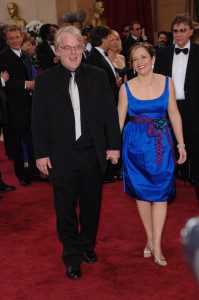

If you don’t live under a rock, you are probably aware of the horrific celebrity deaths that hit newsstands with shock – usually there is one or a two a year (sorry for the irreverence). Among those untimely deaths was that of actor Philip Seymour Hoffman. Almost a year ago (February 2014), the surprising announcement was made about the loss of this great Oscar winning actor.

If you don’t live under a rock, you are probably aware of the horrific celebrity deaths that hit newsstands with shock – usually there is one or a two a year (sorry for the irreverence). Among those untimely deaths was that of actor Philip Seymour Hoffman. Almost a year ago (February 2014), the surprising announcement was made about the loss of this great Oscar winning actor.

Besides the pain that Hoffman’s family must have felt with his loss, more pain ensued as his heirs dealt with his estate being in shambles at the time of his death. Hoffman failed to update his will leaving his ‘unmarried widow’ and their three kids to battle with costly estate taxes, or inheritance taxes.

Hoffman’s net worth totaled at $35 million, but because he was not married to his kids’ mother (Marianne O’Donnell), she cannot receive any estate tax breaks that are awarded to spouses. On top of that, because Hoffman’s estate valued at more than the Federal Law exemption of $5.34 million, it leaves the rest of the money to be taxed at almost 40%. In addition to Federal taxing, his estate is also taxed by the state at 16%. Yikes!(Forbes.com)

Avoiding Chaos

Properly structured whole life policies can help avoid the chaos that comes with a lot of mismanaged estates. Typically, the death benefit from your life insurance policy is not taxed as income to your beneficiaries – it is not considered a taxable event.

However, the IRS and state tax authorities do try to find ways to tax money, so if you own a policy at the time of death, the death benefit could be included as part of your estate. If your estate values lower than $5.34 million, you’re in the clear. But, when you own a properly structured life insurance policy, the death benefit will increase, and likely exceed the $5.34 million dollar threshold. It is necessary to then have an estate plan in place.

The Point

The goal is to legally avoid paying excess, or any taxes on money passed to beneficiaries. As a policy owner you must be informed on your policy’s value and ensure you have an estate plan in place. There are many ways to ensure your heirs are receiving the maximum value of your policy, without taxes and with the help of an estate-planning attorney.

Read: Infinite Wealth – A Different Kind of Retirement