For retirees, when it comes to making your 401(k) money last the rest of your life, a favorite algorithm used by Wall Street firms is called a Monte Carlo simulation—a very famous simulation demonstrating probability. In other words, “With the right withdrawal rates, you probably won’t run out of money before you die.”

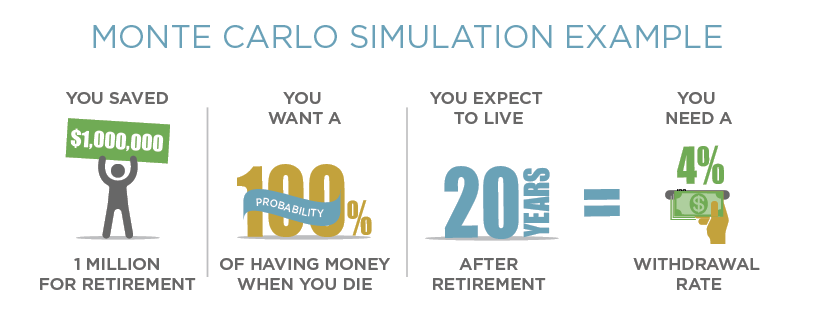

Monte Carlo methods are a broad class of algorithms that repeat random sampling to account for risk. Let’s look at an example to show you the relationship between probability and volume—we’ll answer this question for a retiree, “If I live 20 years beyond my retirement, how much can I withdraw each year and still have money left when I die?”

Our variables in the equation are withdrawal rate and time frame.

Probability is the X we’re solving for; we want 100% probability that we can withdraw money.

We’ll use 20 years, since this is the average life expectancy of a Boomer after retirement.

At 20 years, what withdrawal rate allows 100% probability of having money when we pass away?

The answer, according to the Monte Carlo simulation, is 4%. So if a retiree has $1 million, and he wants a 100% probability of having money until he dies, he can take 4% of the retirement savings out every year, or $40,000.

Here’s the thing you have to understand: when he dies, his money is spent. That original $1 million is not sitting in an account somewhere. He and his family wind up with one dollar—if that.

When you put it in those words, no Boomer would be crazy enough to choose that strategy for their retirement. And yet, this is what Wall Street is asking you to do: they’re asking you to take a gamble, Monte Carlo style, with your money. They want you to gamble with your hard-earned dollars, because you know who has a 100% probability of winning in that scenario? They do.

And what if you live longer than 20 years? There’s a very good chance you will: in the U.S., typical life span has increased significantly since the 1980s. People are living longer than ever before. Traditional financial planning makes no accommodation for this change.

Fortunately, in our financial strategy we do.

At Paradigm Life, we have better solution. We want to teach you a financial strategy that will ease your retirement concerns and pave the way for your dreams for retirement. We guarantee you’ll have significantly more than a dollar when you pass on, and you’ll be leaving a legacy for your family too. With more assured money you’ll be able to afford the rising cost of healthcare and create a lifestyle where you maintain your independence.

Offering ways to grow your wealth, access income, and leaving a financial legacy are the pillars of our mission at Paradigm Life. That’s why we offer financial education. In that vein, we want to share this model with you called Infinite Banking, and we are excited to invite you to take 2 minutes to sign up for a FREE, extensive eCourse called Infinite 101®. You’ll receive access to video tutorials, articles, and podcasts. It literally costs you nothing to become educated on this ideal financial strategy and start changing your wealth paradigm!

Take advantage of this FREE resource by clicking below.