How Much Money Do You Really Need to Retire?

Retirement. Hearing the word makes us think about the future. No need to worry about it now because it is something we can “figure out” later. Wrong. Planning ahead for our future starts today and that includes building the foundation of our wealth now. Our future selves will thank us for being more proactive in the early years than waiting till the last minute to get our ducks in a row. But how much money do we need to be comfortable and secure? How many years do we need to work in order to reach our retirement goal? How much money do we really need to retire? All the guesswork of saving for retirement can make you dizzy.

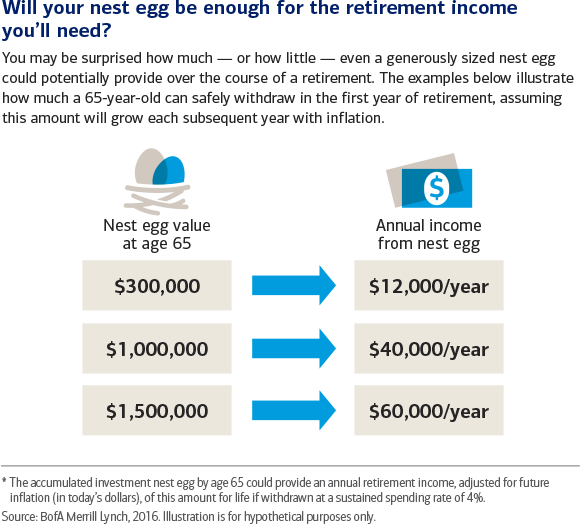

You’ve heard all sorts of “rule of thumb” advice on how much you need to save to retire. But what is right for you? And how do you know you are on the right path? No expert can tell you the exact amount of money you will need, because of everyone is different. Most people will be surprised at how their large nest egg translates to their annual income. Which begs the question, will your nest egg be enough for the retirement income you will need? Merrill Edge’s article provides some clarity around this by displaying an example below of how much a 65-year-old can safely withdraw in the first year of retirement, assuming this amount will grow each subsequent year with inflation.

Looking at the example, your nest egg will grow based on what you save and invest. But the big question is how much of it will you get to spend once you retire. That’s why it is important to plan ahead and paint a more practical picture of what you will need in the future; it will be different than what you need now. Let’s take a look at some factors to consider as you decide what your savings goal should be. It’s one of the downsides of putting your money in the market with wishful thinking as your retirement safety net—which is why we can show you a better way, but let’s continue with what is the retirement norm for most people in the U.S.

“Having a percentage or dollar amount to give you a rough idea for planning can be helpful, but you can’t be focused solely on that,” says Bill Hunter, director, personal retirement strategy and solutions, Bank of America Merrill Lynch. “Everybody’s lifestyle is different. What they want to do in their retirement years may be very different as well.” Hunter and his colleagues encourage you to create a rough annual estimate rather than a general figure because your retirement plans could change. It’s good advice regardless of how you decide to save and prepare for retirement.

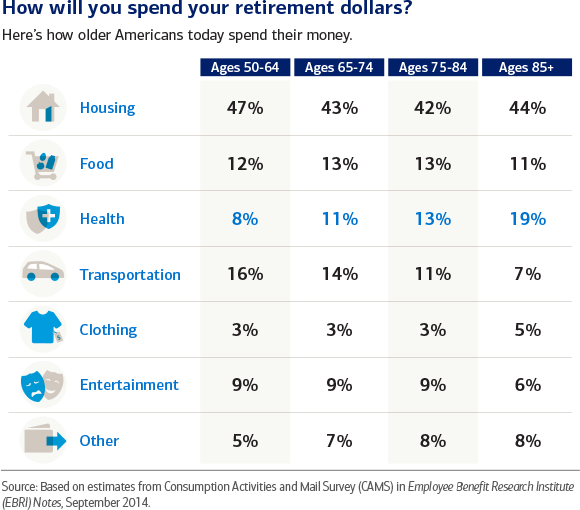

This chart from the Employee Benefit Research Institute shows how older Americans today spend their money, and how it changes as they get older.

As you can see, all these categories may change as we enter retirement. For example, if you plan to travel more or take on an expensive hobby, you need to consider adding in some flexible spending for that too. Remember that there is more than one component for reaching your future retirement income goal.

Here’s a question for you. .. did you know that social security is the backbone of most American’s retirement savings? That’s a scary reality. Merrill Edge reminds us not to forget about other sources of income that you will want available to you many years from now, including the money in your workplace and personal retirement accounts, pensions, annuities, proceeds from selling your home or business, rental income or an inheritance. Retirees today are even increasing their income by taking part-time jobs or starting their own business. The best way we know to offer that diversity and security is called The Perpetual Wealth Strategy, and we recommend it to all of our clients.

To successfully estimate how much you need for your retirement, recognize your retirement expenses and income. It can be tough to turn that goal into a realistic amount to invest today and to know if you’re on track when your goal is decades away. To make sure we are on the right track and if changes should be made, we will look at two different ways to see if our retirement goals are realistic.

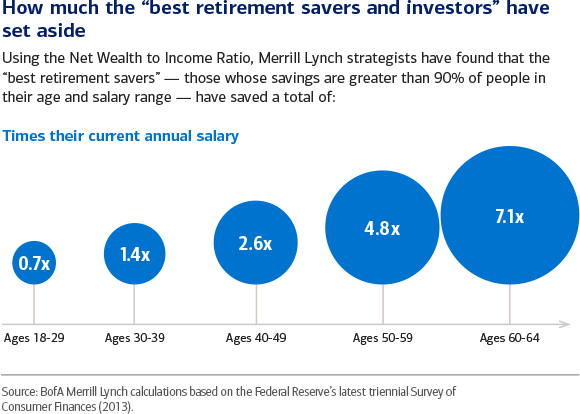

- Just as it can be helpful to see how your health stacks up against others, let’s look at an example that shows how the “best retirement savers” are saving greater than 90% of people within their age and salary group.

2. To get a better idea of where you rank right now and areas of improvement, check out The Merrill Edge Personal Retirement Calculator. This tool is extremely useful because you can create different scenarios based on several factors including your retirement goal, money you have saved currently, investment choice, and date of retirement. It will also help create a clearer picture of the potential adjustments you would need to make for your future. Then let us coach you on a better way to save, grow, and access that money now and when you reach retirement.

Any method of saving for retirement takes discipline. Whatever you spare and contribute today will impact your future. Let us help you discover a better way using The Perpetual Wealth Strategy. Your future self will thank you for starting today. And you’ll thank us for helping you find a retirement strategy that offers you—growth, stability, access, long-term comfort, and a legacy for your family.

We invite you to take 2 minutes to sign up for a FREE, extensive eCourse called Infinite 101®. You’ll receive access to video tutorials, articles, and podcasts. It literally costs you nothing to become educated on this ideal financial strategy and start building wealth.