Revolving debt (credit cards) increased 4.1 percent while non-revolving debt, which includes car loans and education rose to 11.8 percent.

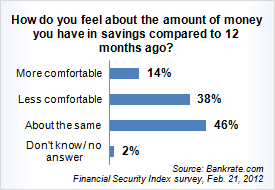

Bankrate.com recently did a survey on how Americans feel about their personal finances.

Here Are Some of Their Findings:

- 26% of those younger that 65 are less comfortable with their debt than a year ago vs. 10% of those 65 and older.

- 15% of those making $75,000-plus are less comfortable with debt vs 27% of those making less than $75,000.

- 47% of those 50-65 years old say they’re less comfortable with savings than a year ago – that’s 10 to 15 percentage points higher than other age groups.

- 25% of high earners ($75,000-plus) say they’re less comfortable with savings now vs. about 44% of those earning less than $75,000.

- College grads feel more comfortable with their savings (18%) than those who have a high school diploma or less (10%)

(Source: BankRate.com)

Startling Credits Card Statistics:

- The average credit cardholder has 3.5 credit cards. Including both cardholders and non-cardholders, the average consumer has 2.7 cards each. (Source: “The Survey of Consumer Payment Choice,” Federal Reserve Bank of Boston, January 2010)

- The average age at which a U.S. consumer under the age of 35 first adopted a credit card is 20.8 years. The average age of credit card adoption for a consumer over the age of 65 is 40.6 years. (Source: “The 2008 Survey of Consumer Payment Choice,” Federal Reserve Bank of Boston)

- Half of college undergraduates had four or more credit cards in 2008. That’s up from 43 percent in 2004 and just 32 percent in 2000. (Source: Sallie Mae, “How Undergraduate Students Use Credit Cards,” April 2009)

- The average consumer’s oldest obligation is 14 years old, indicating that he or she has been managing credit for some time. In fact, one out of four consumers had credit histories of 20 years or longer. Only one in 20 consumers had credit histories shorter than two years. (Source: myfico.com)

- Approximately 51 percent of the U.S. population has at least two credit cards. (Source: Experian national score index study, February 2007)

- On average, today’s consumer has a total of 13 credit obligations on record at a credit bureau. These include credit cards (such as department store charge cards, gas cards, and bank cards) and installment loans (auto loans, mortgage loans, student loans, etc.). Not included are savings and checking accounts (typically not reported to a credit bureau). Of these 13 credit obligations, nine are likely to be credit cards and four are likely to be installment loans. (Source: myfico.com)

(Source: CreditCards.com)

The good news is Americans currently have a higher savings rate than its low of -1.5% (2005), but at a 3% savings rate there is much work to be done in bringing down the total American consumer debt of 2.5 Trillion.

For more information about Paradigm Life and Infinite Banking, download our article or contact us at info@paradigmlife.net or by phone at 1-800-870-8670.