Baby Boomers have benefitted handsomely from dramatic increases in their home equity over the decades and generous pension plans. But that does not mean they’re riding comfortably into the retirement sunset. Quite to the contrary, Baby Boomers feel the same financial fears as the rest of the population – except for them, they’re already retired or approaching an age where they can no longer work. Let’s review the three main reasons that Baby Boomers are shaking in their bonnets about their uncertain financial futures:

Baby Boomers have benefitted handsomely from dramatic increases in their home equity over the decades and generous pension plans. But that does not mean they’re riding comfortably into the retirement sunset. Quite to the contrary, Baby Boomers feel the same financial fears as the rest of the population – except for them, they’re already retired or approaching an age where they can no longer work. Let’s review the three main reasons that Baby Boomers are shaking in their bonnets about their uncertain financial futures:

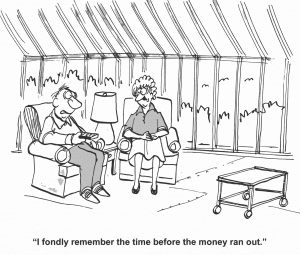

They fear running out of money before they die:

Baby Boomers have worked hard all of their lives to save for retirement and done their best to reach very lofty savings goal. But was their savings goal the right goal? Will they have enough to live comfortably on for the rest of their lives? These fears keep them up at night, especially given the volatility of the financial markets and fears about steep inflationary forces eroding their nest eggs.

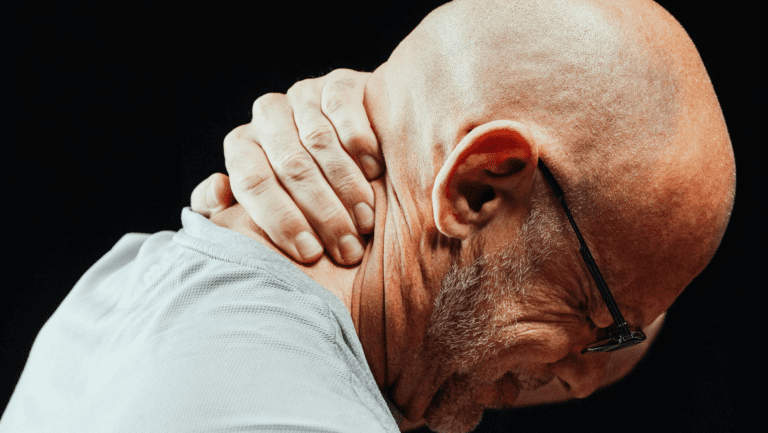

They fear unexpected healthcare costs:

The politics surrounding healthcare remain as intense as ever before, and the costs of healthcare just keep rising. Where does that leave the average Baby Boomer who counted on being able to receive high-quality, affordable healthcare coverage for the rest of their lives? No one can say for certain what the future of the U.S. healthcare system will look like – or how much insurance will cost 10 or 20 years down the road.

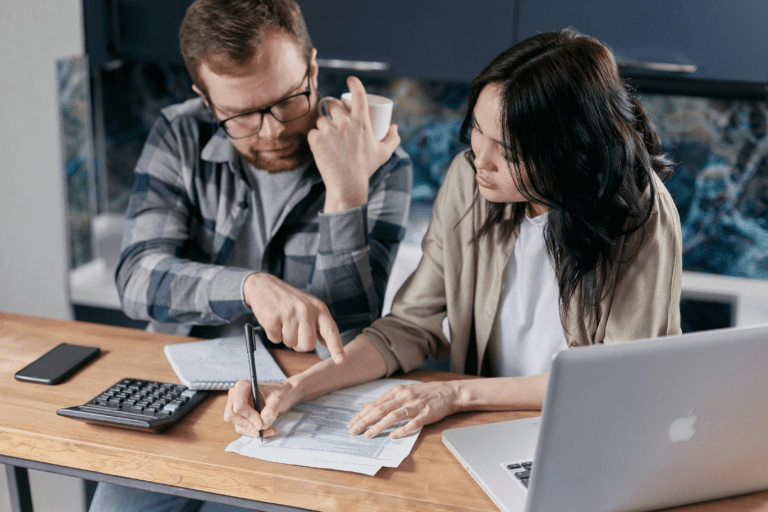

They fear losing their financial independence:

Baby Boomers are a fiercely independent generation that worked hard all their lives to secure their financial future without becoming a burden on their children. But with so much uncertainty in the financial markets and fears about rising inflation, most Baby Boomers do not feel financially secure, and thus, worry about losing their ability to live comfortably and with financial independence.

Despite everything they’ve done to prepare for retirement, Baby Boomers have no reason to breathe easy about their financial standing in the final years of their lives. They fear running out of money, unexpected healthcare costs, and losing their financial independence – and worst of all, most Baby Boomers believe it’s too late to reverse their fortunes.

The good news is that there is still hope for Baby Boomers, and it starts with radically rethinking your wealth-building strategy. To learn how you can achieve financial freedom at any age, visit Paradigm Life’s Optimizing Retirement Income.

FAQ

Q: What are the main financial fears of Baby Boomers?

A: Baby Boomers fear running out of money before death, facing unexpected healthcare costs, and losing their financial independence.

Q: How does the fear of running out of money impact Baby Boomers?

A: This fear arises from uncertainty in savings goals and market volatility, causing anxiety about maintaining a comfortable lifestyle in retirement.

Q: What concerns Baby Boomers about healthcare costs?

A: The rising costs and political uncertainties surrounding healthcare coverage create worries about affording quality care in later years.