There are so many “Goliaths” when it comes to financial advice this is beat into our heads every day. These “experts” spout the same diatribes so much that they become the status quo – Invest in the stock market. Put money in your 401k. Use this specific type of IRA. However, the irony of the whole thing is that the General Motors, and the Bank of America, and Janet Yellen, and Ben Bernanke, and even the Federal Reserve all use alternative methods like annuities and fixed products, not the risk-filled and government-run programs that are so commonly preached. Isn’t it incredible? They’re behind the scenes and they get to see it firsthand. They have the intelligence to do that. This tactic is a stark difference to most people. They’re focused on their career, focused on their specific industry–and it’s not investing and it’s not financial management. It just comes down to that relationship of trust.

Something we try to teach our clients you shouldn’t do ANYTHING until you know what it is because, in the end if you trust somebody now, that is basically taking a dollar that you earned and have full control over, and you give it to somebody who doesn’t have that value or control. It’s one of those battles that is going to go on for a long time and I think there’ll probably be some correction in the next few years. It just comes down to gambling with American private money.

What is that event that’s really going to trigger people to thinking differently? I don’t know. Maybe it’s never going to come, but it doesn’t mean we shouldn’t keep fighting the fight. We still need to fight to teach people what’s wrong with traditional financial advice that is given to them.

This is serious stuff because it really ostracizes honesty and I think that’s one of the biggest things about how you save and you warehouse your money. It’s one of the really big issues, and you’re not gonna get it from the media and you’re not gonna get it from Wall Street. We’ve met with some high-up, government officials and they don’t even know.

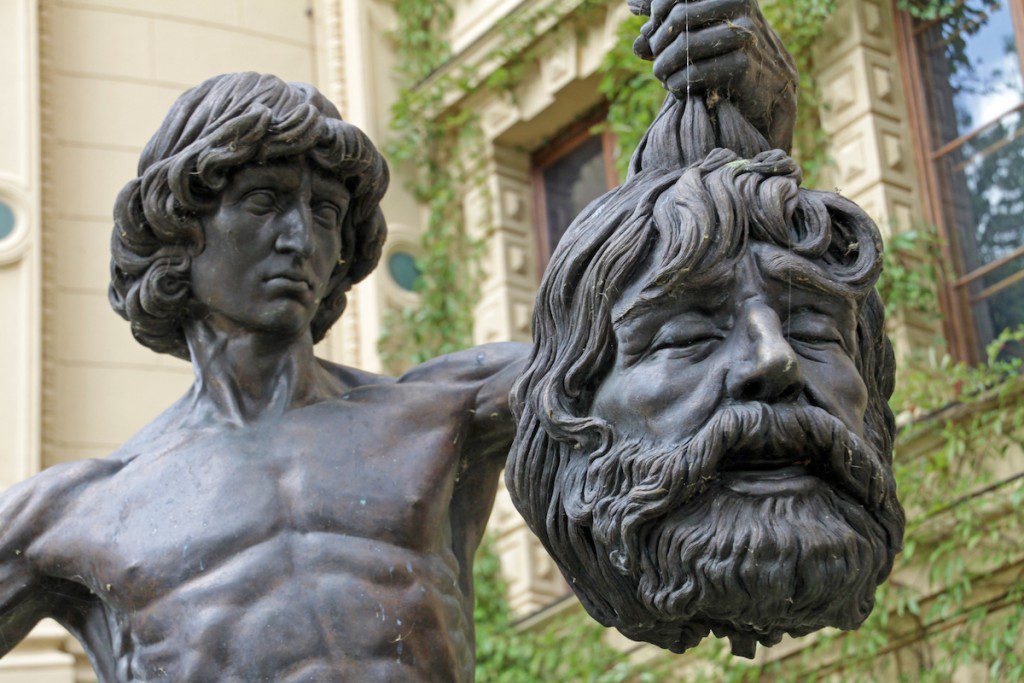

When it comes to financial education, we run into the Underdog Syndrome. The guy at the top doesn’t have to work because they’re already at the top and everybody already believes them. It’s the underdog has to work. They have to put in the extra effort, because they’re the ones who are trying to climb to the top. Sometimes, in that process, you become an expert while the person at the top, because he’s been “resting on his laurels” will make some mistakes.

But the fact of the matter is that the traditional way of thinking, teaching, and learning about financial management is all wrong. It puts control of your money in the wrong places, and the potential for loss is much greater than the potential for gain. Thousands, if not millions of Americans have lost their opportunity for a comfortable retirement because of the traditional strategies that are taught by the most popular financial “experts.”

It is of vital importance that you dive into alternative ways of making money than these methods. Wall street, 401k’s, IRAs, and other common investments are all controlled by the government. A government that is buried by debt and that can’t possibly make good on their promised returns to its citizens.

There are better, more stable ways to save and gain returns on your money to prepare you for retirement. The best part is that you don’t have to pay any money to learn about them! It’s time to be a “David” when it comes to finding the right investment that gets you ahead. There are lots of resources online to help teach you some better ways of investing than the traditional approaches. Reach out to us today and see how we can help you start your journey towards financial freedom.