The Donohoe Bulletin

Issue 10: How To Use The Volatility Buffer To Achieve Financial Independence

July 1st 2020

One of the most valuable business lessons I have learned is uniting a team around a clear and concise mission, vision, and purpose.

Our company ‘why’ is to help you, our client, live a more meaningful life.

Specifically, the mission of Paradigm Life is to come alongside clients to implement a personalized wealth strategy that empowers them to live a fulfilling life now, and ensure a future of their dreams.

Our first goal when working with you is to gain clarity around your purpose and why you are saving, investing, and pursuing better ways to manage wealth.

It is with rare exception that clients aren’t after the same end result—a more meaningful life. Money and wealth are simply tools to get there. Tools that give you more time doing what you love with the people you love. Tools that remove uncertainty. Tools and strategies that afford you opportunities to give to those less fortunate, and so on. Money and wealth are the means, not the end. Without that clarity, our job is difficult.

There is, however, a differentiating factor: Every client comes to us with a unique financial situation and definition of what financial independence and a meaningful life is to them.

It is the mission of Paradigm Life to identify what you, the client, really want and create a personalized wealth strategy to help you get there.

The first step is to identify the financial phase of life you are in. The GROWTH phase of life is where the focus is on building wealth. During the growth phase is when you identify what it will take to achieve financial independence. When that is identified and achieved, the INCOME phase begins. The focus here is generating the highest and most tax efficient income from your accumulated assets. LEGACY is the last phase, which represents leaving assets behind smoothly and efficiently with all relevant parties kept in the loop.

A good wealth strategy is designed to achieve an outcome with the highest degree of certainty possible. When I analyze a person’s finances I want to know the answers to the following questions:

I then take a three-step approach:

I want to illustrate what I have just shared through a recent experience with a client I’ve had the privilege of working with for the last 10 years. I’m going to show you what financial independence and a meaningful life is to this particular family and how a wealth strategy can be created to achieve that. My real goal is for you to better identify what financial independence and a meaningful life is for you and how your wealth strategy is leading you to that end.

This example is peculiar, almost a dichotomy, because the wealth they have accumulated would support their lifestyle four times over. I am sharing to demonstrate how important it is to have a well thought-out end result and a strategy as early as possible.

This particular family is financially wealthy, and most people would consider them affluent if they looked at their financial statement. However, on the surface, they live a simple life, similar to someone who spends every paycheck and has zero assets.

I was introduced to this family in 2010. At the time, they owned and operated a successful business and were in the process of selling it. The business was 20 years old, had loyal customers, was highly profitable, had zero debt and a lot of assets. The business was clearly marketable, and any qualified buyer could easily have obtained financing and bought it outright—even in that hard economic time. However, the family wanted to sell the business on a structured note, where the buyers would pay for the business over 10 years. Later on, I discovered that one of the primary motivators for this unconventional way to sell was to maintain a paycheck for another 10 years.

The family assets at the time were moderately diversified. They had a lot of cash, a few annuities, retirement accounts, gold, silver, a rental property, and land. Over the years, we set up multiple insurance policies, annuities, and recommended strategic partners who specialized in single family rentals and real estate syndications.

When we met up recently, their finances were in great shape, but their initial GROWTH strategy wasn’t. We hadn’t shifted gears to the next phase of life, INCOME. The family was paying their bills with random investment returns and cash. Their anxiety levels were high, almost red-lining. Although the shift in strategy from GROWTH to INCOME was my priority, LEGACY would also be part of the conversation, how they would pass on surplus assets that were not going to be used for income.

The meeting took place during the COVID-19 economic shutdown through a video conference. Although they had amassed several millions of dollars in assets, there still remained an underlying sentiment of uncertainty. The cause was due to both the market volatility at the time and the lack of an INCOME strategy.

The family balance sheet consisted of no debt and almost a dozen different asset classes: equities, bonds, real estate, mutual funds, annuities, precious metals, commodities, land, and business interests. Each asset had not only a different risk profile but a different way in which it was taxed. On top of all of that was the question of how and when to file for Social Security.

