Saying we love our families more than a banking institution seems obvious and people will say, “Well, of course I love my family more than I love the bank.” However, I only make this assertion because if we were to examine how we treat our money, it would appear that we love our banks or at least treat them better than we treat our own family at least from a financial sense.

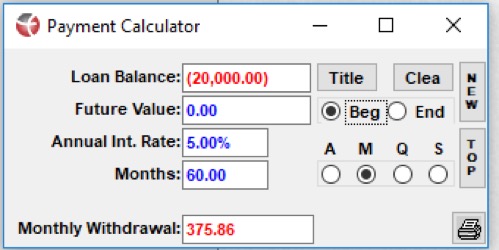

If we have a traditional loan from our local banker we set up loan repayments to pay back principal and interest, on a scheduled basis. Look at the attached payment calculator and you will see that for a $20,000 we agree to pay the bank $375.86 every month and, more than likely, we have that taken directly out of our household checking account. Over the term of the loan we pay back a total of $22,552.

Albert Einstein was credited with saying about interest on money “Those who understand it — EARN it. Those who don’t — PAY IT!” What I have observed over the past 30 yrs dealing with clients and their finances is that they will fall into one of four categories.

- Never pay back the money they take from their own account

These clients think their money has no value and are willing to give it away in exchange for items

- Pay the money back to their own account but with 0 additional interest

These clients are savers but don’t understand how interest works and the don’t understand the time value of money

- Pay back to their account the same as what the bank payment would be

These clients understand interest but still don’t understand how to get ahead of the bank

- Pay back to their account at a higher rate than the bank payment would be

These clients understand interest and that the money they are paying back will grow more inventory and that inventory will grow wealth

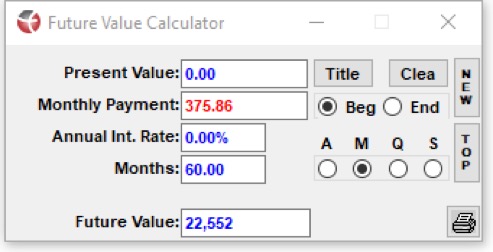

Now let say we have $20,000 in our account and we want to make the same purchase. If we love our family should we not make that same payment back to our account? If so, then we should agree to the same terms that we were willing to pay to the bank and capture that interest payment that would have ended up in the banks profits and our account ends up with the same $22,552. What this illustrates is that we put ourselves and our family on the same footing as the bank and that we are willing to treat them equally. However, I love my family more than I love the bank so I am willing to pay my financing operation more then I pay the bank.

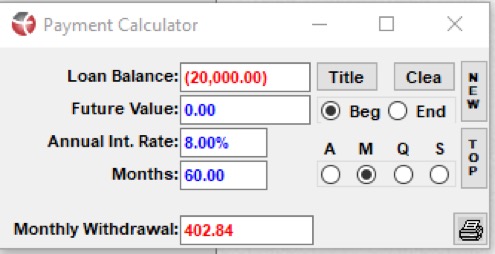

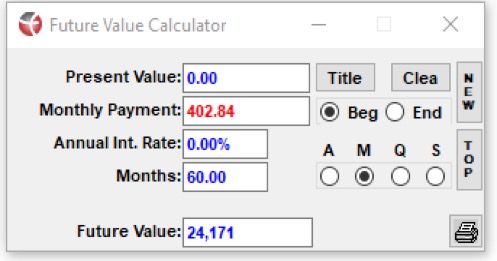

In this example I am paying a higher rate then I paid at the bank so that I can create a larger pool of money for my next transaction. Now, I end up with $24,171 in my account instead of the $22,552. This just increases my inventory of cash and that additional inventory will feed my family’s Perpetual Wealth Strategy.

Why do we do this? I believe it is a symptom of our conditioned thinking. Check out my previous post for reference. We are taught that paying interest is bad, which it may be unless you are the bank, then interest is good and as R. Nelson Nash stated in his book, “Becoming Your Own Banker,” you finance everything we do, even if you pay cash. A friend of mine, Don Blanton, is fond of saying that you either pay up interest or you give up interest. So, no matter how you pay for things, there is a cost associated with those purchase and we here at Paradigm Life want to show you how to mitigate those costs and actually take advantage of compound interest, putting it to work for you and your family rather than for Wells Fargo.

At Paradigm Life we can customize a policy to fit your financial situation. Our expert Wealth Strategists are available to answer your questions and show you customized illustrations, outlining an individual plan of action to help you achieve your goals.  , no strings attached.

, no strings attached.