A Rider is a provision of an insurance policy that is purchased separately from the basic policy which provides additional benefits, sometimes at an additional cost.

A Rider is a provision of an insurance policy that is purchased separately from the basic policy which provides additional benefits, sometimes at an additional cost.

Every new day brings the potential for new life changes; being prepared is the best way to secure a satisfying future, explaining why Insurance Riders exist.

What is a Rider?

In terms of Insurance, a Rider is an addition to a standard Whole Life Insurance Policy to adjust for stages of life changes that may not have existed for the policy holder when the policy was initially written.

Think of a life potential, and more than likely there is a Rider available to accommodate it. In addition to the many Insurance Rider options, they can be blended according to your present and future insurance needs.

It is important to note that some Riders must be included in the Whole Life Policy when it is being written, whereas other Riders can be added after.

Why Use Insurance Riders?

Insurance Riders are extension to a Whole Life Insurance policy, a helpful attribute is that you are able to select the Rider (or Riders) that fit your current or potential future life needs best.

For example:

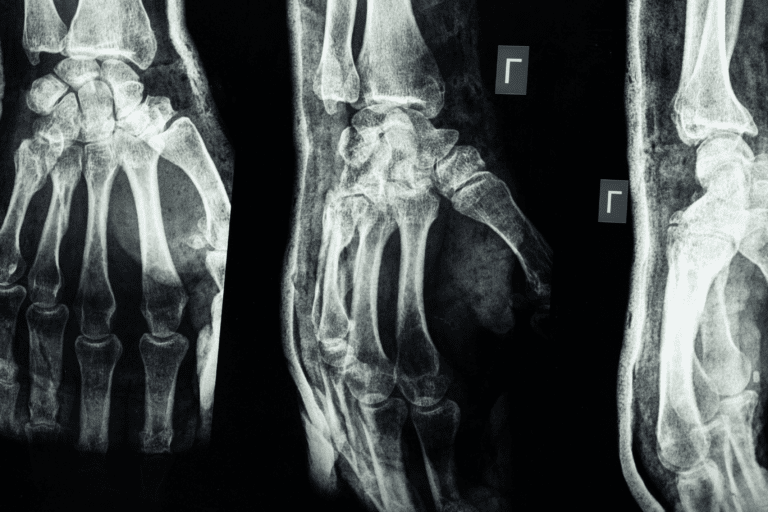

Do you have a high-risk profession? Then the Waiver of Premium Rider would be most valuable to have initially included and written into your Whole Life Policy. Future premiums are waved off if the insured becomes permanently disabled or loses their income as a result of injury or illness (prior to a specific age).

Have young children? The Child-Term Rider may be a welcomed addition to your existing Whole Life Policy. This Rider provides death benefits in case a child dies before a specific age, and can be turned into an individual policy when the child matures.

Do you worry about the potential financial burden to your loved ones, should you need long-term care? Perhaps the Long-Term Care Rider would put your mind more at ease. If the insured’s poor health requires a stay at a nursing home or to receive home care, this Rider offers monthly payments.

If you have already been prudent enough to purchase a Whole Life Insurance policy, then you are keenly aware of the benefits and security that a Whole Life Insurance policy provides for the “what-ifs” and the “unavoidable” in life.

Purchasing additional Riders and adding cash value to your Whole Life Policy aids you in preparing even further for life.

When is the Best Time to Purchase a Rider?

Ideally, you would want to have the Rider in place that fits the life event the Rider is meant to prepare you for. Yet the beauty of Insurance Riders is that there are some that you can purchase after you have completed your Whole Life Insurance policy. You aren’t expected to foresee future life events to know what Riders you may need. You can always review your policy with your agent as you and your policy matures to see if Riders need to be added.

Read: Banking on Long Term Success

Watch: How to Protect Your Policy

Listen: The Wealth Standard Radio