Tax-Efficient Investing: How Whole Life Supports Smarter Wealth Growth

As your wealth grows, so does the risk of losing more of it to taxes. Without a clear strategy, much of what you build —

As your wealth grows, so does the risk of losing more of it to taxes. Without a clear strategy, much of what you build —

Tax efficiency is one of the most powerful—and often underutilized—ways to accelerate wealth building and achieve financial independence. Yet many people don’t fully understand how

When it comes to building lasting wealth, how your money grows can be just as important as where you invest it. One of the most

Are you taxed on life insurance benefits? If you’ve ever wondered whether life insurance benefits could be taxed, you’re not alone. Understanding the tax rules

As a business owner, every tax dollar saved is a dollar you can reinvest in your business or secure your future. Strategic tax planning cuts

Real estate provides some of the best tax benefits out there—if you know how to use the right strategies. As a real estate investor, understanding

As a high-income earner, navigating hefty tax bills can feel like an uphill battle. But with the right strategies, you can reduce your taxable income,

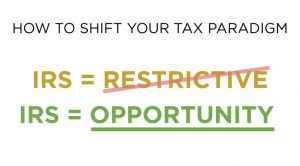

Most people see the IRS tax code as a restrictive set of rules designed to take more of their money. But the reality is, the

Taxes play a major role in your financial journey, and understanding how to protect your money and legally reduce your tax burden can make a

Have you ever wondered just how much of your hard-earned income actually belongs to you after all the taxes are deducted? What percent of your

650 South 500 West, Suite 128 | Salt Lake City, UT 84101 | 801-877-9458