Why is it that some families in this country seem to have it all? Do they work harder? Are they luckier? Where they born under a lucky star? More than likely, it is none of the above. There’s a better than average chance they are the benefactors of preceding generations that had a strategic plan, forethought and wisdom to set them on the right path. With that wisdom from prior generations, came the responsibility to do the same for their heirs. There are many examples that we can point to where the family name is synonymous with wealth i.e. Rothschilds, Rockefellers, Getty’s, and Carnegies.

These family dynasties just didn’t happen. There were a great number of families that had as much money as these famous names, but weren’t able to hold onto their wealth. For example, take a look at the Vanderbilts. Though they still have prestigious name, their family wealth is nowhere near where it once was. How does this happen? It can be argued that they didn’t pass along the one thing that made these other families wealthy – the knowledge of how to acquire and keep wealth – nor did they have the plan on perpetuating their fortune to the next generation.

As Nelson Nash pointed out in his book Becoming Your Own Banker, the Infinite Banking Concept, “If by some authoritative power distributed all the money in the world equally among all the people in the world, within 10 years time 97% of the money would be under the control of 3% of the people.”

How does that apply to you and what we are discussing today? I would like to share a conversation I had with a client of mine about this same topic. I had a client I’ll call Ben, who is 65 years old. He wanted to pass along to his son and grandson the gift of his estate, along with the knowledge on how to retain that gift for future generations. We all got together and I presented the following idea.

For this example, Ben is 65, Carl (his son) is 45, and Jimmy (his grandson) is 25.

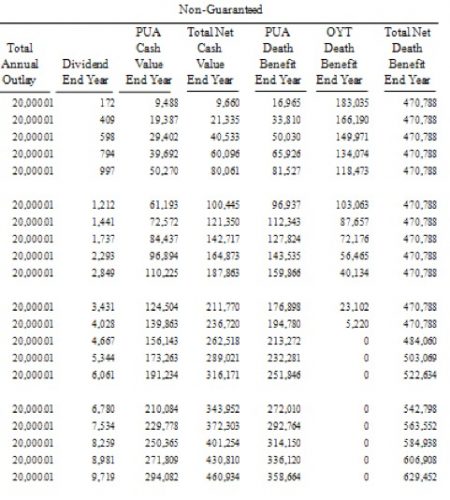

Ben wanted to gift $20,000 per year to his son, who was taking over the family business. I proposed a uniquely-structured life insurance policy owned by Carl on the life of Ben to be paid at death to Carl.

Fast forward 20 years into the policy and the hypothetical death of Ben. His policy could then be passed to Carl. One thing we stressed is that if you borrow money from the policy you should also have a strategy to pay it back, as we should love our family far more than we like our local banker. If the banker charged us interest, we would surely pay it, so why not do the same for our own financing operation.

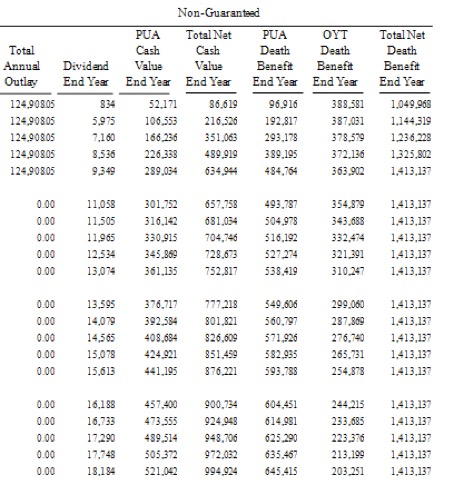

Now we take the Death benefit from Ben’s policy and without any new money we purchase a policy on Carl and pay for it over the next 5 yrs. Notice the cash value you still have access to, in the event you want to use it in your business. Now, when Carl passes away in year 20 or age 85, there is a $1,413,137 death benefit passed to Jimmy income tax free.

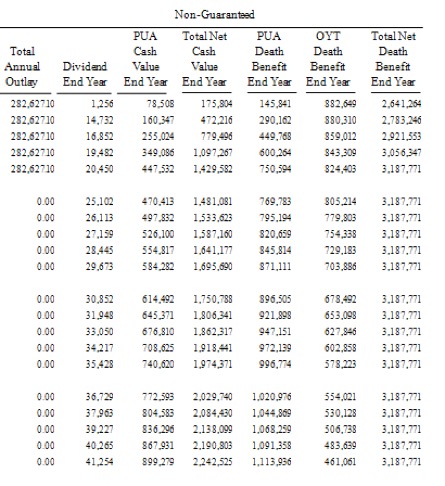

Now, Jimmy takes the death benefit from Carl’s policy and places the money in another properly structured policy over a five year period, with no out of pocket money on his part. He can have access to the total net cash value for cash flow purposes and, at age 85 when Jimmy passes away, the insurance company will issue out a death benefit of $3,187,771 tax-free and the cycle would continue for his children and grandchildren.

Now we have intergenerational wealth not subject to income tax, being passed down as well as access to that money to help run the business with a pool of safe, liquid money that we can use to grow and expand our family enterprise or take advantage of opportunities when they arise all for 12 cents on the dollar, and imagine how this would have turned out if the son and grandson were as generous and funded these policies Like Ben did at the beginning with the $20,000 per year.

What we want to do for you is show you how those that have money think about money so you are not part of the 97%. This is a process that will give you access to a financing system that has been around for centuries and can provide you a way to avoid the wealth destroyers of fees, taxes, and inflation.

At Paradigm Life, we know how important it is to pass on a legacy to your loved ones. Not only can this legacy benefit them, it can also benefit you now.

Take advantage of this FREE resource by clicking below.