At Paradigm Life we often get clients that have credit card debt and they just don’t quite know how to dig out of it. They know it is a serious issue, but never know how severe it truly is. Some have heard of a “snowball effect” and apply that strategy. Others are just paying the minimum payments, just because they have no other disposable income to make larger payments or simply because the bank or lending institution allows them to do so.

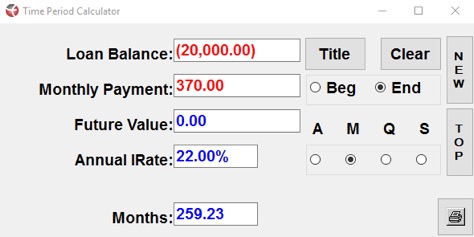

Many people do not realize a small amount can amount to a very large sum. This is often the case with credit card debt. When we work with clients we often gather as much accurate financial information so we can give accurate and precise solutions and projections. Clients often give us estimates on their credit card balances. Imagine a client has a credit balance of approximately $20,000, the minimum payment on that credit card is $370 and the credit card company is charging 22% interest. You may think 22% is high; however, that is often the case and at times even higher! When we plug those numbers into a calculator provided by our friends at Truth Concepts we get the following:

Making the minimum payment of $370/month will take nearly 21 years and 8 months and equal total payments of $96,200 on a $20,000 debt! This is not uncommon when someone makes the minimum payments. Given that many did not know this was the case banks and credit card companies are required within the credit card statements to show minimum payback schedules so consumers know how much they are paying.

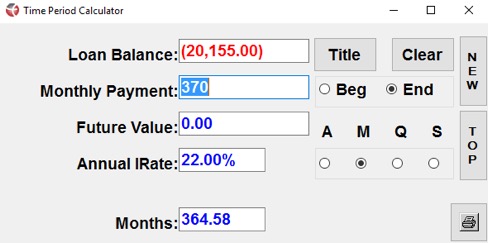

Remember we mentioned earlier that many clients give us estimates or approximations of their actual credit card debt? Take this approximate $20,000 credit card debt. Suppose that the client comes back and says the balance is really $20,155. You may not think that is much of a difference; however, let’s use the same calculator as before and see what we get.

As you can see it will take nearly 30 years and 5 months to pay off this same debt totaling $135,050 of payments which is $38,850 more than the $20,000 balance! As you can see little amounts ($155) can add up to a large sum over time. And the banks and credit card companies have known this for many years and have been enjoying the profits at the cost of their “valued customers” expense.

Now that we have covered how a little difference can make a huge difference to your personal pocket book, let’s discuss a way that we teach at Paradigm Life how you can “Be the Bank” and recapture money normally paid to the bank or credit card companies.

Imagine you had followed the advice of one of our Wealth Strategists (or possibly someone else) and had accumulated $20,000 of cash value in a properly structured dividend paying whole life insurance policy. Since you have the cash value in your policy you can borrow against that cash value for whatever you choose.

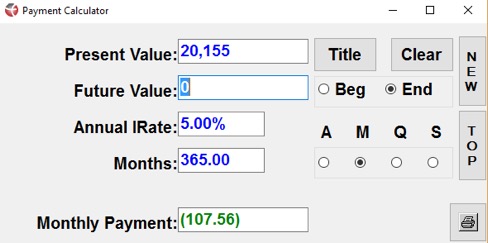

Take for instance this credit card debt of $20,155. You simply take a policy loan from the insurance company and use that money to pay off your credit card debt. Now this is where it gets fun. You now become the banker and pay yourself back at the same interest rate the credit card company was charging you! You heard me correctly. You now become the banker! The money that you borrow against in your cash value will continue to compound and grow within your policy and the insurance company gives you the $20,000 from their general fund. The insurance company will charge you interest on that $20,000 and the going interest rate currently ranges from 4.50%-5.00%. For this example lets use 5.00%. I mentioned earlier that you now “become the banker” and charge yourself the same interest the bank or credit card company was charging you. This is what we call being an “Honest Banker” with yourself. Using another calculator from our friends at Truth Concepts your payments back to the general fund of the insurance company would be:

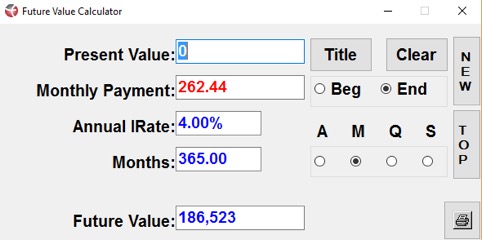

You would make payments to the insurance company in the amount of $107.56/month for a total amount paid back to the insurance company of $39,259.40. We said earlier to make sure you are an honest banker, so you would make an additional payment back to yourself for $262.44 ($370-$107.11) and put that into your dividend paying whole life insurance policy. Let’s assume your whole life policy is earning 4% so that payment that you are now making back to yourself would look like this:

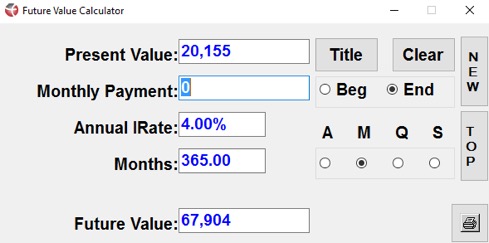

Simply by having your own policy cash value you are able to “be your own banker” and literally accumulate $186,523 inside your own whole life insurance policy. And remember we mentioned earlier that your cash value continues to grow even while you borrow against that cash value. That means your $20,155 of cash value that you borrowed against would have done this over the 365 months:

That’s an additional $47,749 of growth to add to all the previous numbers AND that growth inside your policy accumulated without you having to pay tax on that growth!

To sum up, you accumulated $186,523 inside your policy plus your original $20,155 of cash value compounded to $67,904 for a total of $254,427 and you paid the insurance company general fund back $39,259.40 for a total net gain of $215,167.60! Imagine having a strategy where you can “make money” by paying off a credit card.

Possibly as you are reading this blog you can see that the banking process is a very lucrative business. Most often every day consumers have been left out of this lucrative business, but there is now a way for you to be included. We at Paradigm Life can assist you in being on the “banker’s side” of the coin. Feel free to contact us with any questions or if you would like to learn more about eliminating debt quickly.