10 Ways to Avoid Outliving Your Retirement Income

One of the biggest fears that Americans, and especially baby boomers, have is running out of money before they die. The last thing we want

One of the biggest fears that Americans, and especially baby boomers, have is running out of money before they die. The last thing we want

Most of us are saving as much as we can for retirement, using the savings vehicles that are advocated by our employer (i.e., the 401(k)

Paying taxes feels like an endless game. And guess what? It is. The more money you earn, the more the government takes away from you

Real Estate as an Investment We’ve all been told that real estate is a safe, incredibly lucrative investment. Real estate gives the owner financial leverage,

Edvisors.com reports that students graduating college in 2015 left university with an average debt of $35,051. Both the average debt and the number of students

With volatile markets and shaky economic conditions around the globe, knowing where to keep your hard-earned money can be confusing. How safe is your money?

Every mathematician, accountant, and financial advisor will tell you that compound interest is a powerful force. Albert Einstein famously referred to compound interest as “the

A century ago, individuals who claimed to be millionaires were part of a rare and exclusive club, but a million bucks today doesn’t go as

The short answer is NO! The Basics of no-Cost Mutual Funds No-cost mutual funds, also called no-load mutual funds, do typically cost less in terms

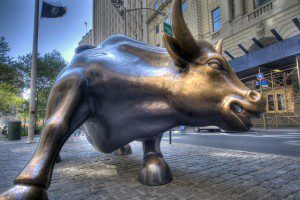

Just like Warren Buffet says, “Be fearful when others are greedy, and greedy when others are fearful.” This couldn’t be a truer and more relevant

Each of us are looking for ways to increase cash flow. And probably most of us who invest, or at least want to invest, have

‘Retirement’ is a buzz word in the financial industry that we don’t like to hear. That is because too often individuals we work with either