A Modified Endowment Contract, also known as a MEC, could be a great way to pass on assets to your heirs through permanent life insurance policies. Or, it could be the worst thing to happen to your whole life insurance policy. In this article, we’ll break down the pros and cons of a Modified Endowment Contract as it relates to your life insurance policy, explain how to use one for estate planning through it’s tax benefits, and show you how to avoid having your whole life insurance policy from becoming a MEC.

What is a Modified Endowment Contract (MEC)?

To understand what a MEC is, you first have to understand the benefits of whole life insurance. In addition to a death benefit for your heirs, whole life insurance offers a number of living benefits to the policyholder:

- A guaranteed rate of return

- Liquidity

- Protection against market volatility

- Cash flow in retirement

- Tax advantages

Cash Value of a Whole Life Policy

Whole life insurance policies come with a built-in savings component called a cash value account or surrender value. You can withdraw your cash value or use it in the form of a policy loan. Both offer liquidity and a way to increase cash flow.

The cash value of your policy not only grows when you pay a policy premium, it also earns a guaranteed rate of return—regardless of what happens in the stock market. When you purchase a policy through a mutual insurance company, you may also earn potential dividends. The accumulated interest and dividends in whole life insurance policies are eligible for certain tax advantages that make them attractive to people trying to grow and protect their wealth.

With all this in mind, it’s easy to see why people would want to put as much money as possible into a whole life insurance policy. And, for over a hundred years, many individuals and businesses have. In fact, banks and corporations today hold billions of dollars in whole life insurance.

The Technical and Miscellaneous Revenue Act (TAMRA)

Before MEC laws were created, anyone who owned a policy could pay taxes on a single large premium or very large premiums over a short amount of time to quickly generate tax-deferred cash value. From there, owners could access the liquidity from their policy through policy loans without paying taxes.

By the 1970s, many life insurance companies were creating products specifically designed to optimize cash value and advertising the tax benefits of owning them. Congress perceived this tax-benefit to be misused so legislation was specifically aimed at limiting the use of whole life insurance as a tax-sheltered investment.

In 1988 the Technical and Miscellaneous Revenue Act, also known as TAMRA, was passed. TAMRA put limits on the amount of money that could be paid into an insurance policy, thereby regulating whole life insurance’s tax-advantaged status.

Under TAMRA, policies that were over-funded no longer qualified as life insurance policies, instead they fell under a new classification known as Modified Endowment Contracts, or MECs. MECs don’t have as many tax advantages. They function more similarly to investment tools like non-qualified annuities, and you may be penalized for accessing funds in a MEC before age 59 1/2.

Here is how the tax treatment of whole life insurance contracts compare to those of a Modified Endowment Contract:

Taxes & Your Whole Life Insurance Policy

- Tax-free growth of interest and dividends

- Growth of cash value can be used tax-free

- Tax-free policy loans

- Tax-free retirement income

- Income tax-free death benefit

- Estate tax-free death benefit

Taxes & Modified Endowment Contracts

- Tax-deferred growth of interest and dividends

- Growth of cash value is taxed when used

- Policy loans are taxed

- Retirement income is taxed

- Income tax-free death benefit

- Estate tax-free death benefit

FIFO vs. LIFO

When an insurance policy becomes a Modified Endowment Contract, the way they are accounted for shifts. This is why they are taxed differently.

Whole life insurance policies follow first-in-first-out accounting practices, or FIFO. When you take a withdrawal or a policy loan from your full cash value life insurance amount, you are accessing the first funds you put into the policy (your premiums) first, up to the cost basis (the total amount of premiums paid). Once those funds have been depleted, you may be taxed on the remaining interest and dividends if you are taking a withdrawal (policy loans and death benefits remain tax-free).

Modified Endowment Contracts follow last-in-first-out accounting practices, or LIFO. When you take a withdrawal or a policy loan from your cash value, you are accessing the most recent funds put into the policy (interest and dividends) first. They are taxed, regardless of whether you are taking a withdrawal or a policy loan (the policy’s death benefit remains tax-free).

When you have a Modified Endowment Contract and you withdraw funds or take out a policy loan, your subsequent taxes are due annually when you file your tax return. You’ll also have to pay an additional 10% penalty if you’re under age 59 1/2.

How Do Life Insurance Policies Become a MEC?

Policyholders familiar with Modified Endowment Contracts will often ask what the set amount or number is to prevent their policy from entering MEC status. The answer is that there is no set amount, it is unique and individual to the policyholder and their death benefit threshold, which is outlined by the variables of age, gender, and overall health.

The 7-Pay Test for a Permanent Life Insurance Policy

Whole life insurance policies are subject to what is called a “Seven-pay test” to determine whether or not they meet the qualifications of an insurance policy vs. a Modified Endowment Contract. The “7-pay test” places a limit on the number of policy premiums that can be paid into a whole life insurance contract policy over a 7-year period.

