You can’t hide from it. Every time you pull out your wallet you are participating in the law of demand. Without even thinking about it you affect the price and availability of goods and services on this planet daily. Does that make you feel powerful . . . or ignorant? Don’t worry, we want to help you understand this concept and how it applies to just about everything—especially your investments.

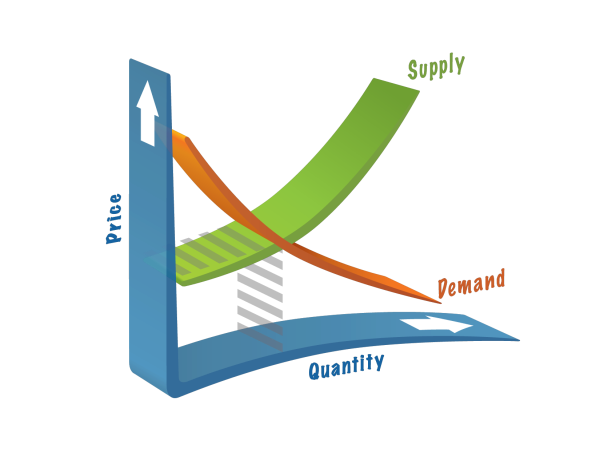

The law of demand is simple. When a lot of people buy something, the price of that product, whatever it may be, goes up. When fewer people buy something, the price drops. Alternately, the higher the price, the lower the quantity demanded (because the consumer makes more tradeoffs to acquire the expensive product). It becomes very clear when you think about it this way: On Valentine’s Day roses sell for ninety bucks a dozen. Why? That’s right, demand! However, (if you’re an oaf) and you buy roses for your spouse the day after Valentine’s Day, you’ll probably pay about $25 for the same roses (because the only people who need roses are other oafs). Graphic from Thirst. Here’s where it gets interesting. Skeptics would argue that some things we consume don’t operate within this law. They assume that something like a household’s use of water, for example, would not change if the price increased. What do you think?

Here’s where it gets interesting. Skeptics would argue that some things we consume don’t operate within this law. They assume that something like a household’s use of water, for example, would not change if the price increased. What do you think?

Take a look at the drought in California. Even with water, there is room to reduce consumption when the price goes up. Households can do larger loads of laundry or shower quickly instead of bathe, for example. Did you know the main users of water, however, are agriculture and industry? Even they will adjust their usage according to price. Farmers can change crops or irrigation methods for given crops. Indeed, we even see innovation happen to avoid paying a price increase. Though the extent of the flexibility for the law of demand varies widely, it’s always lurking in the background of literally every transaction.

Let’s apply that to, say, Wall Street. No big deal, right? Aaaah, but demand is everything when determining the price of individual stocks that make up the market. If the economy is doing better generally, the demand for stocks goes. . .up, and what goes up will likely come down based on the law of demand. Now, don’t worry about your life savings, because companies can mess with the price of stock by doing something like this:

Decreasing their own supply of shares through stock buybacks—a company can buy back its shares from the marketplace. Repurchased shares are absorbed by the company and the relative value of the remaining stock increases.

Issuing new shares through a spinoff or initial public offering (IPO)—each time a new company lists or creates a spin off, it increases the quantity of stocks that compete for capital. It’s a great way for distressed companies to issue stock—that will drop.

Looking at the ways the law of demand influences your world may make you feel a little out of control, but it also guides you in what to watch for as you monitor the equilibrium and volatility of the market and your investments. That’s just one reason why Wall Street should be viewed as a game, rather than a bank where you grow your life savings.

For this reason and many more, we always recommend growing your retirement wealth outside of Wall Street in a time-tested method that has proven to yield similar or better results than the market. It’s called the Perpetual Wealth Strategy, and it’s the perfect way to build, access, maintain, and pass on your wealth throughout your life; untouched by the fickle law of demand.

We invite you to take 2 minutes to sign up for a FREE, extensive eCourse called Infinite 101®. You’ll receive access to video tutorials, articles, and podcasts. It literally costs you nothing to become educated on this ideal financial strategy and start building wealth.

Take advantage of this FREE resource by clicking below.