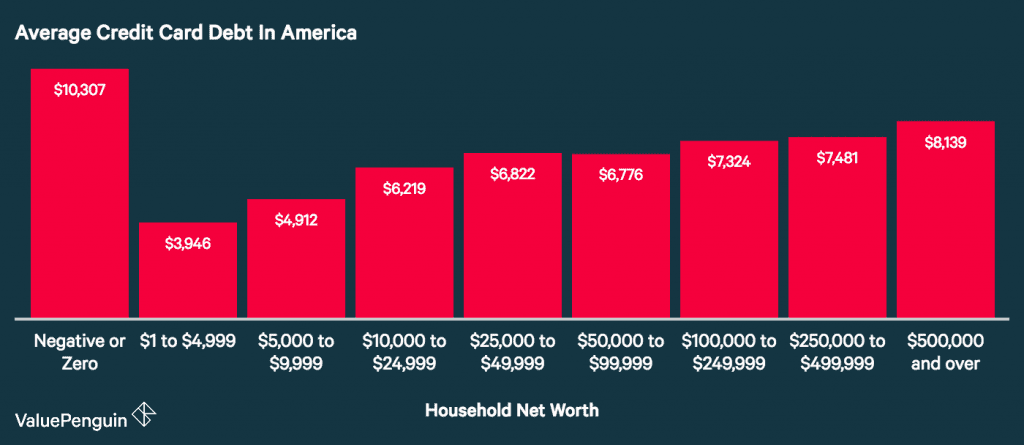

Here’s something really scary—consumer debt. The total outstanding credit card debt in the U.S. is $2.4 trillion dollars, and at an average interest rate of 12.31%, that’s funneling an astronomical amount of money back to creditors. Good for them, but bad for you. Holding large amounts of credit card debt actually negates your other investment gains, and investing instead of paying off your credit card debt is a guaranteed loss.

Source: Value Penguin

What if someone told you that you could receive a guaranteed 12.31% return on every purchase you make? If you could sustain that return, the money would pile up. We know a way you can. It’s as simple as paying cash for large purchases using the Perpetual Wealth Strategy. Paying in cash for everyday items as well as cars, vacations, and furniture adds up in interest savings.

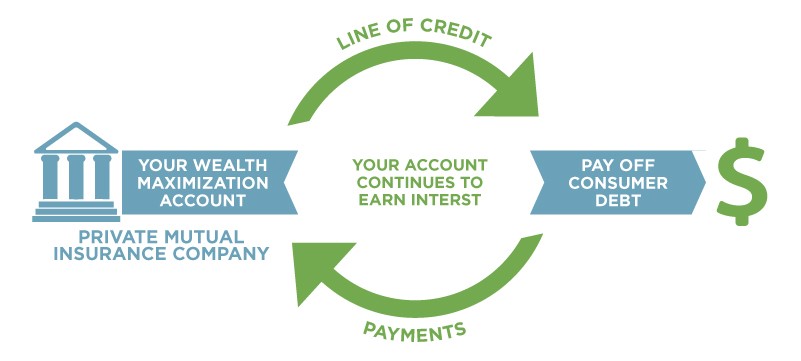

The Perpetual Wealth Strategy involves adding cash value to a permanent life insurance policy, borrowing from your cash value, and paying yourself back. It’s even easier than it sounds, but you don’t want just any policy, so here are the details:

- Get a policy. Permanent life insurance is a timeless, proven financial product—when you set it up the right way and leverage all of the characteristics. Open your mind to the potential.

- Pay up cash addition. Forget putting money in a bank savings account. Put all of your extra money into the cash addition you set up with your policy. It has a guaranteed higher return and more benefits. In fact, if you want to pay off your credit cards at hyper-speed, move money from another investment to your cash addition.

- Borrow from yourself. You can borrow up the full value of your cash addition from what we call a Wealth Maximization account, while the value of your cash still earns a return from the mutual insurance company (of which you are a policyholder and part owner).

- Pay off debt. We want you to say goodbye to credit cards that don’t offer returns. Trust us when we say you can do that without giving up your quality of life. Don’t be afraid to pay those “money suckers” off totally with the money you’ve borrowed from yourself. It won’t make the debt vanish, but it will considerably hack your high interest rate (we’re talking from 26% to about 4%).

- Pay yourself back at a low interest rate. As you pay yourself back at about a 4% interest rate, you’ll set your own repayment terms. You need only pay the interest each year. The money in your policy continues to earn interest even while you’re using it elsewhere. It’s a wicked awesome way to take advantage of the velocity of money.

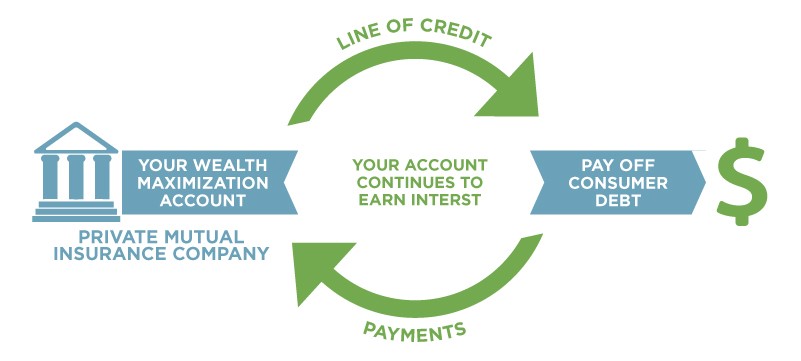

- Make ongoing large purchases from policy. Here’s the part where you don’t sacrifice your quality of life. We heard you need a new deck, so go ahead and borrow money from the paid up cash addition and get that thing built. Having the strategy and discipline to create a cash addition and pay yourself back allows you to repeat this process over and over again; saving yourself thousands of dollars in interest alone.

Learn how to eliminate debt from out financial experts. It’s really that easy and that good for your holistic financial wellbeing.

We’re only offering a glimpse here of the strategy that can improve all aspects of your finances. Allow us to share more free education about how you can build that wealth outside of Wall Street with certainty, liquidity, and control. We invite you to take 2 minutes to sign up for a FREE, extensive eCourse called Infinite 101®. You’ll receive access to video tutorials, articles, and podcasts. It literally costs you nothing to become educated on this ideal financial strategy and start changing your wealth paradigm!

Take advantage of this FREE resource by clicking below.

FAQ

Q: What are the steps to effectively banish consumer debt?

A: The steps to effectively banish consumer debt include creating a budget, prioritizing high-interest debts, and exploring debt consolidation options to simplify payments.

Q: Why is creating a budget an essential step in managing consumer debt?

A: Creating a budget is an essential step because it helps individuals track their expenses, identify areas for savings, and allocate funds towards debt repayment.

Q: How can prioritizing high-interest debts help in the journey to debt freedom?

A: Prioritizing high-interest debts is crucial as it reduces the overall cost of debt by paying off the most expensive loans first, allowing individuals to become debt-free faster.