You may think the topic of capital gains tax is a snooze-fest until you are ready to sell an asset. When you sell what the IRS deems a capital asset; which is just about anything, you’ll pay capital gains taxes—and the percentage can be hefty. Most taxpayers pay a 15% rate, but it can be as high as 28%. And as the Internal Revenue Service points out, just about everything you own qualifies as a capital asset. That’s the case whether you bought it as an investment, such as stocks or property, or for personal use, such as a car or a big-screen TV. For some Americans, a low tax rate on capital gains is better than any Christmas gift.

An ISideWith.com poll asks if the government should increase the tax rate on profits earned from the sale of stocks, bonds, and real estate. Most Americans say no, that increasing the capital gains tax will limit investment in our economy. Those who say yes are generally supportive of raising other taxes as well to create income inequality. Supporters of the increase also argue that capital gains should be taxed like any other income and should be raised to at least 31.5% (the average U.S. tax rate).

It’s not a necessarily a partisan issue. Though Republicans have led the way in pressing for low capital gains tax rates, they have relied on a significant bloc of Democratic allies to prevent an increase and to protect the preferential treatment of money earned through investments over money earned through labor.

In most cases, your home is exempt

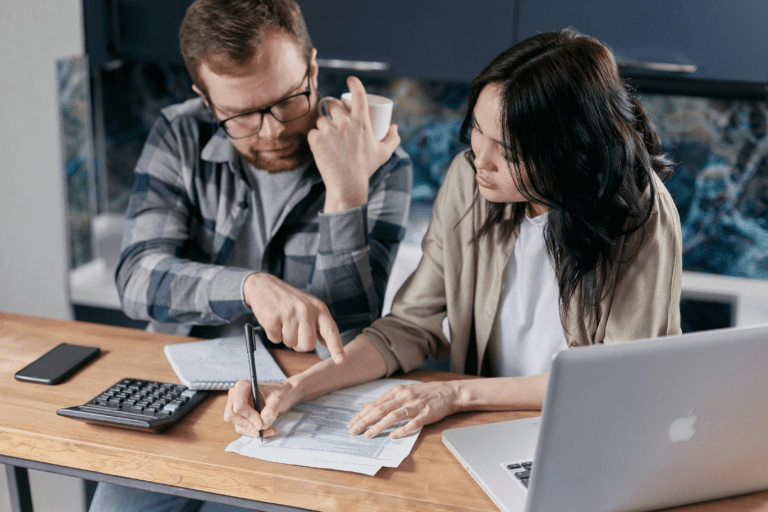

The single biggest asset many people have is their home, and depending on the real estate market, a homeowner might realize a huge capital gain on a sale. The good news is that the tax code allows you to exclude some or all of such a gain from capital gains tax, as long as you meet three conditions:

- You owned the home for a total of at least 2 years in the 5-year period before the sale.

- You used the home as your primary residence for a total of at least 2 years in that same 5-year period.

- You haven’t excluded a gain from another home sale in the 2-year period before the sale.

If you meet these conditions, you can exclude up to $250,000 of your gain if you’re single, $500,000 if you’re married filing jointly.

Here’s what you need to know

While it’s true that many middle-class Americans own stocks or bonds, they tend to stash them in tax-deferred retirement accounts like a 401k, where the capital gains rate does not immediately apply. By contrast, mega-rich Americans reap huge benefits in capital gains. Over the past 20 years, more than 80 percent of the capital gains income realized in the United States has gone to 5 percent of the people; about half of all the capital gains have gone to the wealthiest 0.1 percent. If you’re looking for some legal tricks the mega rich use, Forbes has an article, 14 Ways To Avoid Paying Capital Gains.

As a wealth-building strategy, we recommend you contribute to a paid-up cash addition in a permanent life insurance policy. It’s the only way to both invest your money and have access to it at the same time! Access to your money opens opportunity for you make more money. Regarding property you’ve invested in, we recommend you keep it through the ups and downs of the market, realizing the cash flow it brings to you as a rental. You’ll pay income tax on the rental income, but being a landlord has its own set of tax advantages—and passive income is always a good thing.

If you are in the higher tax brackets during your working career, you can also benefit from contributing to a traditional IRA or 401k. This reduces your income while you are in the higher brackets and eliminates any capital gains as a result of trading in the account. However, we always recommend that you invest with expendable money; not your retirement stash—for that you should build wealth outside of Wall Street. Let us show you how.

At Paradigm Life, we always recommend building your wealth in a stable environment that has offered proven returns for over a hundred years with no capital gains tax paid when you borrow from yourself. It’s called the Perpetual Wealth System, and it offers a way for you to build wealth and have access to liquid cash when you need it. We are excited to invite you to take 2 minutes to sign up for a FREE, extensive eCourse called Infinite 101®. You’ll receive access to video tutorials, articles, and podcasts. It literally costs you nothing to become educated on this ideal financial strategy and start changing your wealth paradigm!

Take advantage of this FREE resource by clicking below.