Should the government prevent “mega mergers” of corporations that could potentially control a large percentage of market share within its industry? At least 71% of Americans say yes, but let’s take a closer, nonpartisan look at the consumer pros and cons of this economic phenomenon.

In October 2016, AT&T announced that it intended to buy Time Warner Cable for $84.5 billion. The merger would create one of the biggest media companies in the history of the U.S. The announcement sparked criticism from Congressional Democrats and Republicans who argued that huge corporate mergers create monopolies which prevent competition. Since President Obama took office, his administration has prevented several mega-mergers from taking place including Sprint and T-Mobile, AT&T and T-Mobile, and Allergan and Pfizer. In 2015 $3.8 trillion dollars’ worth of mergers and acquisitions occurred— which made it the largest year for corporate consolidation in the history of the U.S. (reference: isidewith.com).

Supporters of mergers argue that the government should not interfere with corporations and the free market should be allowed to run its own course. Those against mega mergers would say it’s an obstruction of the free market (it lessens competition and drives up prices) and a violation of the Sherman Antitrust Act (law preventing intentional monopolies passed by Congress in 1890).

Economics.Help offers a list of pros and cons that may help you decide your stance. Here’s our take on the pros and cons.

Consumer Advantages

- Prices drop through economies of scale. The biggest advantage of mergers is all the economies of scale (savings due to increased production) hat the company can offer customers. In a horizontal merger, this could be quite extensive and can reduce fixed costs—those savings are usually passed to the customer and the price of the product drops.

- Prices drop through network economies. In some industries, companies need to provide a national network with economies of scale. That usually means one company is the most efficient way to service the industry. For example, when T-Mobile merged with Orange in the UK, they justified the merger on the grounds that it cut out duplication and created a single super-network. Customers received a bigger network and better coverage. It was a good move for cost reduction and the environment.

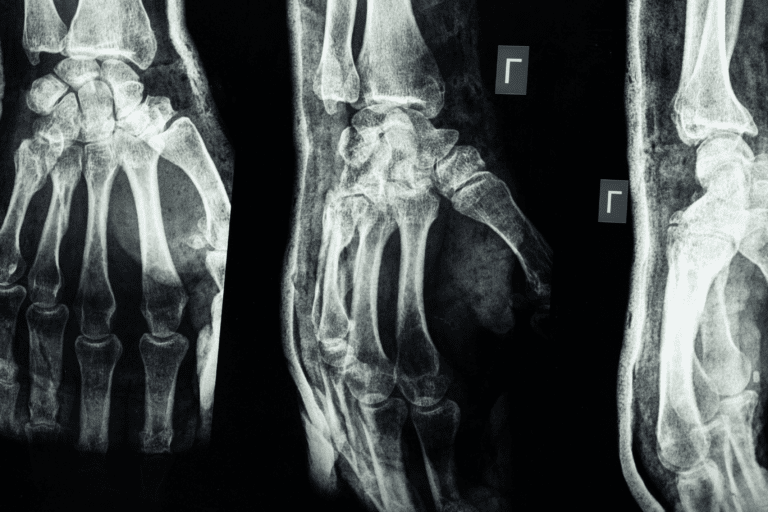

- Research and development. In some industries, research and development is the lifeline to discover new products and technology. A merger allows the company to funnel more dollars to research and development. Industries like drug research especially benefit from this strategy.

Consumer Disadvantages

- Prices rise through dis-economies of scale. The new company can experience a rise in cost that is passed to the consumer. Dis-economies of scale from increased size happen when the new, bigger organization can’t monitor and control departments and struggles to motivate workers. If workers lose their purpose and feel they are just part of a multinational machine, they are less motivated to be productive.

- Prices rise through monopoly. A merger can reduce competition and give the new company monopoly power. With less competition and greater market share, the newly-formed organization can usually increase prices for consumers. For example, there is opposition to the merger between British Airways (parent group IAG) and BMI (reference: Guardian). This merger would give British Airways an even higher percentage of flights leaving Heathrow and therefore power to set higher prices.

- Choices dwindle. If a monopoly knocks out the competition, a merger can lead to fewer product choices for consumers.

- Employees lose Jobs. A merger can lead to job losses. This is especially a cause for concerns if the merger is an aggressive takeover by an ‘asset stripping’ company—an organization that seeks to merge and get rid of under-performing sectors of the target company.

Regardless of personal and consumer opinion, the initial headlines announcing mega-corporate mergers and acquisitions usually focus on how it benefits Wall Street through improved finances, less duplication of services and staff, the ability to grow a company faster, and the anticipation of higher returns for shareholders when the two companies merge into one.

Often downplayed are the job losses and decreases in morale and productivity among the rank-and-file—a common by-product of many corporate mergers that attempt to slam together two diverse corporate cultures. Many of the so-called survivors of the layoffs are left to deal with the loss of institutional knowledge, increased workloads, and a sense of uncertainty about their own futures.

From these examples of potential pros and cons you can see that whether a mega merger is good or bad varies widely on many factors. They can be either or both. The only sure bet is that they create volatility and drastic change. At Paradigm Life one of our main goals is to provide free, relevant financial information to help you take control of your own financial future. On a personal level, we want to share a financial plan that stabilizes your future regardless of mega mergers or Wall Street. It’s called the Perpetual Wealth System, and it offers a way for you to build wealth and have access to liquid cash when you need it. We are excited to invite you to take 2 minutes to sign up for a FREE, extensive eCourse called Infinite 101®. You’ll receive access to video tutorials, articles, and podcasts. It literally costs you nothing to become educated on this ideal financial strategy and start changing your wealth paradigm!

Take advantage of this FREE resource by clicking below.