If life insurance policyholders’ premiums over the initial 7-year period don’t exceed the limit outlined by the variables of age, gender, and overall health, the whole life insurance policy will remain such for the rest of the policyholder’s life, provided they don’t make changes to the policy which would restart the 7-year period for which the policy must meet non-MEC requirements.

If, during the initial 7-year period or any subsequent 7-year periods imposed due to significant policy changes, a whole life insurance policy is overpaid it will fail the “7-pay test” and become classified as a Modified Endowment Contract. Certain tax advantages will no longer apply and the policy will function more like a non-qualified annuity than a cash value insurance product. The death benefit remains intact, but policy loans will no longer be tax-free.

At Paradigm Life, we structure whole life insurance policies so that they will pass the “7-pay test” and function as they were intended: As your own personal banking system earning tax-free interest and dividends for tax-free policy loans and retirement income, plus a death benefit to leave a legacy for your heirs.

Preventing a Policy From Becoming a MEC

When you work with a Wealth Strategist at Paradigm Life, not only can we structure your whole life insurance policy to pass the “7-pay test”, they can also add on insurance policy riders to help your personal finance situation. Policy riders are supplemental insurance products that can increase the benefits of your whole life insurance policy. The main rider we use to help grow wealth with traditional life insurance policies and products is called the paid-up additions rider, or PUA rider.

The Paid-Up Additions Rider (PUA)

Prior to the creation of the paid-up additions rider and TAMRA legislature being passed, single premium policies were one of the more popular types of permanent insurance. With a single premium policy, you buy insurance with one upfront payment. The cash value for these types of policies will typically be more than 90 percent of that initial, one-time payment in the policy’s first year. The cash value of a single premium policy continues to earn interest and potential dividends each year and eventually exceeds the single premium paid, typically in year three or four.

Before TAMRA, the gains earned on the cash value of a single premium policy were tax-free. If you bought and funded a policy at a young age, the accumulated interest and dividends on it could have been substantial to pay income tax on. Single premium policies were considered the ideal savings vehicle.

After TAMRA was passed, the gains on single premium policies became tax-deferred, not tax-free. This led to the development of the PUA rider. Including a paid-up additions rider with your whole life insurance policy is crucial if your financial goal is to grow as much cash value inside your traditional life insurance policy, as possible without it becoming a Modified Endowment Contract.