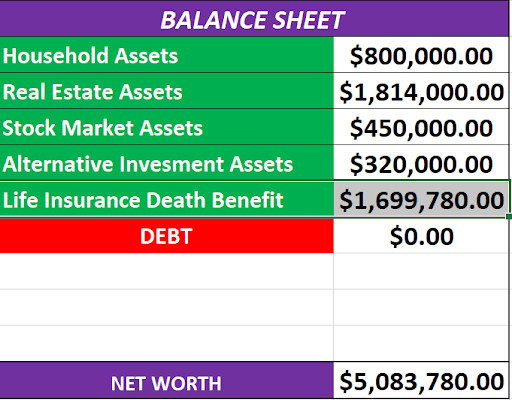

Here is a snapshot of their financial statement so you can get an idea:

Over the course of our discussions, it was clear to me that the family’s definition of financial independence and a meaningful life was simple, even though their finances were complicated.

This family wanted a monthly paycheck they could count on for the rest of their life. A paycheck that sufficiently maintained a lifestyle they loved, the one that provided what they considered a meaningful life. It was as if they were paralyzed from making any other decisions until that certainty was achieved.

The income amount they wanted was $95,000 per year. I alluded to a reasonable income in the $300,000 range, conservatively. Surprisingly, there was resistance. Their house was paid off and so were their cars. Their travel plans would not change much or their other living expenses. They didn’t know what they would spend the money on.

The strategy I settled on was what we call the covered asset. It is when you optimize the relationship between a straight life annuity and a permanent life insurance policy. A straight life annuity is when you give a sum of money to the insurance company and they guarantee a monthly paycheck for life. The catch is, to get the highest payout from the insurance company, you agree that the paycheck goes away when the annuitant dies. That is why we ‘cover’ the asset with life insurance because if the annuitant dies early in the annuity, the life insurance will pay out.

The family already had two deferred annuities that had been growing for the last 10 years. We now have income for life at $33,972/year. Additionally, we converted cash assets that were earmarked for hard money lending, but given the economy and the inherent risks in real estate, we agreed to allocate that money to a more certain asset, a SPIA (Single Premium Immediate Annuity). The annual income from that immediate annuity is $34,125.

After taxes and lifestyle expenses, there is still a surplus of $6,532 per year.

The permanent life insurance that the family has in place is $1,699,780. The required coverage to ‘cover’ the asset is $525,000.

Here it is broken down:

Their balance sheet now looks like this:

The death benefit of the permanent life insurance is now delegated as the LEGACY benefit and regardless of when death occurs, will be paid out to the estate.

Now that a strategy exists to eliminate the short-term friction, a monthly paycheck to cover living expenses, the next objective is to align actions and decisions with the family’s respective values, what they care most about in life. These values have an order of importance. Usually, values are family, business, profession, or hobbies.

I spent 10 years getting to know this family and I knew their values well. First, they cared about their church, specifically donations and time to volunteer. The lifestyle expenses of $95,000/year afford them the time to serve in their church service.

Their next value was family, their kids and grandkids who all lived out of state. They travel several times a year to visit their kids and grandkids and also wanted to start covering an annual vacation. This would be another $40,000 per year in expenses. The income that would allow them to provide this annual family retreat would come from their real estate cash flow.

To ensure that this amount of money was consistently available, we incorporated the Volatility Buffer. The Volatility Buffer is a strategy we use to optimize those assets that can lose value or not produce income in any given year. The strategy is to take income from an uncorrelated asset that is liquid and can’t go down in value the year AFTER the primary income asset that does happen to lose value. This strategy gives that primary income asset time to rebound and recover. Because much of their wealth was in assets that could lose value, maintaining 5-8 years in this uncorrelated asset was a conservative approach.

The Wealth Maximization Account™ (high cash value permanent life insurance) is the ideal vehicle to serve as the Volatility Buffer. The policies on the family have $535,000 of total cash value which is sufficient to cover a withdrawal of $40,000 for over 8 years.

Here is how the income breaks down:

Although establishing an income strategy was the priority, analyzing LEGACY was still important to consider as part of the overall strategy. While the life insurance policies serve both a role in the covered asset and volatility buffer strategy, there is a surplus of cash flow sufficient to cover required premiums. The cash value will continue to build and so will the death benefit, providing for even more options in the future.

Future conversations about LEGACY will include preparations for assisted living and long term care, more in depth legacy planning for the kids and grandkids, as well as how to transfer assets efficiently.

I did another Donohoe Bulletin on typical retirement planning which you can access via this link.

Typical retirement planning in the growth stage of life advocates growing wealth in a balanced portfolio inside a tax deferred account. The transition to retirement is recommended at an older age, usually 65-70 years old. In retirement, income comes from withdrawing a percentage of the portfolio every year based on a Monte Carlo simulation. A Monte Carlo simulation determines the probability of a positive portfolio at the end of a given time frame. The example below illustrates this concept, ranging from a 3% withdrawal rate up to an 8% withdrawal rate, showing the likelihood of having enough money to retire.

