Whole life insurance allows you to take advantage of investment opportunities when they arise because the cash value of your insurance policy is extremely liquid.

There are multiple ways to invest in real estate, including single-family homes, multi-family units, commercial real estate, or REITs. As with all wealth building strategies, it’s important to do your homework and know what you’re buying.

Conclusion

Building wealth is not the same thing as saving money. To provide yourself financial security in retirement, you need to implement a range of important wealth building strategies, ranging from reining in your spending to divesting from Wall Street to adopting a circular investing strategy with whole life insurance.

At Paradigm Life we can customize a policy to fit your financial situation. Our expert Wealth Strategists are available to answer your questions and show you customized illustrations, outlining an individual plan of action to help you achieve your goals.  , no strings attached.

, no strings attached.