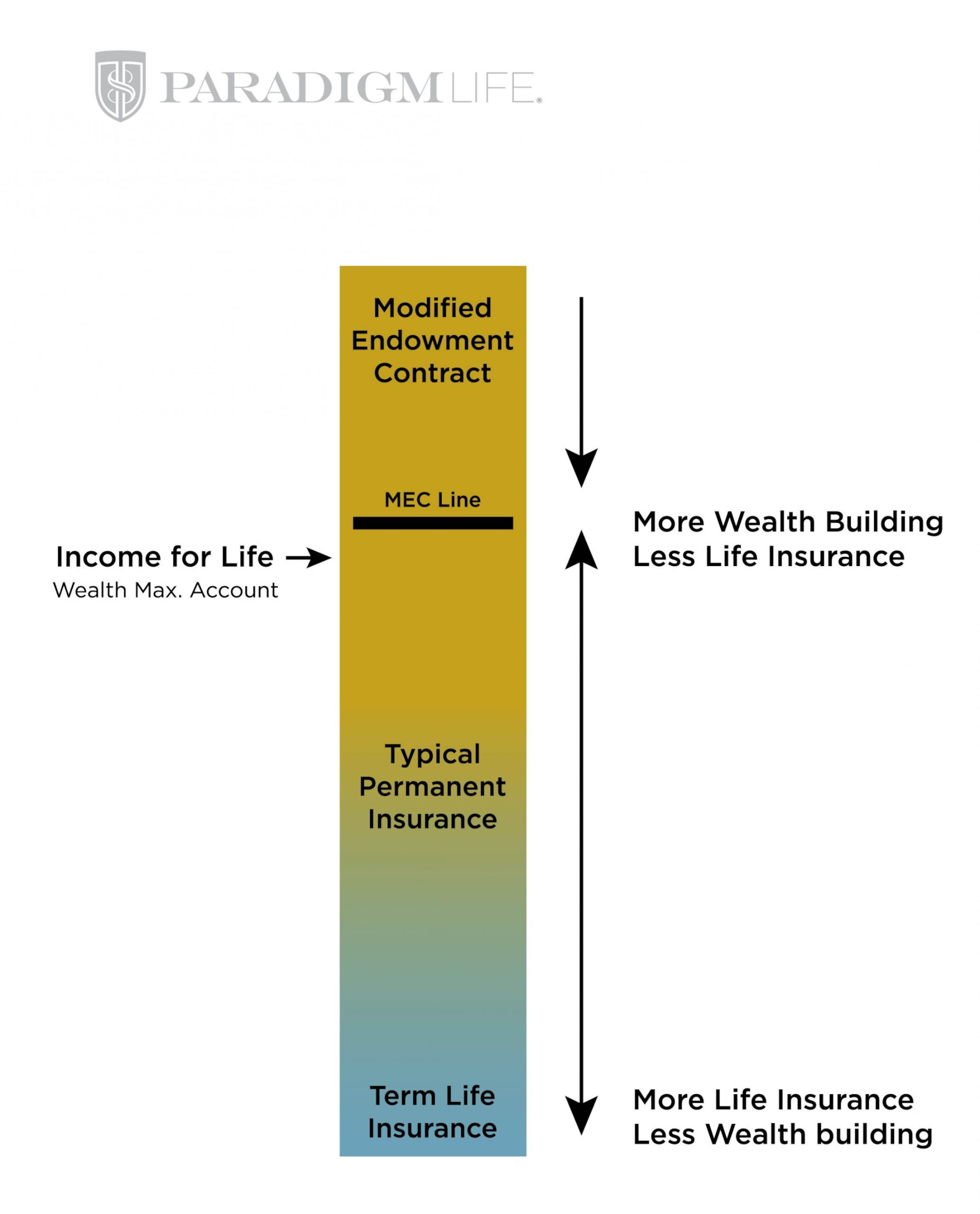

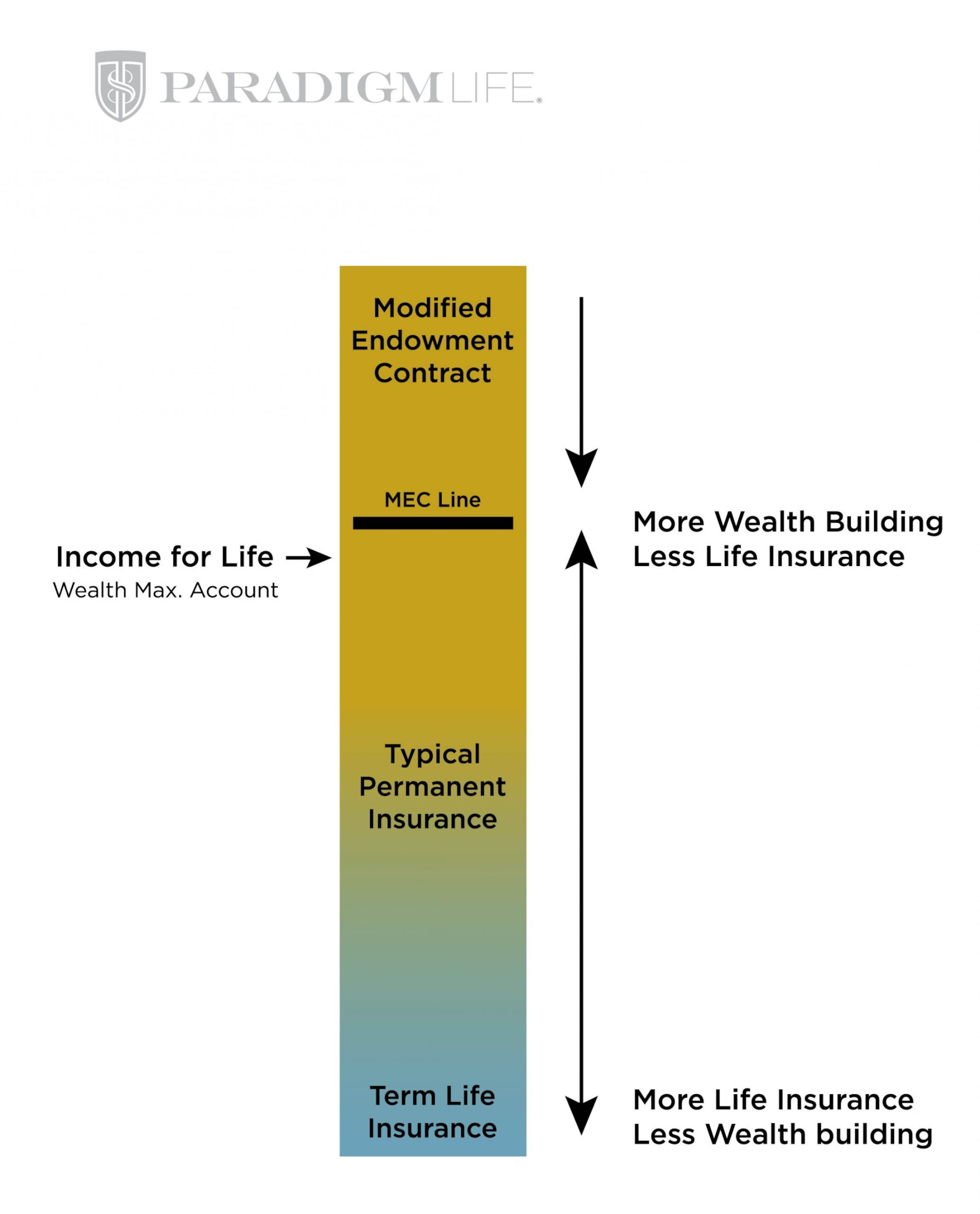

A PUA rider allows you to overfund your policy right up to the line of it becoming a Modified Endowment Contract, maximizing your policy’s cash value and interest-earning potential. The majority of the PUA premium paid is immediate cash value. The idea with this type of whole life insurance policy, also known as a Wealth Maximization Account™, is to have as much cash value as possible with the lowest death benefit TAMRA will allow. This kind of policy isn’t designed for insurance coverage, it’s designed to store cash and build wealth, which are living benefits.

If you’ve heard that whole life insurance policies take a long time to earn cash value and receive a low rate of return, it’s because the policyholder isn’t using a PUA rider. When structured properly with a PUA rider, whole life insurance competes with market-based investments in terms of returns, but offers much more protection against market volatility.

Multiple Insurance Policies

The IRS has a lot of ways in which it can regulate how much money you put into savings vehicles. When it comes to qualified plans, it limits how much you can put into a 401(k), IRA, or Roth IRA. In health insurance, it limits how much you can put into a HSA or FSA. With life insurance, the IRS has created the 7-pay limit, which is a per-policy measurement.

One thing the IRS doesn’t currently regulate is how many life insurance policies you can have. That is determined by your insurance company. Insurance carriers won’t insure your life for more than you are worth, but you can hold multiple insurance policies and contribute large amounts of wealth into each.

You can also take out life insurance coverage or policies on anyone whose death would affect you financially. This is called insurable interest. You can insure family members, business partners, employees, or anyone whose loss will inflict justifiable financial loss. Multiple policies within a family are collectively referred to as the family bank or private family banking. This strategy is used to grow family wealth and to create a legacy that can be passed down for generations.

Reversing a Modified Endowment Contract

In rare circumstances will you overpay your premium. Overpayment is rare, because your insurance agent should be very aware of your policy’s status, and what is necessary to avoid it from becoming a Modified Endowment Contract. Should your policy become a MEC, insurance companies will warn you of your policy’s pending status, and you’ll have two options:

