Sorting out our personality types is useful in all kinds of situations. Perhaps one of the most useful is financial wellness. Could it be true that none of us really crave money, but we crave the emotional and psychological satisfaction that suits each of our temperaments? Knowing how your personality type affects your relationship with money helps you win the game of money.

In his book, What Will I Do With My Money?, Ray Linder suggests that emotional and psychological satisfaction that comes when you recognize your unique temperament and how that affects your wants, needs, and money decisions. True wealth begins when you identify those needs and adapt your financial patterns to meet them—that’s capitalizing on your assets.

What’s your money personality? Linder separates personality types into four categories and lists the accompanying Myers-Briggs types (if you know your Myers-Briggs personality type, it’s simple to see what type you are likely to be. If you don’t we recommend researching it more). Compare Linder’s categories to how you think about yourself and your finances—does it match up?

Protector (Myers-Briggs Types: ESTJ, ESFJ, ISTJ and ISFJ). By nature, you’re very conservative. You think ahead and plan for the future. You are consistent in your plan and often end up working the banking system, but not taking big Wall Street risks. Though it’s a great way to be, it’s hard for you to spend in the here and now on things like taking a vacation. You could also make bad on-the-spot decisions out of sheer panic. Advice—prepare for the unexpected by having a full emergency fund, which should cover at least six months of net income.

Planner (Myers-Briggs Types: ENTJ, ENTP, INTJ and INTP). Definitely a more long-term investing type of person, you are okay to take a calculated risk as long as you have a contingency plan. You’ll likely track your finances closely. You’re great a big-picture thinking, but careful that you don’t become so focused on the forest that you don’t see the trees. You could miss the opportunities right in front of you because of “analysis paralysis.” Advice—choose a portion of your income to divert immediately to long-term savings, and set up another account specifically for “mad money” to use for indulgences today.

Pleaser (Myers-Briggs Types: ENFJ, ENFP, INFJ and INFP). You take money personally—it’s like an extension of yourself. How you spend and save is an expression of your identity. Think of the word pleaser two ways—pleasing yourself or others. It’s different from planning, because a pleaser is about emotional and relational needs in themselves and others. Be careful others don’t take advantage of you and watch out for overspending because, “you’re worth it.” Advice—steer clear of toxic friends who can manipulate your best intentions.

Player (Myers-Briggs Types: ESTP, ESFP, ISTP, ISFP). You love having the freedom to react to the moment, and since you’re characterized by a tendency to be compulsive, you’re unlikely to think long-term. You’re often in the group with the highest financial risk. The good news is you’re optimistic, resourceful, and have a can-do attitude. Most entrepreneurs are this personality type. Advice—slow down and focus on the advantages of your personality type to bring in and save money.

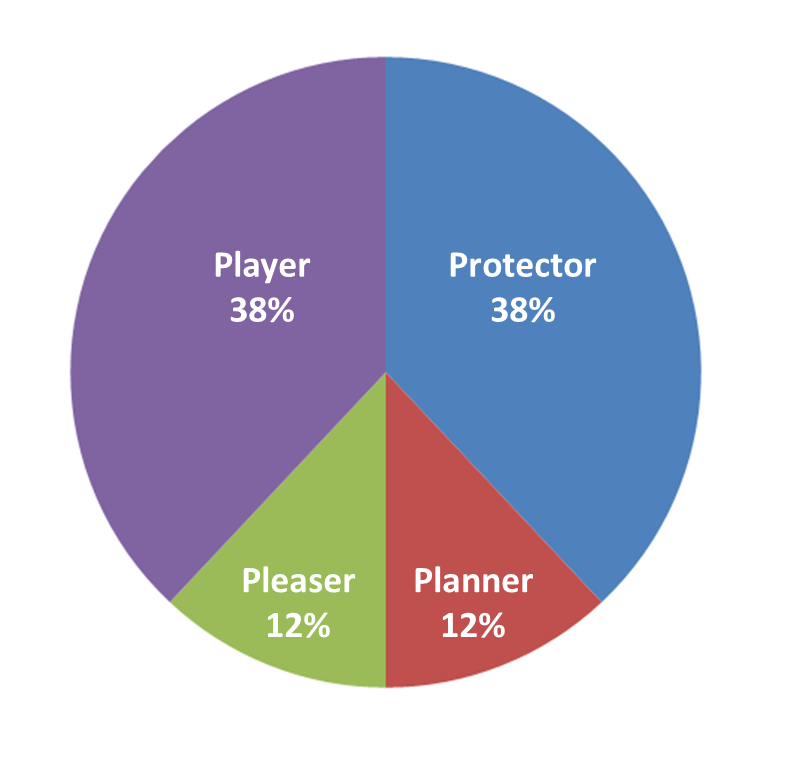

Here’s the breakdown for percentage of the population for each type:

The important thing to remember across all categories is that it’s not about the money, but what money means to you and the needs it fills. All money personality types can benefit from a few simple steps to managing your financial strategy:

- Validate your personality, tendencies, and advantages when it comes to money.

- Discover the real reason you make money like freedom, security, leisure, or making a positive impact.

- Set a specific financial goal and write it down.

- Automate savings by skimming money from your paycheck that goes directly to your long-term strategy.

The best way we know to automate savings, access liquid money, and provide for your family’s future is called the Perpetual Wealth System. At Paradigm Life, we want to show you how the Perpetual Wealth System can offer the best financial strategy for all personality types. We always recommend building your financial strategy around a stable environment outside of Wall Street. If you like the excitement of risk, go ahead and use your expendable money for that. We are excited to invite you to take 2 minutes to sign up for a FREE, extensive eCourse called Infinite 101®. You’ll receive access to video tutorials, articles, and podcasts. It literally costs you nothing to become educated on this ideal financial strategy and start changing your wealth paradigm!

Take advantage of this FREE resource by clicking below.