Ensuring Sustainable Cash Flows for the Last 20+ Years of Life

For many, the final 20+ years of life are filled with dreams of travel, family time, and personal freedom—but without a clear plan, those years

For many, the final 20+ years of life are filled with dreams of travel, family time, and personal freedom—but without a clear plan, those years

The Untapped Potential of Whole Life Insurance Whole life insurance policies are more than just a safety net for your loved ones; they can also

…and how to use that knowledge to your advantage The Significance of Cash Value Life Insurance in Long-Term Financial Planning Cash value life insurance plays

The Basics of Life Insurance Riders Life insurance riders are optional add-ons to a standard life insurance policy that provide additional benefits or coverage tailored

Many people view life insurance as a safety net for their loved ones, designed only for use after they’re gone. However, what if your policy

Why Small Business Owners Need Life Insurance Life insurance is a crucial component of financial planning for small business owners. It provides a safety net

What Are SGLI Loans and Why Are They Important? SGLI loans are financial products that allow servicemembers to use their Servicemembers’ Group Life Insurance (SGLI)

For those new to infinite banking, understanding how to take control of your financial future can feel overwhelming. While the concept of using whole life

The Role of Trusts in Estate Management to Protect Assets Trusts are indispensable estate planning tools designed to manage and protect assets held both during

Credit card debt has exceeded $1.08 trillion, keeping many stuck in high-interest cycles. At Paradigm Life®, we use The Perpetual Wealth Strategy™ to eliminate debt

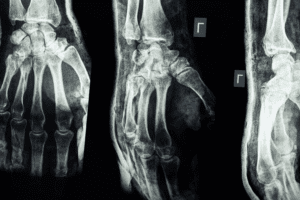

As your career progresses and your income increases, ensuring that your disability insurance coverage keeps pace with your evolving financial situation is essential. The Future

Whether it’s long term disability insurance or short term disability insurance, we have you covered. Disability insurance serves as a critical safety net, offering financial