- The insurance company can process the overpayment and notify the IRS that your policy is now a MEC.

- The insurance company can return the overpayment and your policy remains a non-MEC.

Once a policy becomes a Modified Endowment Contract, it will always be a MEC, which is why this change of contract is so serious.

If you’re not diligent about keeping track of your premium payments, you may be putting your policy at risk. However, if your life insurance policy is properly structured, you should never have to worry about your policy entering into a Modified Endowment Contract.

Pros and Cons of a Modified Endowment Contract

After reading about all the advantages of a whole life insurance policy compared to a Modified Endowment Contract, it might seem like a MEC is a bad thing to have. The truth is MECs are neither good nor bad; their position depends on your financial goals.

A Modified Endowment Contract doesn’t prohibit you from receiving tax advantages, it just regulates your advantages. For some people, a MEC is a beneficial financial tool. Here are some reasons why you may want to have a MEC:

- You don’t plan on accessing you cash value until after age 59 1/2

- You want guaranteed returns with less volatility than the stock market

- You want to increase the tax-free death benefit your heirs receive

On the other hand, there are reasons a whole life insurance policy might be more suited to your financial goals:

- You need liquidity (penalty-free) before age 59 1/2

- You want to use your cash value as your own personal banking system

- You want tax-free income in retirement

Estate Planning With a Modified Endowment Contract

If your main financial goal is to pass on the most tax-free wealth possible to your family, a Modified Endowment Contract can be a great estate planning tool. Compared to other savings vehicles like CDs or money market accounts, MECs typically earn a higher interest rate. Essentially a single premium life insurance policy, funds are placed into a MEC in one lump sum or in a series of large payments in the first few years of the policy. From there, cash value rapidly accumulates.

Regardless of how you plan to use whole life insurance, it’s imperative that your policy is structured in a way that helps you accomplish your goals. The Wealth Strategists at Paradigm Life are experts in helping people all over the United States and Canada grow and protect their wealth.

Request a free virtual consultation today to find the best policy for your needs.