Monte Carlo protects the investor from ‘sequence of returns risk’ which occurs during times of market volatility. For example, if your portfolio balance was $100,000 at the beginning of the year and the market declined by 30% and you took a 10% withdrawal for income, your ending balance would be $60,000. Even if the market rebounded that next year by 30% to get back to what they consider break even, your balance would only be $78,000.

That example is why Monte Carlo simulations are performed and where the 4% rule came from. The 4% being a safe withdrawal rate that would weather ‘sequence of return risk.’ However, the 4% was developed based on markets and interest rates during the 90s when assets weren’t as correlated and safer assets had higher yields. The 4% rule is no longer reliable due to different market conditions.

Typical retirement planning does not give the investor control over their wealth and financial future.

Having more control over your wealth/wealth strategy gives you more freedom and more certainty in the future.

Control is a function of education and experience and enables the individual to obtain a positive outcome.Today, many claim that technology, algorithmic trading, and a more scientific approach completely mitigate risk factors. To me, that is a dangerous perspective to have, as human behavior is not linear and calculated. Human beings are always growing and innovating, yet are still prone to irrationally reacting to the unknown and uncertain. No matter how clever we become or think we know what the future looks like, there are always variables that disrupt.

During times like these you have to make your own informed decisions and question conventional assumptions. The quality of your decisions is in direct proportion to your education, experience, and corresponding control and influence. That is freedom.

Another way to approach successful wealth strategy is by drawing out the worst case scenario from the beginning.This exercise stimulates the best questions and assesses risk at the core. Most people are afraid to dig into the worst case scenario because no one likes to experience fear, even though it might just be conjecture. It allows you more freedom because you can use your intelligence to mitigate any inherent risks now, not in the moment when risk manifests itself. You can formulate options, plan B, plan C, maybe even a plan D. Options equal freedom.

“Life is a dance between what you want the most and fear the most.” —Tony Robbins

Clients do not come to us with a clean-slate financial life nor do they move forward by implementing everything we recommend. They have pre-existing assets, assumptions, challenges, and mindsets. That is why we start with some common ground, where you want to be.

First: Define where you want to be and what financial independence means to you.

Independence isn’t necessarily a function of money, it’s more of a mindset. Someone can have millions of dollars in savings accounts but feel trapped. Someone with a nominal residual income that pays for their lifestyle expenses and only works because they want to has infinitely more financial independence. Read more on how to have a mindset of financial freedom.

Financial independence goes beyond your financial statement. So, what does your ideal life look like? How would you characterize what financial independence is to you?

For a more practical approach, I like to use the 3-legged stool analogy to illustrate the three common elements I’ve observed that bring about financial independence.

Leg 1: Do meaningful work within an integrated lifestyle where you can live a life you love, and do work that you love and that makes a difference.

Leg 2: Focus on assets that you can control that give you a residual income—income that you don’t have to do much for. The caveat is first obtaining financial education to increase control and reduce risk.

Leg 3: Establish a secure foundation which consists of adequate reserves and liquidity in a Wealth Maximization Account™, a spending plan (budget), proper insurance protection and asset protection.

Second: Determine the biggest obstacle in your way.

The biggest impediment to living with more independence is fear. You have to tackle it head on. Thinking through the worst case scenario and, in a sense, living it out is a way to better understand your fear. Once you’ve done that, you can ask better questions and take preventative measures to either mitigate it from ever happening or knowing what to do when it does.

Third: Continually assess your financial statement, the role of your assets, and distance to achieving financial independence.

Most of our clients come to us heavily invested in the stock market. Typical financial planning is based around the idea of handing your wealth to someone else to take care of, and it’s something that isn’t always carefully thought through. Additionally, the narrative of ‘investing for the long-term’ implies that it’s ok when the market or your portfolio drops. Other than diversifying across asset classes and committing for the long haul, typical financial planning offers very little, if any, certainty or control, let alone a path to financial independence.

Determine your “why” and your expenses in retirement. Both the volatility buffer and the covered asset strategy typically offer higher income with less risk and better return rates (not to mention more tax advantages) than a qualified retirement plan.

You’re not alone on this journey and we are here to help.

Don’t hesitate to reach out to your Wealth Strategist.

A Wealth Maximization Account is the backbone of the Perpetual Wealth Strategy™